Reflecting On Cable and Satellite Stocks’ Q1 Earnings: WideOpenWest (NYSE:WOW)

As the Q1 earnings season wraps, let's dig into this quarter's best and worst performers in the cable and satellite industry, including WideOpenWest (NYSE:WOW) and its peers.

The massive physical footprints of fiber in the ground or satellites in space make it challenging for companies in this industry to adjust to shifting consumer habits. Over the last decade-plus, consumers have ‘cut the cord’ to their traditional cable subscriptions in favor of streaming options. While that is a headwind, this affinity to streaming means more households need high-speed internet, and companies that successfully serve customers can enjoy high retention rates and pricing power since the options for internet connectivity in any geography is usually limited.

The 6 cable and satellite stocks we track reported a weaker Q1; on average, revenues were in line with analyst consensus estimates. while next quarter's revenue guidance was 1.9% below consensus. Stocks, especially growth stocks where cash flows further in the future are more important to the story, had a good end of 2023. But the beginning of 2024 has seen more volatile stock performance due to mixed inflation data, and while some of the cable and satellite stocks have fared somewhat better than others, they collectively declined, with share prices falling 2% on average since the previous earnings results.

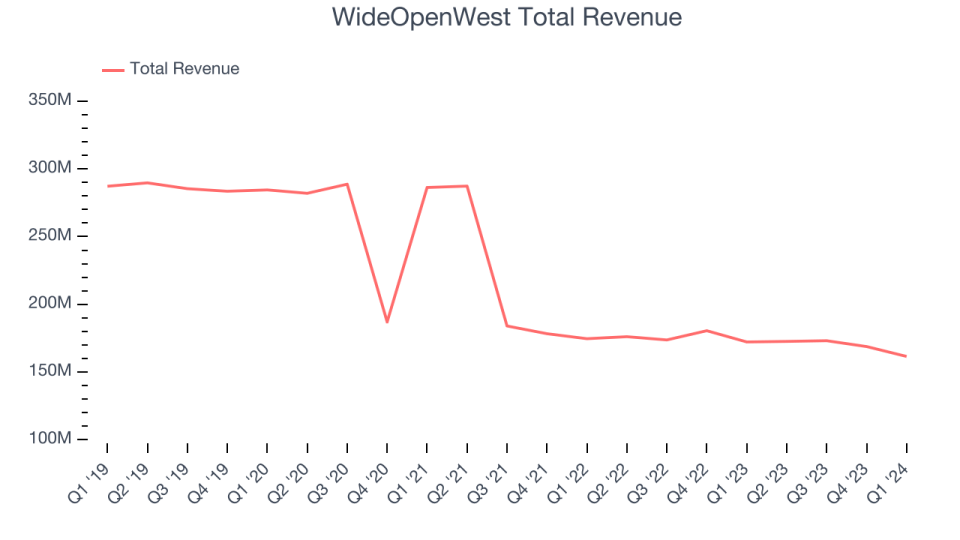

WideOpenWest (NYSE:WOW)

Initially started in Denver as a cable television provider, WideOpenWest (NYSE:WOW) provides high-speed internet, cable, and telephone services to the Midwest and Southeast regions of the U.S.

WideOpenWest reported revenues of $161.5 million, down 6.2% year on year, in line with analysts' expectations. It was a weak quarter for the company, with a miss of analysts' operating margin and earnings estimates.

Reminder that WOW received an acquisition offer from DigitalBridge Investments and Crestview $4.80 per share in cash on May 3, 2024; WOW's Board of Directors established a special committee to evaluate the proposal.

"Our first quarter results represent a strong start to the year as we make further progress in our new Greenfield markets and continued improvements in our legacy footprint," said Teresa Elder, WOW!'s CEO.

WideOpenWest delivered the slowest revenue growth of the whole group. The stock is up 4.7% since the results and currently trades at $5.08.

Read our full report on WideOpenWest here, it's free.

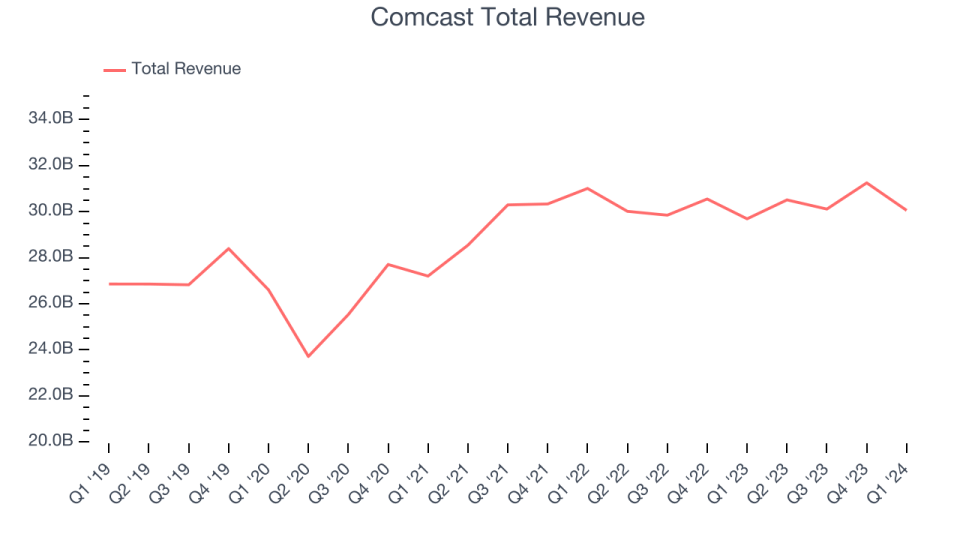

Best Q1: Comcast (NASDAQ:CMCSA)

Formerly known as American Cable Systems, Comcast (NASDAQ:CMCSA) is a multinational telecommunications company offering a wide range of services.

Comcast reported revenues of $30.06 billion, up 1.2% year on year, in line with analysts' expectations. It was a mixed quarter for the company: revenue was slightly ahead while adjusted EBITDA slightly below. The all-important volume metric of domestic broadband subscribers was in line with expectations.

Comcast delivered the fastest revenue growth among its peers. The stock is down 4.9% since the results and currently trades at $38.21.

Is now the time to buy Comcast? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Cable One (NYSE:CABO)

Founded in 1986, Cable One (NYSE:CABO) provides high-speed internet, cable television, and telephone services, primarily in smaller markets across the United States.

Cable One reported revenues of $404.3 million, down 4.2% year on year, falling short of analysts' expectations by 1%. It was a weak quarter for the company, with a miss of analysts' earnings estimates.

Cable One had the weakest performance against analyst estimates in the group. The stock is down 10.4% since the results and currently trades at $355.02.

Read our full analysis of Cable One's results here.

Charter (NASDAQ:CHTR)

Operating as Spectrum, Charter (NASDAQ:CHTR) is a leading telecommunications company offering cable television, high-speed internet, and voice services across the United States.

Charter reported revenues of $13.68 billion, flat year on year, falling short of analysts' expectations by 0.5%. It was a slower quarter for the company, with a miss of analysts' earnings estimates.

The stock is up 12.1% since the results and currently trades at $290.93.

Read our full, actionable report on Charter here, it's free.

Sirius XM (NASDAQ:SIRI)

Known for its commercial-free music channels, Sirius XM (NASDAQ:SIRI) is a broadcasting company that provides satellite radio and online radio services across North America.

Sirius XM reported revenues of $2.16 billion, flat year on year, surpassing analysts' expectations by 1.4%. It was a slower quarter for the company, with a miss of analysts' core subscribers estimates and a miss of analysts' earnings estimates.

Sirius XM scored the biggest analyst estimates beat among its peers. The stock is down 14.8% since the results and currently trades at $2.71.

Read our full, actionable report on Sirius XM here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance