Reflecting On Electronic Components Stocks’ Q1 Earnings: Vicor (NASDAQ:VICR)

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Vicor (NASDAQ:VICR) and the best and worst performers in the electronic components industry.

Like many equipment and component manufacturers, electronic components companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include data centers and telecommunications, which can benefit companies whose optical and transceiver offerings fit those markets. But like the broader industrials sector, these companies are also at the whim of economic cycles. Consumer spending, for example, can greatly impact these companies’ volumes.

The 10 electronic components stocks we track reported a decent Q1; on average, revenues beat analyst consensus estimates by 0.8%. while next quarter's revenue guidance was in line with consensus. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, but electronic components stocks have shown resilience, with share prices up 8% on average since the previous earnings results.

Vicor (NASDAQ:VICR)

Founded by a researcher at MIT, Vicor (NASDAQ:VICR) provides electrical power conversion and delivery products for a range of industries.

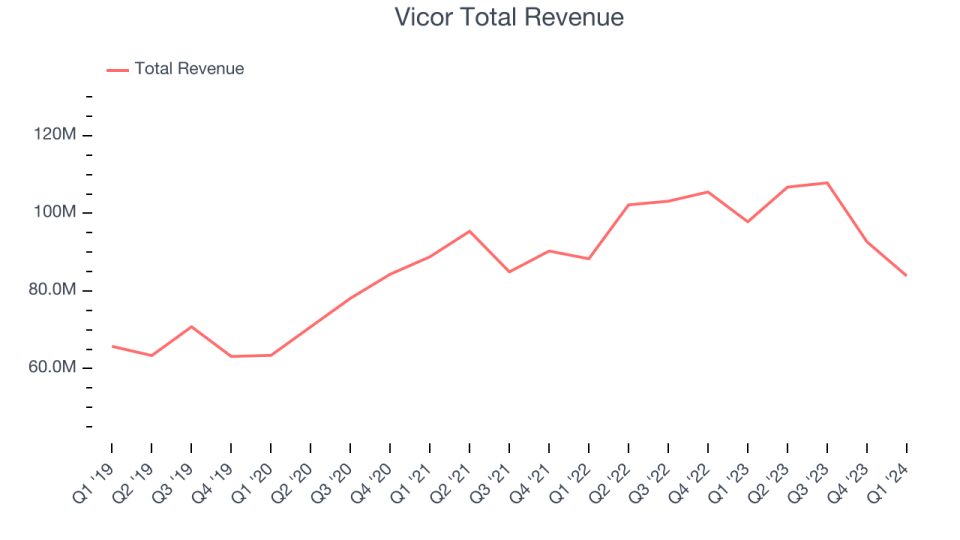

Vicor reported revenues of $83.87 million, down 14.3% year on year, falling short of analysts' expectations by 1.1%. It was a weak quarter for the company with revenue and EPS missing analysts' expectations.

Commenting on first quarter performance, Chief Executive Officer Dr. Patrizio Vinciarelli stated: “Q1 gross margins and operating expenses reflect a step up in royalty income and legal expenses relating to our campaign to assert Vicor Intellectual Property. Licenses to OEMs, giving access to patented power system technology from otherwise infringing suppliers, will complement future revenues from our 5G product line and ChiP foundry. These capabilities position Vicor ahead of demands for escalating current and power density, with superior performance and foundry capacity that anticipate market requirements.”

The stock is down 4.9% since the results and currently trades at $33.44.

Read our full report on Vicor here, it's free.

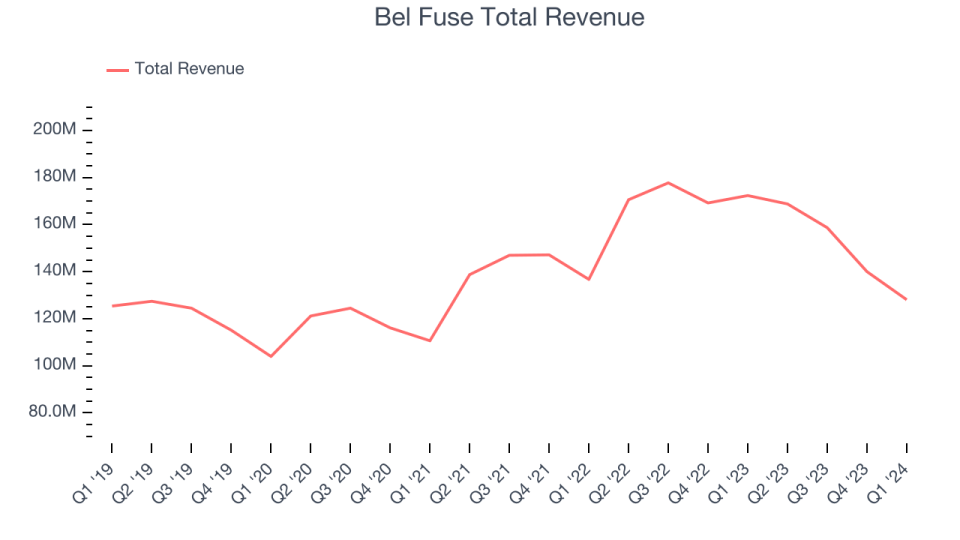

Best Q1: Bel Fuse (NASDAQ:BELFA)

Founded by 26-year-old Elliot Bernstein during the electronics boom after WW2, Bel Fuse (NASDAQGS:BELF.A) provides electronic systems and devices to the telecommunications, networking, transportation, and industrial sectors.

Bel Fuse reported revenues of $128.1 million, down 25.7% year on year, falling short of analysts' expectations by 0.4%. It was a mixed quarter for the company, with a narrow miss of analysts' sales estimates. On the other hand, EPS came in ahead of expectations.

Bel Fuse had the slowest revenue growth among its peers. The stock is up 17.7% since the results and currently trades at $84.11.

Is now the time to buy Bel Fuse? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Advanced Energy (NASDAQ:AEIS)

Pioneering technologies for radio frequency power delivery, Advanced Energy (NASDAQGS:AEIS) provides power supplies, thermal management systems, and measurement and control instruments for various manufacturing processes.

Advanced Energy reported revenues of $327.5 million, down 23% year on year, falling short of analysts' expectations by 6.9%. It was a weak quarter for the company, with a miss of analysts' earnings estimates.

Advanced Energy had the weakest performance against analyst estimates in the group. The stock is up 11.5% since the results and currently trades at $106.95.

Read our full analysis of Advanced Energy's results here.

Belden (NYSE:BDC)

With its enamel-coated copper wire used in WWI for the Allied forces, Belden (NYSE:BDC) designs, manufactures, and sells electronic components to various industries.

Belden reported revenues of $535.7 million, down 16.5% year on year, surpassing analysts' expectations by 4.3%. It was a strong quarter for the company, with an impressive beat of analysts' Enterprise revenue estimates and a solid beat of analysts' earnings estimates.

The stock is up 13.5% since the results and currently trades at $92.3.

Read our full, actionable report on Belden here, it's free.

Knowles (NYSE:KN)

Holding a swath of patents, Knowles (NYSSE:KN) offers acoustics components for various industries.

Knowles reported revenues of $196.4 million, up 36.1% year on year, in line with analysts' expectations. It was an ok quarter for the company, with a narrow beat of analysts' revenue estimates.

Knowles delivered the fastest revenue growth among its peers. The stock is up 7.7% since the results and currently trades at $17.

Read our full, actionable report on Knowles here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance