From inheritance tax to stamp duty: how much money you stand to gain (or lose) under Reform

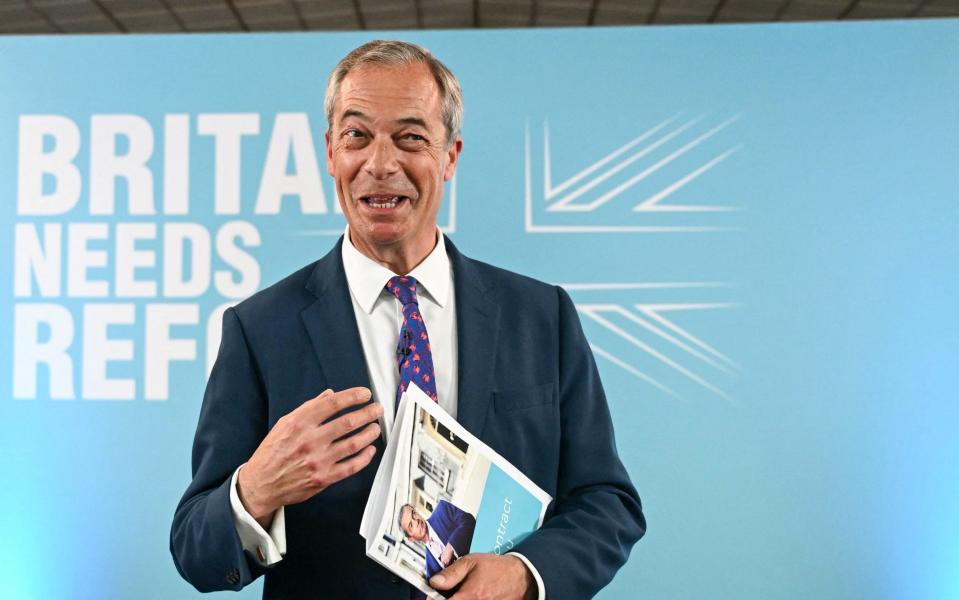

Reform UK has unveiled its plans for personal finance after overtaking the Tories for the first time in the polls last week.

Nigel Farage has admitted that he is not expecting to win the general election on July 4, but at an event in Wales on Monday, Mr Farage said he wanted Reform to become “the proper voice of opposition” to Labour. He would then use that voice “to build a big national campaigning movement around the country over the course of the next five years for genuine change.”

There is little to no chance of Reform forming the next government – but the fledgling party seems certain to hoover up hundreds of thousands, if not millions, of votes. Mr Farage is on course to become highly influential whichever party runs the country over the next five years and, who knows, by 2029 anything’s possible.

So, how much money would you stand to lose or make if Reform’s financial policies came into effect?

Income tax: £1,500 saving for an average earner

Reform is promising to raise the minimum income tax threshold from £12,571 to £20,000, lifting up to seven million people out of income tax.

It also wants to increase the higher rate threshold from £50,270 to £70,000.

Raising these tax bands would result in a £1,500 tax saving for the average worker, earning £35,000, while someone on £75,000 would save £5,500 per year.

Rachael Griffin, of wealth manager Quilter, said: “The pledge to increase tax thresholds would be a welcome proposition for many, signalling a potential increase in take-home pay for hardworking people. However, the specifics of how that would be funded lacks detail, leaving voters to wonder about the financial feasibility of such promises.”

Stamp duty: save £76,000 on a £1.5m property purchase

The party has also said that stamp duty, the tax paid on residential property transactions, would be scrapped for homes valued at less than £750,000, down from £250,000 currently. This would save someone purchasing a £750,000 property about £25,000 in stamp duty.

After that, the rate would be 2pc on £750,000 to £1.5m and 4pc over £1.5m. According to stockbroker AJ Bell, someone buying a £1.5m property would save more than £76,000.

Inheritance tax: bill would fall by £100,000 for a £2.5m estate

Reform has pledged to abolish inheritance tax for estates worth under £2m. In addition, it wants to reduce the charge from 40pc to 20pc.

Currently, people can pass on £325,000 without having to pay death duties. Homeowners get an extra £175,000 allowance – so couples can leave behind a maximum of £1m.

Raising the threshold to £2m would dramatically slash the number of people paying inheritance tax.

In 2020-21, the latest year for which data exists, over 24,000 of the 27,000 families that paid inheritance tax had estates worth less than £2m.

Meanwhile, someone inheriting a £2.5m estate would see their bill fall from £200,000 to £100,000.

VAT on energy bills: £100 off energy bills

Reform has pledged to scrap VAT on energy bills, which it said would save households £100 per year

It also wants to lower fuel duty by 20p per litre and reduce VAT from 20pc to 18pc – calculating that these measures would save £240 per driver and £300 per household each year.

Landlords: reverse cuts to tax reliefs

Reform wants to reverse George Osborne’s policy of scaling back tax relief on mortgage interest. Currently property investors get a 20pc “credit” to offset mortgage costs from before calculating profits. Reform would turn the clock back to a time when all mortgage costs could be deducted.

In addition, Reform plans to abolish the Renters’ Reform Bill, which would ban landlords from evicting tenants without a reason – the infamous “Section 21” eviction. The party said the new legislation, championed by Michael Gove, was “inadequate to address bad practices”.

Students: scrap interest... but extend life of student loans

Reform has promised to scrap the interest on student loans.

Students graduating today owe on average £45,000. The maximum interest on Plan 2 student loans is currently 7.8pc, the highest ever level, adding thousands of pounds to graduates’ debt.

However, Reform would also extend the capital repayment period to 45 years – so graduates would be paying the debt well into their 60s. Since October 2023 new student loans are wiped after 40 years, up from 30 years previously.

Pensions: look Down Under

Reform has said it wants to improve the savings and pension system in the long term to make it “much better and cheaper, from a much younger age”, citing Australia as a model. It said the current system is riddled with “complexity, huge cost and poor returns”.

Australia’s pension system was the model for Britain’s automatic enrolment programme, which makes workplace pensions nearly compulsory for most workers. However, minimum contributions are much higher Down Under while experts agree most people in the UK are not saving enough towards their retirements.

Tax allowance for married couple: extra tax breaks.. if you have children

The party said it would allow married couples with children to share their tax allowance, as is currently the case in France and Germany.

It would, “as soon as finances allow” introduce a 25pc marriage tax allowance. With their personal allowance of £20,000, this would mean no tax on a spouse’s first £25,000 of income.

Laura Suter, of AJ Bell, said: “Currently if one half of a couple earns less than the £12,570 personal allowance they can hand any unused allowance to their spouse, with a potential tax saving of around £250 a year. But Reform would extend this for couples with children to hand them an even bigger tax break.”

Self-employed: scrap IR35 to help freelancers

Reform has pledged to scrap the IR35 or “off-payroll working” rules. These were introduced in 2000 to prevent “disguised employment” where workers pay less employment tax despite effectively working as an employee of a company.

In 2017 the Government made it the job of an employer to work out whether contractors were “inside” or “outside” the rules.

They are deeply unpopular among the self-employed who say the rules have made it much harder to find work and have landed them with huge, retrospective tax bills.

Andy Chamberlain, of the Association of Independent Professionals and the Self-Employed, a trade body, said: “IR35 is the top priority for thousands of freelancers and contractors at this election.

“By pledging to scrap it, Reform will take thousands of votes away from Labour and the Conservatives who have so far neglected to acknowledge the flaws in this damaging legislation.”

Yahoo Finance

Yahoo Finance