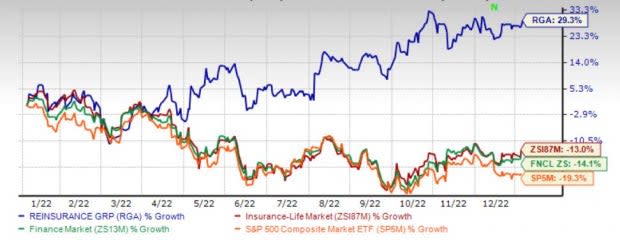

Reinsurance Group (RGA) Gains 29% in a Year: Will the Rally Last?

Shares of Reinsurance Group of America, Incorporated RGA have rallied 29.3% in a year against the industry’s decline of 13%. The Finance sector and the Zacks S&P 500 composite have declined 14.1% and 19.3%, respectively, in the same time frame. With a market capitalization of $9.5 billion, the average volume of shares traded in the last three months was about 0.4 million.

Improved pricing, business expansion in the pension risk transfer market, solid in-force business ensuring predictable long-term earnings and effective capital deployment continue to drive this Zacks Rank #3 (Hold) insurer.

This insurer has a decent track record of beating estimates in three of the last four quarters. The Zacks Consensus Estimate for the 2023 bottom line has moved 0.5% north in the past 60 days, reflecting analyst optimism.

Image Source: Zacks Investment Research

RGA has a VGM Score of A. This helps to identify stocks with the most attractive value, growth and momentum.

Can RGA Retain the Momentum?

The Zacks Consensus Estimate for Reinsurance Group’s 2023 earnings is pegged at $15.49, indicating an increase of 3% on 2.9% higher revenues of $17.2 billion. It has a Growth Score of B.

RGA has a leadership position in the U.S. and Latin American traditional markets. Significant value embedded in the in-force business is anticipated to generate predictable long-term earnings. While product line expansion contributes to risk diversification, matured Individual mortality provides a base for stable earnings and capital generation.

In Canada, Reinsurance Group is a market leader with solid growth and profitability. A sizable block of in-force business ensures a significant source of future earnings. While longevity insurance provides a source of diversified income, it also acts as a hedge to a large mortality position. Increasing demand for longevity insurance is expected to drive long-term growth for the product.

Life insurers are direct beneficiaries of an improving interest rate environment. The Fed raised interest rates seven times in 2022, with more on the horizon this year. At its December meeting, the Fed indicated taking the interest rate to 5.1% in 2023 to combat its expected 3.1% inflation. RGA’s high-quality investment portfolio is well-positioned as it remains diversified across asset classes, sectors, issuers and geography. Thus, an improving interest rate environment should add to the upside.

This leading global provider of traditional life and health reinsurance and financial solutions has a solid capital position providing sufficient financial flexibility and supporting effective capital deployment. While the insurer raised its dividend by 9.6% in August 2022, it also engaged in share buyback.

Stocks to Consider

Some better-ranked stocks from the insurance industry are Root, Inc. ROOT, Kinsale Capital Group, Inc. KNSL and CNA Financial Corporation CNA, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Root delivered a trailing four-quarter average earnings surprise of 22.44%. In the last six months period, ROOT lost 80.2%.

The Zacks Consensus Estimate for ROOT’s 2023 earnings indicates a year-over-year increase of 23.9%.

Kinsale Capital’s earnings surpassed estimates in each of the last four quarters, the average being 15.16%. In the last six months period, KNSL gained 6.9%.

The Zacks Consensus Estimate for KNSL’s 2023 earnings implies a year-over-year rise of 22.4%.

The Zacks Consensus Estimate for CNA Financial’s 2023 earnings implies a year-over-year rise of 12.5%. In the last six months period, CNA lost 3.6%.

The Zacks Consensus Estimate for CNA’s 2023 earnings has moved 2.5% north in the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CNA Financial Corporation (CNA) : Free Stock Analysis Report

Reinsurance Group of America, Incorporated (RGA) : Free Stock Analysis Report

Kinsale Capital Group, Inc. (KNSL) : Free Stock Analysis Report

Root, Inc. (ROOT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance