Research Antibodies & Reagents Market Research Report 2022

Global Research Antibodies & Reagents Market

Dublin, July 27, 2022 (GLOBE NEWSWIRE) -- The "Global Research Antibodies & Reagents Market by Product (Antibodies (Type, Form, Source, Research Area), Reagents), Technology (Western Blot, Flow Cytometry, ELISA), Application (Proteomics, Genomics), End-user (Pharma, Biotech, CROs), and Region - Forecast to 2027" report has been added to ResearchAndMarkets.com's offering.

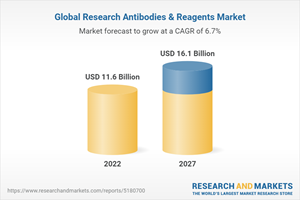

The global research antibodies and reagents market is projected to reach USD 16.1 billion by 2027 from USD 11.6 billion in 2022, at a CAGR of 6.7%

The research antibodies and reagents market evolved owing to factors such as increasing proteomics and genomics research, growing demand for antibodies for research reproducibility, and increasing R&D expenditure in the life sciences industry.

Driven by the increasing demand for personalized medicine and structure-based drug design. It is expected that the global research antibodies and reagents market will witness significant growth in the coming years.

On the basis of product, the reagents segment holds the highest market share during the forecast period

On the basis of product, the research antibodies and reagents market are segmented into reagent and antibodies. In 2021 the reagent segment accounted for the larger market share. Factors such as increasing applications of biosciences and biotechnology within the healthcare and pharmaceutical fields is driving the market.

On the basis of technology, the flow cytometry segment is expected to register the highest CAGR during the forecast period

On the basis of technology, the research antibodies and reagents market is segmented into western blotting, flow cytometry, ELISA, Immunohistochemistry, Immunofluorescence, Immunoprecipitation, and other technologies. During the forecast period the flow cytometry segment is expected to witness the highest growth.

Factors such as advantages of this technique, its ability to perform simultaneous multi-parameter analysis on single cells within a heterogeneous mixture, offering high throughput along with technological innovations in flow cytometry and increasing oncology research, are driving the growth of this segment.

On the basis of application, the proteomics segment holds the highest market share during the forecast period

On the basis of application, the research antibodies and reagents market is segmented into proteomics, drug development and Genomics. In 2021, Proteomics held the largest share of the global research antibodies and reagents market. Factors such as increasing efficiency maps drug-protein and protein-protein interactions.

Additionally, proteomic technologies have minimized the cost, time, and resource requirements for chemical synthesis and biological testing of drugs and are highly efficient. Such factors are driving the market.

On the basis of end-user, the pharmaceutical & biotechnology segment holds the highest market share during the forecast period

The research antibodies and reagents market is divided into the pharmaceutical & biotechnology companies, academic & research institutions and Contract Research Organizations.

In 2021 the pharmaceutical & biotechnology companies held the largest share of the global research antibodies and reagents end-user market. Factors such as growing use of research antibodies in drug development for the identification and quantification of biomarkers and other techniques are driving the market.

By Region, Asia Pacific is expected to register the highest CAGR during the forecast period

During the forecast period (2022 to 2027), the Asia Pacific research antibodies and reagents market is expected to grow at the highest CAGR. Factors such as increasing research in proteomics and genomics and growing research funding, investments by pharmaceutical and biotechnology companies, and growing awareness in the region are driving the market in the region.

Key Players

The key players operating in the research antibodies and reagents systems include Thermo Fisher Scientific, Inc. US), Merck KGaA (Germany), Abcam plc (UK), Becton, Dickinson and Company (US), Bio-Rad Laboratories (US), Cell Signaling Technology (US), F. Hoffmann-La Roche (Switzerland), Danaher Corporation (US), Agilent Technologies (US), PerkinElmer (US), Lonza (Switzerland), GenScript (China), and BioLegend (US).

Premium Insights

Increasing R&D Expenditure in the Life Science Industry to Drive Market Growth

Proteomics Accounted for the Largest Share of the Asia-Pacific Research Antibodies and Reagents Market in 2021

China Shows the Highest Revenue Growth Opportunities During the Forecast Period

North America Will Continue to Dominate the Research Antibodies and Reagents Market Until 2027

Developing Markets to Register a Higher Growth Rate in the Forecast Period

Market Dynamics

Drivers

Increasing Research Activity and Funding for R&D

Growing Industry-Academia Collaboration

Restraints

Quality Concerns and a Lack of Reproducible Results

Opportunities

Emerging Markets

Personalized Medicine and Protein Therapeutics

Growth in Stem Cell and Neurobiology Research

Increasing Focus on Biomarker Discovery

Rising Interest in Outsourcing

Challenges

Cost and Time-Intensive Antibody Development Processes

Pricing Pressure Faced by Prominent Market Players

Industry Trends

Increasing Research on Therapeutic Antibodies

Recombinant Antibodies Supporting the Smooth Transition from in Vitro to in Vivo

Growing Consolidation of the Life Sciences Market for Antibodies and Reagents

Stakeholder Analysis

Strategic Benchmarking

Impact of COVID-19 on the Research Antibodies and Reagents Market

Supply Chain Analysis

Technology Analysis

Regulatory Analysis

Porter's Five Forces

Companies Mentioned

Abcam plc

Agilent Technologies, Inc.

Analytik Jena AG

Atlas Antibodies

BD

Bio-Rad Laboratories, Inc.

Biolegend

Cell Signaling Technology, Inc.

Danaher Corporation

Dovetail Genomics

F. Hoffmann-La Roche

Fujirebio Diagnostics AB

Genscript

Illumina, Inc.

Immunoprecise Antibodies Ltd

Lonza

Merck KGaA

Omega Bio-Tek

Perkinelmer, Inc.

Thermo Fisher Scientific, Inc.

For more information about this report visit https://www.researchandmarkets.com/r/7dtq08

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance