Returns Are Gaining Momentum At Red 5 (ASX:RED)

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. So when we looked at Red 5 (ASX:RED) and its trend of ROCE, we really liked what we saw.

Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Red 5 is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.12 = AU$67m ÷ (AU$669m - AU$133m) (Based on the trailing twelve months to December 2023).

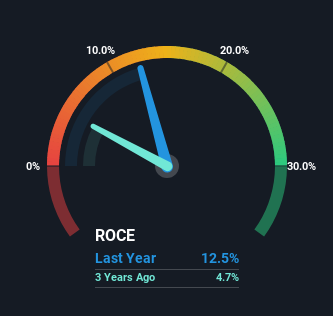

Therefore, Red 5 has an ROCE of 12%. That's a relatively normal return on capital, and it's around the 11% generated by the Metals and Mining industry.

Check out our latest analysis for Red 5

Above you can see how the current ROCE for Red 5 compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering Red 5 for free.

What The Trend Of ROCE Can Tell Us

Red 5 has recently broken into profitability so their prior investments seem to be paying off. About five years ago the company was generating losses but things have turned around because it's now earning 12% on its capital. And unsurprisingly, like most companies trying to break into the black, Red 5 is utilizing 339% more capital than it was five years ago. This can indicate that there's plenty of opportunities to invest capital internally and at ever higher rates, both common traits of a multi-bagger.

In another part of our analysis, we noticed that the company's ratio of current liabilities to total assets decreased to 20%, which broadly means the business is relying less on its suppliers or short-term creditors to fund its operations. Therefore we can rest assured that the growth in ROCE is a result of the business' fundamental improvements, rather than a cooking class featuring this company's books.

What We Can Learn From Red 5's ROCE

To the delight of most shareholders, Red 5 has now broken into profitability. Since the stock has returned a staggering 176% to shareholders over the last five years, it looks like investors are recognizing these changes. With that being said, we still think the promising fundamentals mean the company deserves some further due diligence.

On the other side of ROCE, we have to consider valuation. That's why we have a FREE intrinsic value estimation for RED on our platform that is definitely worth checking out.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance