Revolution Medicines Inc (RVMD) Reports Earnings: R&D Investments Surge Amidst Clinical Progress

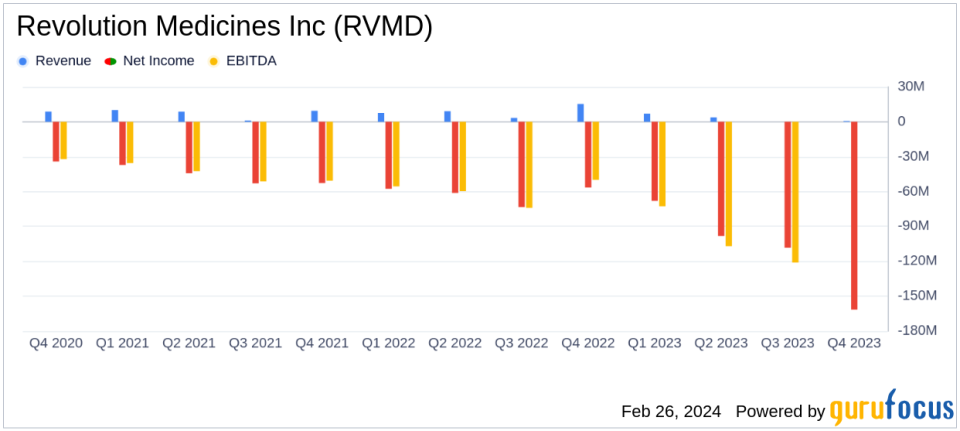

Revenue: Total revenue decreased to $0.7 million in Q4 2023 from $15.3 million in Q4 2022.

R&D Expenses: R&D expenses increased to $148.5 million in Q4 2023 from $66.1 million in Q4 2022.

Net Loss: Net loss widened to $161.5 million in Q4 2023 from $56.5 million in Q4 2022.

Cash Position: Cash, cash equivalents, and marketable securities stood at $1.85 billion as of December 31, 2023.

2024 Financial Guidance: Projected GAAP net loss between $480 million and $520 million for the full year 2024.

On February 26, 2024, Revolution Medicines Inc (NASDAQ:RVMD) released its 8-K filing, detailing its financial results for the fourth quarter and full year of 2023. The clinical-stage oncology company, known for its targeted therapies for RAS-addicted cancers, reported a decrease in revenue and a significant increase in research and development expenses as it advances its RAS(ON) inhibitors through clinical trials.

Company Overview

Revolution Medicines Inc is at the forefront of precision oncology, developing novel targeted therapies to inhibit elusive, frontier targets within notorious growth and survival pathways, especially the RAS and mTOR signaling pathways. Its product candidates, such as RMC-4630, RMC-6236, and RMC-6291, are designed to tackle various mutations within these pathways, offering hope for patients with specific cancer genotypes.

Financial Performance and Challenges

The company's financial performance reflects its strategic investment in advancing its clinical pipeline. The reported net loss for Q4 2023 was $161.5 million, compared to a net loss of $56.5 million for Q4 2022. This increase in net loss is primarily due to heightened R&D expenses, which surged as the company progresses its RAS(ON) inhibitors through clinical trials. These investments are critical for the company's growth and potential to bring new cancer therapies to market.

Despite the increased R&D spending, the company's cash position remains strong, with $1.85 billion in cash, cash equivalents, and marketable securities as of December 31, 2023. This robust financial standing is partly due to the acquisition of EQRx, which bolstered the company's balance sheet significantly.

Key Financial Metrics

Revenue for Q4 2023 was $0.7 million, a stark decrease from the $15.3 million reported in the same period the previous year. The decline is attributed to the termination of a collaboration agreement with Sanofi. R&D expenses for the quarter were $148.5 million, reflecting the company's commitment to advancing its clinical programs. General and administrative expenses also rose to $32.2 million, up from $10.9 million in Q4 2022, due to increased headcount and stock-based compensation.

The company's financial achievements, particularly its fortified cash position, are significant in the biotechnology industry where the development cycle for new drugs is lengthy and capital-intensive. The ability to sustain operations and fund clinical trials through to 2027 without additional financing is a testament to the company's strategic financial planning and execution.

Analysis and Outlook

Revolution Medicines Inc's performance in 2023 underscores its commitment to developing its RAS(ON) inhibitor portfolio. The company's CEO, Mark A. Goldsmith, M.D., Ph.D., emphasized the transformative nature of the past year and the clinical validation of their RAS(ON) inhibitors. Looking ahead, the company anticipates initiating pivotal trials for RMC-6236 in the second half of 2024, with the goal of addressing second-line treatments for non-small cell lung cancer and pancreatic ductal carcinoma.

The company's 2024 financial guidance anticipates a GAAP net loss between $480 million and $520 million, including non-cash stock-based compensation expense. This projection reflects the company's continued investment in its pipeline and the expected costs associated with advancing its clinical programs.

For investors and stakeholders, Revolution Medicines Inc's progress and financial health are indicative of a company strategically navigating the complex landscape of oncology drug development. With a clear focus on its RAS(ON) inhibitors and a strong cash position to support its endeavors, RVMD is poised to make significant strides in the fight against RAS-addicted cancers.

For more detailed information and to listen to the webcast, please visit Revolution Medicines' website at https://ir.revmed.com/events-and-presentations.

Explore the complete 8-K earnings release (here) from Revolution Medicines Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance