Revvity's (RVTY) New Launch to Boost Newborn Sequencing Research

Revvity, Inc. RVTY recently announced the introduction of a flexible end-to-end workflow solution for newborn research. This will likely enable the users to utilize different instruments, reagents and databases based on a lab’s requirements.

The research-use-only offering includes dried blood spot collection and processing devices, Chemagic kits and instruments for nucleic acid extraction, liquid handlers and reagents for library preparation, VICTOR2 D Instrument for sample quality control and software capabilities. The workflow is compatible with the Element AVITI system and other leading next-generation sequencing (NGS) platforms.

The latest product introduction is expected to significantly boost Revvity’s sequencing research business on a global scale and solidify its foothold in the niche space.

Significance of the Launch

Per Revvity, the solution is expected to enable the identification of variants in more than 350 genes, complemented by a large database of carefully pre-curated variants. Management believes that the new workflow will likely improve customer experience by leveraging a rich variant database for newborn sequencing research and provide critical components necessary to be able to go from sample to result.

Industry Prospects

Per a report by Grand View Research, the global NGS market was estimated at $8.40 billion in 2023 and is anticipated to witness a CAGR of approximately 21.7% between 2024 and 2030. Factors like the rise in applications of NGS and the growing technological developments in NGS instruments and technologies are expected to drive the market.

Given the market potential, the latest launch is expected to significantly boost Revvity’s global business.

Notable Developments

Last month, Revvity announced that its software and informatics division, Revvity Signals, was unveiling the Signals Clinical solution. It is a software-as-a-service, end-to-end clinical data science platform designed to centralize all clinical trial data, providing fast, actionable insights for quicker clinical decisions and accelerated market delivery of therapeutics.

The same month, Revvity announced its fourth-quarter 2023 results, wherein management commented that the company persevered through continued industry headwinds and performed better than expected during the final months of 2023. The company is currently leading with innovation to be a strategic scientific partner for its customers, which is expected to position it well to continue to perform at a high level.

Price Performance

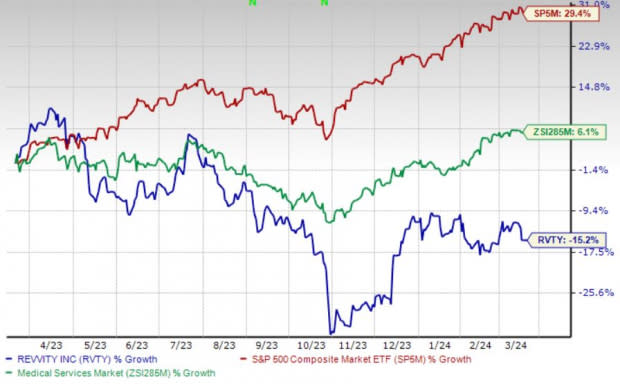

Shares of Revvity have lost 15.3% in the past year against the industry’s 6.1% rise and the S&P 500’s 29.4% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, Revvity carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Cardinal Health, Inc. CAH and Cencora, Inc. COR.

DaVita, sporting a Zacks Rank #1 (Strong Buy), has an estimated long-term growth rate of 12.1%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 35.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 75.2% compared with the industry’s 23.8% rise in the past year.

Cardinal Health, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 14.2%. CAH’s earnings surpassed estimates in each of the trailing four quarters, with the average being 15.6%.

Cardinal Health has gained 55.5% compared with the industry’s 15.6% rise in the past year.

Cencora, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 9.8%. COR’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 6.7%.

Cencora’s shares have rallied 54.8% compared with the industry’s 6.1% rise in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report

Revvity Inc. (RVTY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance