Revvity's (RVTY) New Launch to Boost Research Productivity

Revvity, Inc. RVTY recently introduced the new Signals ChemDraw offering through its software and informatics division, Revvity Signals Software. The innovative chemistry suite is expected to transform the way researchers in the pharmaceutical and non-pharmaceutical chemical industries, and academia develop and communicate complex chemical concepts and collaborate across disciplines.

The latest product is expected to significantly boost Revvity’s Signals Software portfolio on a global scale and solidify its foothold in the niche space.

Significance of the Launch

The Signals ChemDraw will likely combine advanced drawing, collaboration and chemical data management into a cloud-native solution purpose-built to accelerate the development of novel therapeutic molecules, specialty chemicals, or new sustainable materials. This is expected to aid researchers in seamlessly representing and communicating complex chemistry concepts while streamlining the reporting of critical information via the intuitive, cloud-based platform.

Per management, in the current fast-paced scientific environment, administrative duties often overshadow crucial analytical work. By integrating the innovative chemistry communication tool into its cloud-native Revvity Signals Research platform, the company aims to relieve scientists from time-consuming tasks. Management expects seamless integration within the Revvity Signals Research platform to empower multidisciplinary discoveries.

Industry Prospects

Per a report by SkyQuest Technology Group, the global laboratory chemicals market is poised to go from $3.58 billion in 2023 to $5.37 billion by 2030 at a CAGR of 5.2%. Factors like the increasing demand for innovative and high-quality chemicals to support the expanding research and development activities and the growing emphasis on drug discovery technologies are expected to drive the market.

Given the market potential, the latest launch is expected to significantly boost Revvity’s global business.

Recent Launches

This month, Revvity introduced a flexible end-to-end workflow solution for newborn research. This will likely enable the users to utilize different instruments, reagents and databases based on a lab’s requirements.

Last month, Revvity’s software and informatics division, Revvity Signals, unveiled the Signals Clinical solution. It is a software-as-a-service, end-to-end clinical data science platform designed to centralize all clinical trial data, providing fast, actionable insights for quicker clinical decisions and accelerated market delivery of therapeutics.

Price Performance

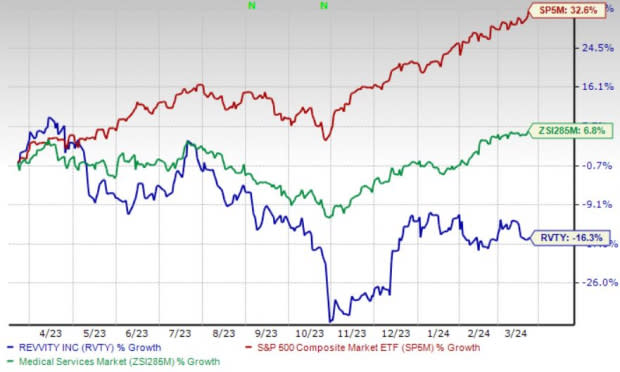

Shares of Revvity have lost 16.3% in the past year against the industry’s 6.8% rise and the S&P 500’s 32.6% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, Revvity carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Cardinal Health, Inc. CAH and Cencora, Inc. COR.

DaVita, sporting a Zacks Rank #1 (Strong Buy), has an estimated long-term growth rate of 12.1%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 35.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 80.8% compared with the industry’s 25.4% rise in the past year.

Cardinal Health, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 14.2%. CAH’s earnings surpassed estimates in each of the trailing four quarters, with the average being 15.6%.

Cardinal Health has gained 59.9% compared with the industry’s 17.1% rise in the past year.

Cencora, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 9.8%. COR’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 6.7%.

Cencora’s shares have rallied 57.6% compared with the industry’s 6.8% rise in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report

Revvity Inc. (RVTY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance