Ride Hailing Global Market Report 2024

Global Ride Hailing Market

Dublin, March 14, 2024 (GLOBE NEWSWIRE) -- The "Ride Hailing Global Market Report 2024" report has been added to ResearchAndMarkets.com's offering.

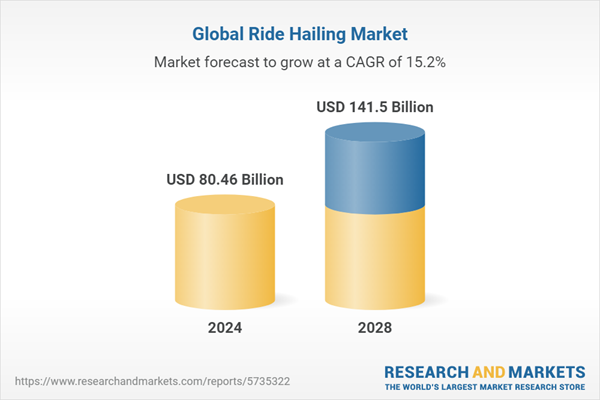

The ride hailing market size has grown rapidly in recent years. It will grow from $70.12 billion in 2023 to $80.46 billion in 2024 at a compound annual growth rate (CAGR) of 14.8%. The growth in the historical period can be attributed to factors such as urbanization and population density, changing consumer behavior, challenges related to traffic congestion and parking, and considerations related to first and last-mile connectivity, along with economic factors.

The ride hailing market size is expected to see rapid growth in the next few years. It will grow to $141.5 billion in 2028 at a compound annual growth rate (CAGR) of 15.2%. The forecasted growth in the upcoming period can be attributed to factors such as integration with multimodal transportation, emphasis on environmental sustainability, adherence to regulatory frameworks, implementation of enhanced safety measures, and expansion into rural and suburban areas. Major trends expected in the forecast period include corporate partnerships for employee transportation, optimization of dynamic pricing, advocacy for regulatory compliance, incorporation of inclusive accessibility features, and the introduction of virtual queues and pre-booking options.

The growth of the ride-hailing market is being propelled by on-demand transportation services and a reduced rate of car ownership among millennials. On-demand transportation services, characterized by flexible routing and ad-hoc scheduling of private vehicles, offer a personalized transport experience, allowing passengers to be picked up or dropped off at locations of their choice. These services enhance the convenience and safety of travel, contributing significantly to the market's expansion. Furthermore, the lower car ownership rates among millennials, driven by the high maintenance costs associated with personal cars, lead to an increased demand for ride-hailing services. Millennials prefer practical, smartphone-accessible transport options that are cost-effective and flexible over the burdens of car ownership, which includes expensive purchases and maintenance. For instance, Transdev estimates that 71 million passengers will use on-demand transportation services in 2022, highlighting the impact of these trends on the ride-hailing market.

The ride-hailing industry faces challenges in adhering to various state and central laws, which are crucial for uninterrupted service. In the United States, these regulations encompass background checks, driver's licenses, vehicle registrations, business licenses, external vehicle displays, and compliance with driver-related and company-related rules. Some countries mandate fingerprint-based background checks due to reported incidents of sexual assault and violence. A report from the Union of Concerned Scientists in April 2021 highlighted that the average U.S. ride-hailing trip results in 69% more pollution than displaced transportation choices, based on federal vehicle efficiency statistics. Consequently, environmental concerns have led to stricter regulations on pollution control, and compliance with these regulations poses potential barriers to the growth of the ride-hailing market.

Leading companies in the ride-hailing market are dedicated to innovating products such as ride-hailing services apps to deliver reliable services to their customers. These apps connect passengers with local drivers who use their personal vehicles. For instance, in March 2023, Godugo Travel Solutions Private Limited, an India-based company offering a vehicle booking mobile app for taxi services, introduced Godugo. This ride-hailing app empowers drivers to operate their businesses through the platform and incorporates advanced features such as a System of Systems (SOS) system. The SOS system sends alerts to users within a 1km radius and the nearest police station when a female passenger or driver feels threatened.

For more information about this report visit https://www.researchandmarkets.com/r/dhdgc5

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance