Robert Karr's Strategic Acquisition in Shoals Technologies Group Inc

Overview of the Recent Transaction

On May 16, 2024, Joho Capital, under the leadership of Robert Karr (Trades, Portfolio), made a significant addition to its investment portfolio by acquiring 2,699,000 shares of Shoals Technologies Group Inc (NASDAQ:SHLS). This transaction increased the firm's total holdings in SHLS to 9,122,545 shares, marking a substantial impact of 2.5% on the portfolio. The shares were purchased at a price of $6.84 each, reflecting a strategic move in the solar energy sector.

Profile of Robert Karr (Trades, Portfolio) and Joho Capital

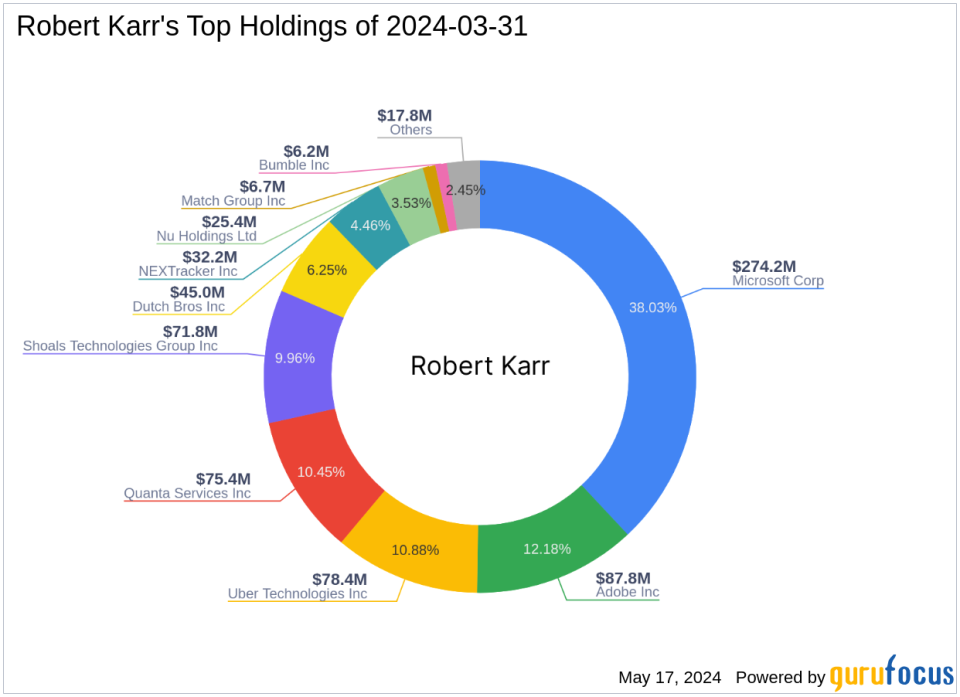

Founded in 1996, Joho Capital is a renowned investment firm established by Robert Karr (Trades, Portfolio), a prominent figure among the Tiger Cubs who trained under Julian Robertson at Tiger Management (Trades, Portfolio). The firm is known for its concentrated investments in new technologies, maintaining a low turnover rate to focus deeply on a select few long-term investments. Joho Capital's top holdings include major names like Adobe Inc (NASDAQ:ADBE), Microsoft Corp (NASDAQ:MSFT), and Shoals Technologies Group Inc (NASDAQ:SHLS), emphasizing its strong inclination towards the technology and industrials sectors. The firm manages an equity portfolio valued at approximately $721 million.

Introduction to Shoals Technologies Group Inc

Shoals Technologies Group, based in the USA, specializes in providing electrical balance of system (EBOS) solutions for solar energy projects. Since its IPO on January 27, 2021, the company has focused on components and system solutions that facilitate the transfer of electric current from solar panels to inverters. Despite a challenging market, Shoals Technologies continues to play a pivotal role in the solar energy sector, with a current market capitalization of $1.11 billion.

Financial Details and Impact of the Trade

The acquisition was executed at a trade price of $6.84, slightly above the current market price of $6.495. This purchase increased Karr's position in SHLS to 8.44% of the portfolio, reflecting a significant commitment to the stock. The firm now holds 5.35% of the total shares of Shoals Technologies, underscoring a strong belief in the company's potential despite recent market downturns.

Market Performance and Valuation Metrics of SHLS

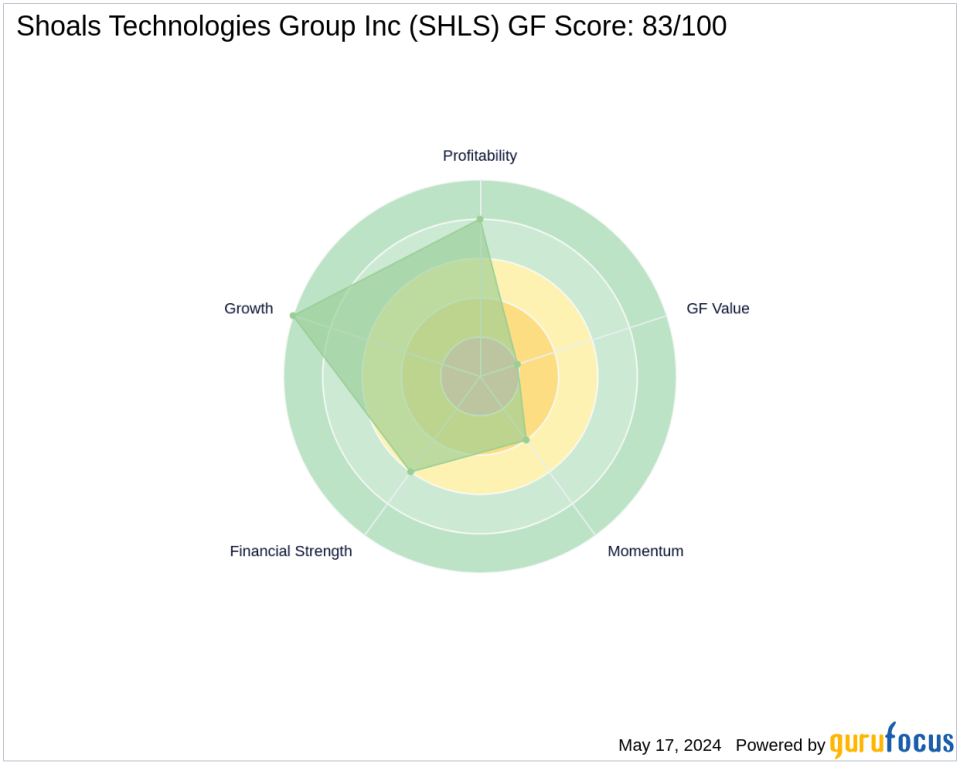

Shoals Technologies is currently rated as significantly undervalued with a GF Value of $24.33, indicating a substantial margin of safety at the current price. The stock's performance metrics, such as a PE Ratio of 36.08 and a GF Score of 83, suggest good potential for future outperformance. The company's financial strength and profitability are highlighted by its ranks in Financial Strength and Profitability Rank, respectively.

Sector and Industry Analysis

Technology and industrials are the predominant sectors in Joho Capital's portfolio, with Shoals Technologies aligning well within these categories. The firm's investment in SHLS not only diversifies its holdings but also strengthens its position in the burgeoning solar energy industry, a subset of the broader semiconductor sector.

Comparative Analysis with Other Gurus

Other notable investors like Ron Baron (Trades, Portfolio) and Joel Greenblatt (Trades, Portfolio) also hold positions in SHLS, although their strategies and holdings sizes vary. This collective interest from top investors could signal a strong market sentiment towards Shoals Technologies' growth prospects.

Future Outlook and Strategic Implications

The decision by Joho Capital to increase its stake in Shoals Technologies may be driven by the firm's optimistic view on the solar energy sector's growth and SHLS's role within it. Considering the current market conditions and the intrinsic value indicated by the GF Value, Robert Karr (Trades, Portfolio)'s firm appears poised for potential gains, assuming the market corrects to recognize Shoals' underlying value.

This strategic acquisition not only enhances Joho Capital's portfolio but also sets a robust foundation for capitalizing on the renewable energy trend, which is expected to gain more traction in the coming years.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance