Can Ross Stores' (ROST) Merchandising Strategies Aid the Stock?

Ross Stores, Inc. ROST has adeptly responded to the macroeconomic challenges by adjusting its merchandise across both primary retail banners. This strategic adaptation has led to an increase in comparable store sales, indicating robust consumer demand and effective merchandise offerings.

In the first quarter of 2024, comps improved 3%, mostly attributable to higher customer traffic. This led to a sales improvement of 8% year over year. The company surpassed the Zacks Consensus Estimate for both the top and bottom lines.

Also, earnings and revenues recorded year-over-year improvement. This robust performance was attributed to customer’s favorable response to quality and branded bargains, resulting in impressive earnings growth.

Ross Stores is a prominent player in the off-price retail sector, with a robust business model that appeals to value-conscious men and women aged 25 to 54 in middle-to-upper-middle-class households. By offering competitive bargains, the company attracts customers in various economic climates, ensuring a steady flow of traffic to its stores.

Let’s Delve Deeper

Ross Stores’ off-price business model offers strong value proposition and micro-merchandising that drive better product allocation and margins. Its strategic focus on value, efficient product allocation and local market customization enables it to maintain a competitive edge in the retail industry.

ROST has been benefiting from lower distribution expenses, domestic freight and occupancy expenses due to the easing of supply-chain headwinds. This improvement contributed to a 140 basis points (bps) decline in the cost of goods sold as a percentage of revenues, consequently improving the operating margin in the first quarter of 2024. Specifically, the company saw a 75-bps decline in distribution expenses and domestic freight improved by 30 bps.

However, these positives were partially offset by a 15-bps year-over-year decline in merchandise margin. The pressure from offering more competitively priced brands was partially offset by lower ocean freight costs.

Ross Stores has maintained a steady track record in executing its store expansion strategies over the years. These strategies are mainly centered around increasing penetration in the existing as well as new markets. As of May 24, 2024, it operated a total of 2,127 stores consisting of 1,775 Ross Dress for Less stores and 352 dd's DISCOUNTS locations. This reflects the company's robust expansion strategy.

Notably, it inaugurated 11 new Ross Dress for Less stores and seven dd's DISCOUNTS outlets in February and March, expanding its footprint across 11 different states. In fiscal 2024, management aims to open a total of 90 new stores.

Assessing the Road Ahead

ROST has been experiencing the challenges of enduring macroeconomic and geopolitical landscape including inflation. The purchasing power of low-to-moderate-income customers remains constrained. To overcome these challenges, the company is diligently managing inventory and expenses, aiming to enhance sales and earnings growth throughout fiscal 2024.

For the second quarter, management envisions comps to rise in the 2-3% band from the year-ago levels. Earnings per share are suggested to be between $1.43 and $1.49, higher than $1.32 reported in the year-earlier quarter. Operating margin is forecast in the range of 11.5-11.8% compared with 11.3% in the prior year.

Further, comps for the 52 weeks ending Feb 1, 2025, are anticipated to be up 2-3%, with earnings per share of $5.79-$5.98 compared with $5.56 for the 53 weeks ended Feb 3, 2024.

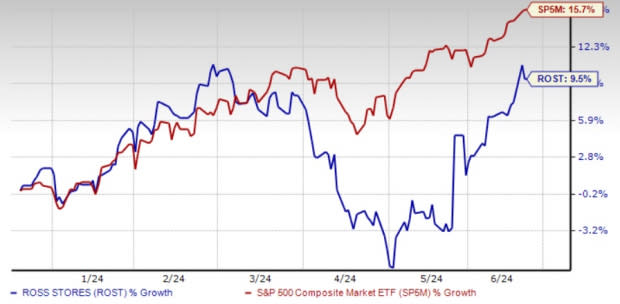

Shares of the Zacks Rank #3 (Hold) company have decreased 9.5% in the past six months against the industry’s growth of 15.7%.

Image Source: Zacks Investment Research

3 Picks You Can’t Miss

We have highlighted three better-ranked stocks, namely, Abercrombie & Fitch Co. ANF, The Gap Inc. GPS and DICK'S Sporting Goods DKS.

Abercrombie & Fitch, a specialty retailer of premium, high-quality casual apparel, currently sports a Zacks Rank #1 (Strong Buy) at present. ANF has a trailing four-quarter average earnings surprise of 210.3%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current fiscal-year sales and earnings indicates growth of 10.4% and 47.3%, respectively, from the year-ago figures.

Gap, a fashion retailer of apparel and accessories, currently flaunts a Zacks Rank #1. GPS has a trailing four-quarter earnings surprise of 202.7%, on average.

The Zacks Consensus Estimate for Gap’s current financial-year sales and earnings per share suggests a rise of 0.2% and 21.7%, respectively, from the year-earlier levels.

DICK'S Sporting operates as an omni-channel sporting goods retailer. It currently carries a Zacks Rank #2 (Buy). DKS has a trailing four-quarter earnings surprise of 4.7%, on average.

The Zacks Consensus Estimate for DICK’S Sporting current fiscal-year sales and earnings implies an improvement of 1.8% and 6.6%, respectively, from the prior-year numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

DICK'S Sporting Goods, Inc. (DKS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance