Ross Stores' (ROST) Strong Business Momentum Aids Stock

Ross Stores, Inc. ROST has been favored by investors on the back of positive customer response to its improved merchandise despite the competitive environment and digital growth. Moreover, the off-price model offers a strong value proposition and micro-merchandising that drive better product allocation and margins. Also, the company stands to gain from lower supply-chain costs from the prior year as ocean and domestic freight costs ease.

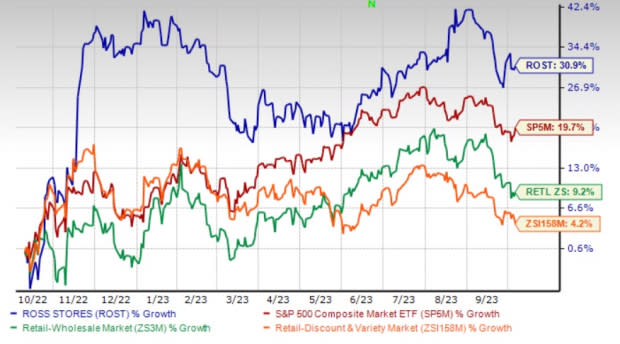

The company’s positive business momentum has been well-reflected in its share price, with the stock outperforming the industry. Shares of this Zacks Rank #1 (Strong Buy) company have rallied 30.9% in the past year compared with the industry’s growth of 4.2%. The stock has also outpaced the sector and the S&P 500’s rise of 9.2% and 19.7%, respectively, in the same period.

Further optimism on the stock is reflected by its forward estimates, which suggest notable growth. The Zacks Consensus Estimate for ROST’s fiscal 2023 sales and earnings suggests growth of 7.1% and 19.4%, respectively, from the year-ago period’s reported numbers.

Image Source: Zacks Investment Research

Positive Business Trend

ROST has been gaining from positive consumer responses to its merchandise. The company has been witnessing positive trends at its dd’s DISCOUNTS chain, driven by better merchandise and moderating inflation. However, low to moderate-income customers continue to reel under higher costs.

The company’s off-price model offers a strong value proposition and micro-merchandising that drive better product allocation and margins. Overall, gains at the core business demonstrated consumers' continued focus on value and ROST’s ability to deliver value bargains to customers. Over the long term, the company expects the rigorous execution of its off-price business models to enable it to consistently deliver solid results.

Ross Stores stays focused on delivering the most compelling bargains going forward, as customer demand for the best-branded values remains high amid prolonged inflation woes. Moreover, the company has been judiciously managing its expenses and inventory to maximize its potential for sales and earnings growth.

Driven by the continued business momentum, management raised its second-half sales and earnings guidance. Comparable store sales for the third and fourth quarters of fiscal 2023 are expected to be up 2-3% and 1-2% year over year, respectively. Total sales are anticipated to grow 4-6% year over year.

For the fiscal third quarter, earnings per share are envisioned to be $1.16-$1.21, suggesting a rise from the last-year quarter’s reported figure of $1.00. The operating margin for the fiscal third quarter is expected to be 10.3-10.5%, whereas it reported 9.8% in the last-year quarter, driven by gains from lower ocean and domestic freight costs, which more than offset increased incentive compensation and store wages.

For fiscal 2023, comparable store sales are anticipated to be up 2-3% year over year. Earnings are forecast to be $5.15-$5.26, whereas it reported $4.38 in the prior year.

Store Growth Ambition Bodes Well

ROST has been consistent with the execution of its store expansion plans over the years. The company’s store expansion efforts are focused on continually increasing its penetration in the existing and new markets.

Ross Stores has ambitious goals, aiming to reach at least 2,900 Ross Dress for Less and 700 dd's DISCOUNTS locations over time. By expanding its store network, ROST strengthens brand visibility, captures new customer segments and unlocks potential sales growth.

The expansion strategy, combined with its strong brand reputation and off-price retail model, positions Ross Stores for success in the dynamic retail landscape. The strategic store openings fortify its competitiveness.

Key Picks

We have highlighted three other top-ranked stocks from the Consumer Staple sector, namely Abercrombie & Fitch ANF, American Eagle Outfitters AEO and Urban Outfitters URBN.

Abercrombie currently sports a Zacks Rank #1. ANF has a trailing four-quarter earnings surprise of 724.8%, on average. Shares of ANF have rallied 256.3% in the past year.

You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Abercrombie’s current financial year’s sales suggests growth of 10% from the year-ago period’s reported figure. Meanwhile, the consensus mark for earnings per share indicates growth of 1,644% from the prior-year period’s actual.

American Eagle has a trailing four-quarter earnings surprise of 43.2%, on average. It flaunts a Zacks Rank #1 at present. Shares of AEO have risen 59.7% in a year.

The Zacks Consensus Estimate for American Eagle’s current financial-year sales and earnings suggests growth of 2.2% and 33%, respectively, from the year-ago period's reported figures.

Urban Outfitters has a trailing four-quarter earnings surprise of 19.2%, on average. It currently sports a Zacks Rank #1. Shares of URBN have rallied 43.7% in the past year.

The Zacks Consensus Estimate for Urban Outfitters’ current financial-year sales and earnings suggests growth of 6.6% and 83.4%, respectively, from the year-ago period's reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance