Royal Caribbean (RCL) Gains on Robust Booking & Ship Addition

Royal Caribbean Cruises Ltd. RCL is well poised to benefit from strong cruising demand from new and loyal guests and robust booking trends. Also, the addition of new ships bodes well for the company. RCL is also focusing on introducing new products and experiences, including private destinations, to fuel growth.

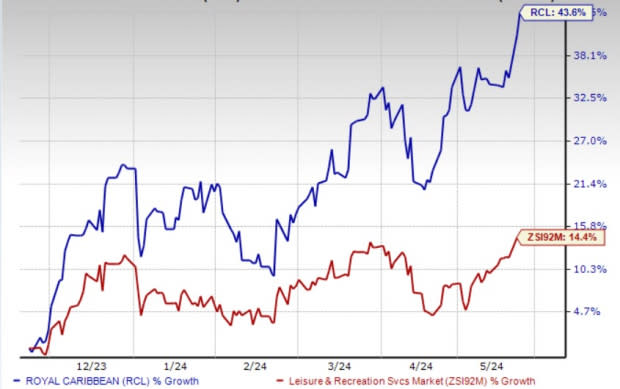

Buoyed by such strengths, shares of the company have soared 43.6% compared with the industry’s 14.4% growth in the past six months. The Zacks Consensus Estimate for the company’s earnings and sales in 2024 indicate growth of 16.6% and 61.9% year over year, respectively. This highlights analysts’ confidence in the stock.

Delving Deeper

During the first quarter, the company reported solid booking volumes concerning all key itineraries. It stated a rise in consumer spending onboard and pre-cruise purchases. The company continues to be in a record-booked position, surpassing prior-year levels, courtesy of greater participation at higher prices. In the first quarter of 2024, load factors were 107%. The company is highly optimistic about the demand and pricing landscape for 2024.

Looking ahead at the remainder of 2024, the outlook appears highly promising, characterized by strong yield and earnings growth. With the projected 60% earnings growth, 2024 is anticipated to be a record-breaking year, in line with the company's strategic objectives. As of Mar 31, 2024, RCL had $6 billion in customer deposits compared with $5.3 billion as of Dec 31, 2023.

The company is focused on introducing innovative ships and unique onboard experiences to differentiate its offerings, aiming to achieve superior yields and margins. In 2023, RCL launched three new ships aligned with this strategy, expected to generate higher yields from 2024 onward. In the first quarter of 2024, the company reported strong performance, with Icon of the Seas particularly noted for high demand and pricing.

For 2024, the company expects an 8.5% year-over-year capacity increase with the introduction of Utopia of the Seas and Silver Ray. These new vessels enhance vacation experiences and attract new customers, driving yield improvements and overall profitability. Utopia of the Seas, the seventh Oasis-class ship, is anticipated to offer the ultimate weekend getaway experience.

Image Source: Zacks Investment Research

RCL is at the forefront of innovation within the vacation industry, introducing new products and experiences, including private destinations to fuel growth. Among these expansions, the upcoming addition of the Royal Beach Club in Cozumel, Mexico, slated to receive guests in 2026, stands out. Designed to cater to diverse vacation preferences, the Royal Beach Club Cozumel aims to elevate guest experiences. Additionally, construction has commenced on the Royal Beach Club Paradise Island in Nassau, which is expected to open next year. RCL expresses optimism regarding the prospects of private destinations and anticipates it as a key driver of growth in the upcoming periods.

On the other hand, the company is also focusing on technological advancements and other innovations. In the first quarter of 2024, the company reported advancements in integrating new technology and artificial intelligence to enhance the customer experience across various distribution channels, with a focus on fostering greater customer loyalty and reducing guest acquisition costs. A significant investment was made in a modern digital travel platform to streamline the vacation booking process and broaden wallet share.

RCL currently carries a Zacks Rank #1 (Strong Buy).

Other Key Picks

Here are some other top-ranked stocks from the Consumer Discretionary sector.

Strategic Education, Inc. STRA currently sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

STRA has a trailing four-quarter earnings surprise of 36.2%, on average. The stock increased 47.9% in the past year. The Zacks Consensus Estimate for STRA’s 2024 sales and earnings per share (EPS) indicates an increase of 6.4% and 33.3%, respectively, from the year-ago levels.

Netflix, Inc. NFLX presently sports a Zacks Rank of 1. NFLX has a trailing four-quarter earnings surprise of 9.3%, on average. The stock rose 76.8% in the past year.

The consensus estimate for NFLX’s 2024 sales and EPS implies a rise of 14.8% and 52.2%, respectively, from the year-ago levels.

AMC Entertainment Holdings, Inc. AMC currently carries a Zacks Rank of 2 (Buy). AMC has a trailing four-quarter earnings surprise of 38%, on average. The stock increased 37.2% in the past month.

The Zacks Consensus Estimate for AMC’s 2024 EPS implies growth of 70.5% from the year-ago level.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Strategic Education Inc. (STRA) : Free Stock Analysis Report

AMC Entertainment Holdings, Inc. (AMC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance