RTX Wins a $526M Contract to Supply Missile Assemblies for ESSM

RTX Corporation RTX recently secured a $525.5 million contract for producing and delivering guided missile assemblies of Evolved Seasparrow Missile (ESSM). This contract includes future options that could bring the total value of the agreement to $2.19 billion.

Details of the Deal

Work related to this contract will be spread across multiple locations globally, including the United States, Australia, Canada, Norway, the Netherlands and a few other nations. This contract is projected to be completed by September 2030.

The award has been provided by the Naval Sea Systems Command, Washington, D.C.

What’s Favoring RTX?

With countries worldwide enhancing their defense capabilities, spending on advanced military arms and ammunition has been rapidly increasing. This includes growing investments in missiles and missile systems, which are essential for modern warfare. RTX, as a prominent manufacturer of missile systems, has been benefiting from a steady flow of orders from the Pentagon and other U.S. allies. The recent contract is an example of that.

Notably, RTX’s ESSM Block II is a highly versatile naval defense system. Its enhanced capabilities provide superior performance in maritime warfare, offering nations the ability to defend their fleet more effectively.

With more than 330 live firings at sea, the ESSM weapon is a thoroughly tested ship self-defense missile against a stressing and wide-ranging set of air and surface targets.

Such notable features of the ESSM are likely to have been boosting its demand, which is further evident from the latest contract win.

RTX’s Growth Prospects

Rising military conflicts, terrorism and border disputes have led nations to increase their focus on national security, particularly on missile defense systems in recent times, backed by the rapid development of advanced missile technologies over the last decade.

This is likely to have prompted Mordor Intelligence to forecast a compound annual growth rate of 5% for the global missiles and missile defense systems market during the 2024-2029 time period.

Such massive growth projections indicate solid opportunities for RTX, which has a handful of combat-proven missiles in its product portfolio, like the TOW missile, Guidance Enhanced Missile, Advanced Medium Range Air-to-Air Missile, Tomahawk, Standard Missile 2 and a few more, in addition to the ESSM.

Prospects of RTX’s Peers

Other defense companies that are likely to enjoy the perks of the expanding missiles and missile system market have been discussed below.

Northrop Grumman Corporation NOC: Northrop Grumman provides high-speed, long-range strike weapons like the AARGM-ER, which is a supersonic, air-launched tactical missile system. It also develops and builds advanced missile defense technology, ranging from command systems to directed energy weapons, advanced munitions and powerful sensors.

The company’s long-term (three to five years) earnings growth rate is 8.7%. The Zacks Consensus Estimate for NOC’s 2024 sales indicates year-over-year growth of 5.4%.

The Boeing Company BA: It manufactures various missile defense systems, including the Ground-based Midcourse Defense, Aegis Ballistic Missile Defense and Avenger. Boeing-built and supported air and missile defense systems have been protecting its customers for nearly 25 years against threats ranging from intercontinental ballistic missiles to hostile aircraft.

The company has a long-term earnings growth rate of 21.3%. The Zacks Consensus Estimate for BA’s 2025 sales indicates year-over-year growth of 20%.

Lockheed Martin Corporation LMT: Lockheed Martin’s missile defense program includes the Patriot Advanced Capability-3 and Terminal High-Altitude Area Defense air and missile defense programs. It also manufactures the Multiple Launch Rocket System, the Joint Air-to-Surface Standoff Missile and Javelin tactical missile programs alongside other tactical missiles.

The company has a long-term earnings growth rate of 4.7%. The Zacks Consensus Estimate for LMT’s 2024 sales indicates year-over-year growth of 5.3%.

RTX Stock Price Movement

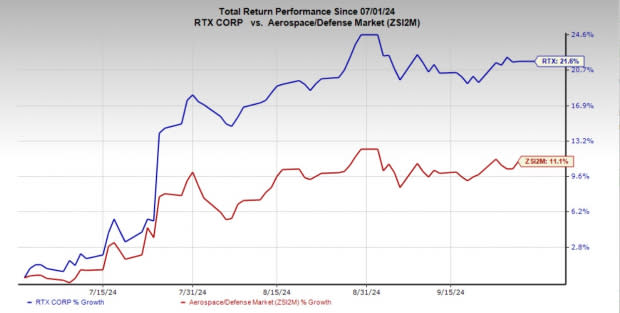

Shares of RTX have gained 21.6% in the past three months compared with the industry’s 11.1% growth.

Image Source: Zacks Investment Research

RTX’s Zacks Rank

RTX currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Boeing Company (BA) : Free Stock Analysis Report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

RTX Corporation (RTX) : Free Stock Analysis Report