SAF-Holland And Two More Prominent German Dividend Stocks

Amidst a backdrop of fluctuating global markets, Germany's economy has shown resilience, though recent data indicates mixed signals with the DAX index experiencing a slight decline. This environment underscores the importance of considering stable investment options such as dividend stocks, which can offer investors potential income and relative steadiness in uncertain times.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.14% | ★★★★★★ |

Edel SE KGaA (XTRA:EDL) | 6.52% | ★★★★★★ |

Deutsche Post (XTRA:DHL) | 4.79% | ★★★★★★ |

Südzucker (XTRA:SZU) | 6.39% | ★★★★★☆ |

MLP (XTRA:MLP) | 4.69% | ★★★★★☆ |

Deutsche Telekom (XTRA:DTE) | 3.45% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 5.99% | ★★★★★☆ |

SAF-Holland (XTRA:SFQ) | 4.82% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 7.98% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.14% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

SAF-Holland

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SAF-Holland SE is a manufacturer and supplier of chassis-related assemblies and components for trailers, trucks, semi-trailers, and buses, with a market capitalization of approximately €0.80 billion.

Operations: SAF-Holland SE generates revenue through three primary geographical segments: €951.75 million from Europe, the Middle East, and Africa (EMEA), €898.79 million from the Americas, and €280.64 million from Asia/Pacific including China and India.

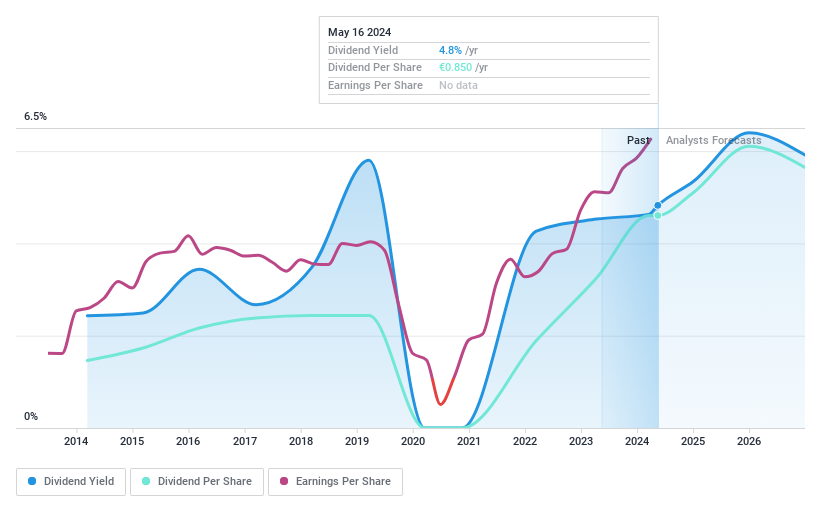

Dividend Yield: 4.8%

SAF-Holland SE, a German company, reported increased earnings with a net income of €26.23 million in Q1 2024, up from €19.56 million the previous year. Despite this growth and a top-tier dividend yield of 4.82%, concerns linger due to its high level of debt and an unstable dividend track record over the past decade. The dividends are well-covered by earnings and cash flows, with payout ratios at 44.6% and 31.6% respectively, suggesting sustainability from an operational perspective.

Südzucker

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Südzucker AG is a global producer and distributor of sugar products, operating in Germany, the rest of the European Union, the United Kingdom, the United States, and other international markets, with a market capitalization of approximately €2.87 billion.

Operations: Südzucker AG's revenue is generated from several segments: Sugar at €4.44 billion, Special Products (excluding Starch) at €2.43 billion, Fruit at €1.57 billion, CropEnergies at €1.21 billion, and Starch at €1.16 billion.

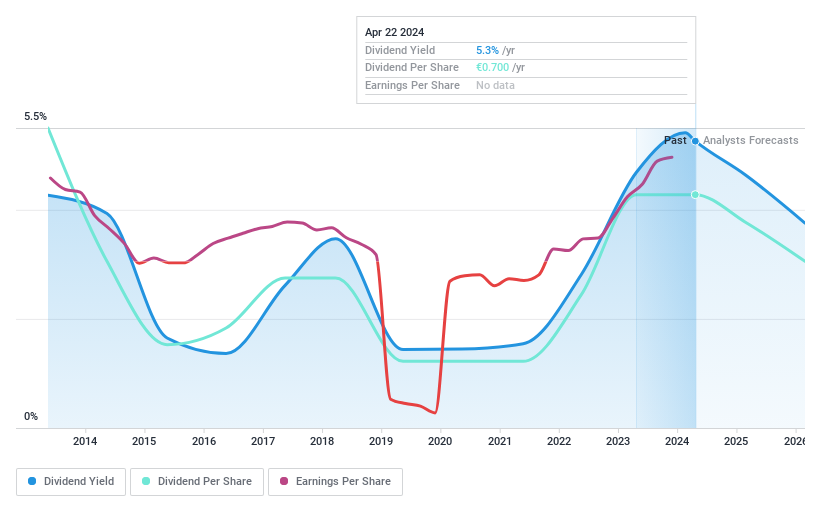

Dividend Yield: 6.4%

Südzucker AG, a notable player in the German market, has demonstrated solid financial performance with a significant increase in sales to €10.29 billion and net income rising to €589 million for FY 2024. Despite this growth, earnings are expected to decline over the next three years. The company maintains a low payout ratio at 33%, ensuring dividends are well-covered by earnings and cash flows. Recently, Südzucker proposed an increased dividend of €0.90 per share for fiscal 2023/24, reflecting confidence in its financial health despite past dividend volatility.

Dive into the specifics of Südzucker here with our thorough dividend report.

Upon reviewing our latest valuation report, Südzucker's share price might be too pessimistic.

technotrans

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Technotrans SE is a global technology and services company with a market capitalization of approximately €138.15 million.

Operations: Technotrans SE generates its revenue through a diverse range of technology and services sectors globally.

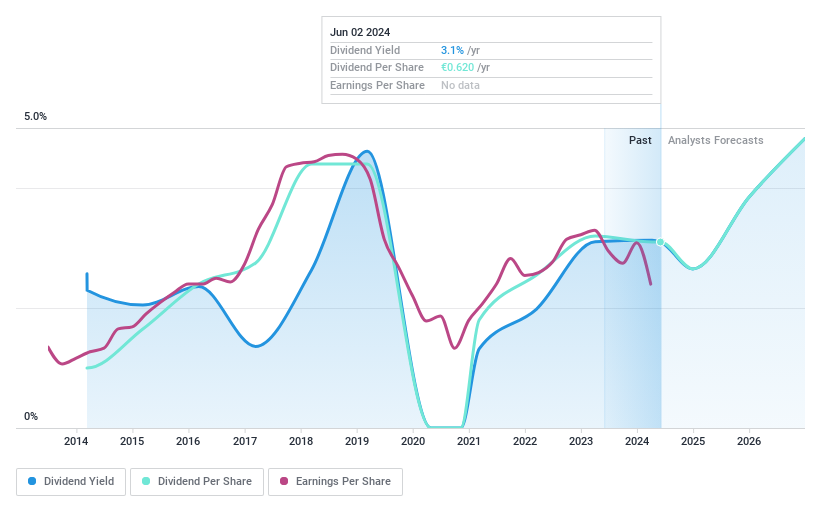

Dividend Yield: 3.1%

Technotrans SE is trading at a 30.1% discount to its estimated fair value, suggesting potential undervaluation. Its dividend yield of 3.1% is below the top quartile in the German market, and its dividend history shows volatility and inconsistency over the past decade. Despite this, dividends are reasonably covered by both earnings and cash flows, with payout ratios of 64.7% and 37.8%, respectively. Recent financials indicate a significant revenue drop to €56.04 million in Q1 2024 from €68.31 million year-over-year, alongside a decrease in net income from €2.2 million to €0.059 million.

Summing It All Up

Click through to start exploring the rest of the 28 Top Dividend Stocks now.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:SFQ XTRA:SZU and XTRA:TTR1.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance