Sagimet Biosciences Inc (SGMT) Reports Full Year 2023 Financial Results: A Close Look

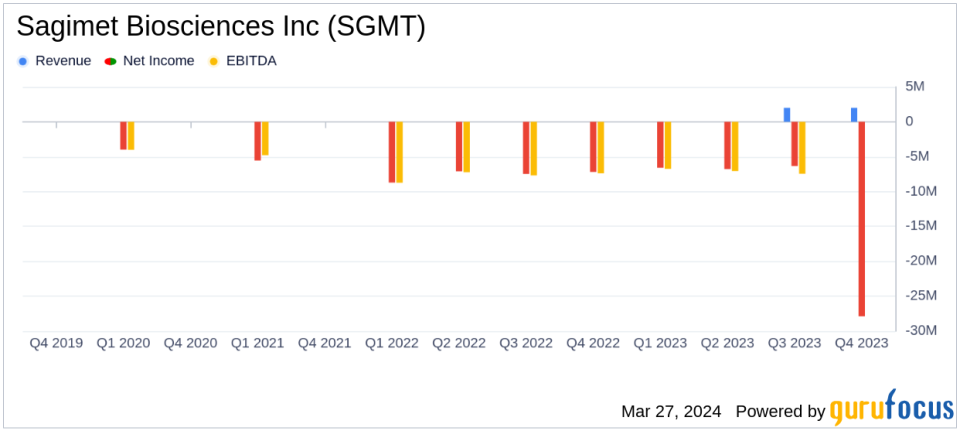

Revenue: SGMT reported license revenue of $2 million, with no estimated revenue from analysts.

Net Loss: The company's net loss stood at $27.876 million, compared to analyst estimates of a net loss of $9.9765 million.

Earnings Per Share (EPS): SGMT posted a net loss per share of $2.66, diverging from analyst estimates of a loss per share of $0.409.

Cash Position: Cash, cash equivalents, and marketable securities totaled $94.9 million as of December 31, 2023.

Research and Development (R&D): R&D expenses were $19.777 million, a decrease from the previous year's $24.919 million.

Sagimet Biosciences Inc (NASDAQ:SGMT) released its 8-K filing on March 25, 2024, detailing the company's financial results for the full year ended December 31, 2023. SGMT, a clinical-stage biopharmaceutical company, is known for its development of selective fatty acid synthase (FASN) inhibitors, including its lead drug candidate, denifanstat, for the treatment of metabolic dysfunction-associated steatohepatitis (MASH).

2023 Financial Summary and Corporate Updates

The company reported a net loss of $27.876 million for the year, which is significantly higher than the analyst's net income estimate of a $9.9765 million loss. The net loss per share of $2.66 also exceeded the estimated loss per share of $0.409. SGMT's license revenue reached $2 million, marking a notable financial achievement for a company in the biotechnology sector where revenue streams are often unpredictable and contingent on clinical trial outcomes and partnerships.

SGMT's research and development expenses decreased to $19.777 million from $24.919 million in the previous year, reflecting efficient management of operational costs. General and administrative expenses, however, increased to $12.963 million from $6.136 million, likely due to the expansion of business operations and increased administrative activities associated with the company's transition to a public entity.

Operational Highlights and Future Outlook

SGMT's topline data from the Phase 2b FASCINATE-2 trial was positive, with denifanstat meeting primary efficacy endpoints and showing a statistically significant reduction in fibrosis. The company anticipates an end-of-Phase 2 meeting with the FDA in the first half of 2024 and aims to initiate a pivotal Phase 3 trial in the latter half of the year.

With a strengthened cash position following a $104.7 million net proceeds offering in January 2024, SGMT has extended its cash runway through 2025. This financial stability is crucial for the company as it prepares for upcoming clinical trials and potential commercialization activities.

Balance Sheet and Income Statement Highlights

The balance sheet shows a robust cash and securities position of $94.9 million, providing the company with a solid foundation to support its clinical development plans. Total assets increased to $96.719 million from $33.031 million in the previous year, demonstrating significant growth in the company's financial resources.

On the income statement, the reported license revenue of $2 million is a testament to the company's ability to monetize its intellectual property through strategic partnerships, a critical aspect for biotech firms that often rely on collaborations for funding.

Analysis of SGMT's Performance

While the company's net loss was greater than analyst expectations, the reported license revenue and the successful completion of the Phase 2b trial are positive indicators of SGMT's potential. The company's strategic positioning and extended cash runway are likely to support its continued research and development efforts, which are essential for bringing innovative treatments to market.

SGMT's focus on MASH, a disease with significant unmet medical needs, positions the company to potentially address a large and growing market. The company's progress in clinical trials and its preparations for Phase 3 studies underscore its commitment to advancing its lead drug candidate, denifanstat, through the development pipeline.

Overall, SGMT's financial results reflect the typical trajectory of a clinical-stage biopharmaceutical company investing heavily in research and development. The company's ability to progress its lead candidate through clinical trials and secure funding through a follow-on offering suggests a strong operational strategy that may benefit shareholders in the long term.

For detailed financial tables and further information on Sagimet Biosciences Inc's (NASDAQ:SGMT) earnings, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Sagimet Biosciences Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance