Salesforce (CRM) Q4 Earnings & Revenues Beat Estimates, Up Y/Y

Salesforce CRM delivered better-than-expected results for fourth-quarter fiscal 2021. The company’s fiscal fourth-quarter non-GAAP earnings of $1.04 per share handily beat the Zacks Consensus Estimate of 75 cents. Quarterly earnings jumped 58% year over year mainly on higher revenues and a benefit of 22 cents per share from mark-to-mark accounting required by ASU 2016-01.

Salesforce’s quarterly revenues of $5.82 billion climbed 20%, year on year, surpassing the Zacks Consensus Estimate of $5.68 billion. The top-line figure also improved 19% in constant currency (cc).

The enterprise cloud computing solutions provider has been benefiting from the robust demand environment as customers are undergoing a major digital transformation. The rapid adoption of its cloud-based solutions resulted in the better-than-anticipated performance during the fiscal fourth quarter.

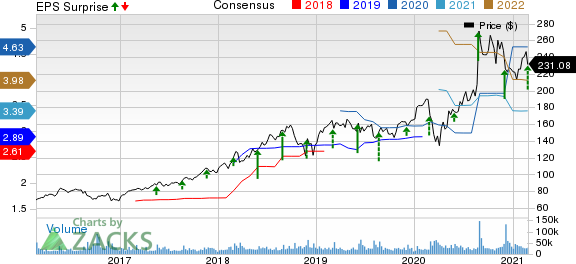

salesforce.com, inc. Price, Consensus and EPS Surprise

salesforce.com, inc. price-consensus-eps-surprise-chart | salesforce.com, inc. Quote

Quarter in Detail

Coming to the company’s business segments, revenues at Subscription and Support increased about 20% from the year-earlier period to $5.48 billion. Professional Services and Other revenues climbed 18% to $341 million.

Sales Cloud revenues grew 11%, year over year, to $1.36 billion. Revenues from Service Cloud, one of the company’s largest and the fastest-growing businesses, also improved 19% to $1.45 billion. Moreover, Marketing & Commerce Cloud revenues jumped 27% to $869 million. Salesforce Platform and Other revenues were up 26% to $1.81 billion.

Geographically, the company registered revenue growth at cc of 18% in the Americas (69% of total revenues), 27% in the Asia Pacific (10%), and 24% in Europe and Middle East Asia or EMEA (21%) on a year-over-year basis.

Salesforce’s gross profit came in at $4.34 billion, up 19.5% from the prior-year quarter. However, gross margin contracted 30 basis points (bps) to 74.6%.

Salesforce recorded a non-GAAP operating income of $1.02 billion, up 36.6% year on year. Operating margin expanded 210 bps to 17.5% on efficient cost management. Operating expenses flared up 14.2% year over year to $3.56 billion.

Salesforce exited the fiscal fourth quarter with cash, cash equivalents and marketable securities of $12 billion compared with the $9.5 billion recorded at the end of the previous quarter. The company generated an operating cash flow of $2.17billion in the fourth quarter and $4.8 billion in fiscal 2021.

As of Jan 31, 2021, current remaining performance obligation, which reflects future revenues under contract, was $18 billion, up 20% on a year-over-year basis.

Guidance

Buoyed by the stellar fiscal fourth-quarter results, Salesforce raised its revenue outlook for first-quarter and fiscal 2022.

For the fiscal first quarter, it now projects total sales between $5.875 billion and $5.885 billion, up from the previous guidance of $5.680-$5.715 billion. Furthermore, Salesforce anticipates non-GAAP earnings per share in the band of 88-89 cents for the current quarter.

For fiscal 2022, the company raised its sales outlook to $25.65-$25.75 billion from the $25.45-$25.55 billion projected earlier. It estimates earnings in the range of $3.39-$3.41 per share for the fiscal year. Additionally, management projects non-GAAP operating margin of 17.7%.

Zacks Rank & Stocks to Consider

Salesforce currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the broader technology sector include Zoom Video Communications ZM, Apple AAPL and Facebook FB. While Zoom sports a Zacks Rank #1 (Strong Buy), Apple and Facebook carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for Zoom,Apple and Facebook is currently pegged at 25%,11.5%and 19.2%,respectively.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.9% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Facebook, Inc. (FB) : Free Stock Analysis Report

Zoom Video Communications, Inc. (ZM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance