Sarepta's (SRPT) DMD Gene Therapy BLA Gets FDA Priority Review

Sarepta Therapeutics SRPT announced that the FDA accepted its biologics license application (BLA) filing seeking accelerated approval for its gene therapy candidate, SRP-9001, to treat ambulant patients with Duchenne muscular dystrophy (“DMD”).

The FDA also granted priority review to the BLA filing. A final decision on the BLA is expected by May 29, 2023.

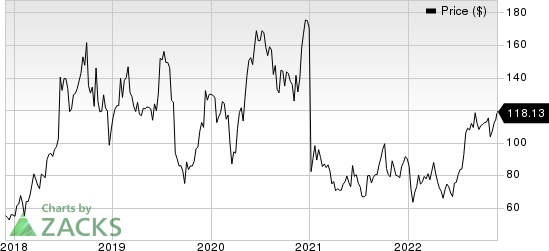

Shares of Sarepta were up 3.1% following the announcement. The stock has risen 31.2% in the year-to-date period against the industry’s 19.5% decline.

Image Source: Zacks Investment Research

The BLA filing is supported by data from multiple studies from the clinical development program evaluating SRP-9001 in DMD. Earlier this June, Sarepta and Roche announced new functional data across these studies, demonstrating that treatment with SRP-9001 led to functional improvements in individuals suffering from DMD compared with a propensity-weighted external control group multiple times. The time points vary from one-, two- and four years post-treatment.

Management also initiated a pivotal phase III study, EMBARK, last year. It will act as a confirmatory study seeking full approval for SRP-9001 in DMD.

If approved by the FDA, SRP-9001 will be the first gene therapy for DMD patients. The therapy is also expected to generate a billion dollars in revenue for Sarepta. The gene therapy has also been granted Fast Track, Rare Pediatric Disease (RPD) and orphan drug designations by the FDA.

The therapy is being developed in partnership with Roche RHHBY. Sarepta and Roche entered into a licensing agreement in 2019 to develop SRP-9001 for DMD. Per the agreement, Roche has exclusive rights to launch and commercialize SRP-9001 in ex-U.S. markets.

Apart from SRP-9001, the company is also developing SRP-5051 (vesleteplirsen), its next-generation exon-skipping pipeline candidate for treating DMD patients with skipping exon 51.

Sarepta’s commercial portfolio consists of three RNA-based PMO therapies targeting DMD — Exondys 51, Vyondys 53 and Amondys 45. These drugs can potentially address nearly a third of all patients with DMD in the United States.

Sarepta Therapeutics, Inc. Price

Sarepta Therapeutics, Inc. price | Sarepta Therapeutics, Inc. Quote

Zacks Rank & Stocks to Consider

Sarepta currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the overall healthcare sector include Angion Biomedica ANGN and Vertex Pharmaceuticals VRTX, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Angion Biomedica’s 2022 loss per share have narrowed from $1.64 to $1.54. During the same period, the loss estimates per share for 2023 have narrowed from $1.54 to $1.48. Shares of Angion Biomedica have plunged 69.7% in the year-to-date period.

Earnings of Angion Biomedica beat estimates in three of the last four quarters and missed the mark just once, witnessing a surprise of 66.42%, on average. In the last reported quarter, ANGN delivered an earnings surprise of 41.67%.

Vertex’s stock has risen 43.6% this year so far. While Vertex’s earnings estimates for 2022 have risen from $14.21 to $14.61 per share in the past 30 days, estimates for 2023 have increased from $15.12 to $15.60 per share during the same period.

Vertex beat earnings estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 3.16%. In the last reported quarter, Vertex reported an earnings surprise of 8.67%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

Angion Biomedica Corp. (ANGN) : Free Stock Analysis Report

Sarepta Therapeutics, Inc. (SRPT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance