Schwab (SCHW) May Net New Assets Up, Q2 Revenue View Affirmed

Charles Schwab SCHW has reported its monthly activity report for May 2024. The company’s core net new assets of $31 billion surged substantially from $1 billion recorded in the previous month and 50% from the prior-year month.

Schwab’s total client assets in May 2024 were $9.21 trillion, up 4% from the April 2024 level and 20% from May 2023. Client assets receiving ongoing advisory services were $5.25 trillion, rising 17% from the prior month and 35% year over year.

Schwab’s average interest-earning assets of $416 billion in May declined 2% from the April 2024 level and 14% year over year. Average margin balances were $67.6 billion, down 2% from the previous month’s level but up 12% on a year-over-year basis. Average bank deposit account balances totaled $86.8 billion in May, down 2% from last month’s level and 12% from May 2023.

Further, Schwab opened 214,000 new brokerage accounts in April 2024, down 13% sequentially and on par with the year-earlier month.

Schwab’s active brokerage accounts totaled 35.5 million at the end of May 2024, which was stable on a sequential basis and up 4% from the year-ago month. Client banking accounts were 1.92 million, up 1% sequentially and 8% from the May 2023 figure. The number of workplace plan participant accounts was up 1% from the prior month and 8% year over year to 5.35 million.

Besides this, Schwab reiterated its second-quarter 2024 revenue and pre-tax margin targets, which were earlier disclosed during the Institutional Investor Day on May 22. The company anticipates total revenues to decrease 1-2% sequentially and an adjusted pre-tax profit margin of approximately 40%. These reflect “anticipated impact of tax season on transactional sweep cash as well as expected trading volumes.”

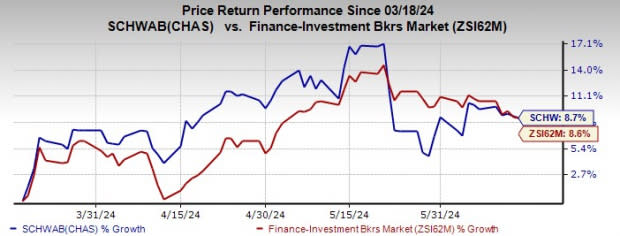

In the past three months, Schwab shares have rallied 8.7% compared with the industry’s rise of 8.6%.

Image Source: Zacks Investment Research

Currently, SCHW carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Competitive Landscape

Interactive Brokers Group, Inc. IBKR released the Electronic Brokerage segment’s performance metrics for May 2024. The segment deals with the clearance and settlement of trades for individual and institutional clients globally. It reported a rise in client Daily Average Revenue Trades (DARTs).

IBKR’s total client DARTs for May were 2,360,000, which increased 27% from May 2023 and 1% from the last month.

Another brokerage firm, LPL Financial LPLA, is expected to come out with its monthly activity report soon.

Currently, IBKR carries a Zacks Rank #2 (Buy) and LPLA has a Zacks Rank of 3.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Charles Schwab Corporation (SCHW) : Free Stock Analysis Report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

LPL Financial Holdings Inc. (LPLA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance