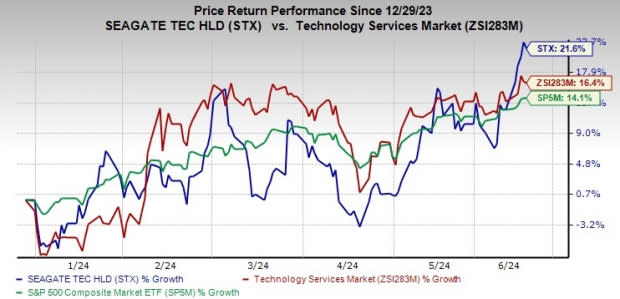

Seagate (STX) Stock Surges 21.6% YTD: Will the Rally Last?

Seagate Technology Holdings plc STX is continuing its upward trajectory, with a gain of 21.6% year to date compared with the S&P 500 composite and sub-industry’s growth of 14.1% and 16.4%, respectively.

With healthy fundamentals and strong growth opportunities, this Zacks Rank #2 (Buy) stock appears to be a solid investment option at the moment.

Apart from a favorable rank, STX has a Growth Score of A. Per Zacks’ proprietary methodology, stocks with a combination of a Zacks Rank #1 (Strong Buy) or 2 and a Growth Score of A or B offer solid investment opportunities.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for the bottom line has been moving northward since the earnings announcement, reflecting analysts’ optimism.

The Zacks Consensus Estimate for fiscal 2024 and 2025 EPS has increased 65% and 19.5%, respectively, in the past 60 days. The consensus estimate for current-quarter EPS has moved up by 79.1% to 77 cents in the same time frame.

The Zacks Consensus Estimate for fiscal 2024 and 2025 EPS stands at 99 cents and $5.69, respectively, implying growth of 421% and 475% on a year-over-year basis.

Growth Factors

Headquartered in Dublin, Ireland, Seagate is a leading provider of data storage technology and infrastructure solutions. The company’s primary product offering is hard disk drives (HDDs) but it also develops other electronic data storage products such as solid state drives and storage subsystems.

STX’s performance is being driven by momentum in mass capacity solutions attributed to stronger nearline cloud demand.

In the last reported quarter, total sales improved 6% sequentially, driven by stronger nearline cloud demand, which offset seasonal declines in the VIA market. Nearline cloud revenues grew owing to higher sales to cloud customers across the United States and China coupled with steady enterprise demand.

On a sequential basis, mass capacity revenues (71.3% of total revenues) increased 11% to $1.18 billion in the last reported quarter. We expect revenues from mass capacity to surge 39.9% year over year in the current quarter.

Management expects secular trends and innovations in driving up aerial density to benefit mass capacity storage. Seagate also noted that the launch of Mozaic 3+ hard drive platform, which features Heat-Assisted Magnetic Recording technology, positions it well to benefit from megatrends like AI and machine learning. This is likely to boost demand for mass-capacity storage solutions in the long term.

Robust Outlook

STX expects incremental improvements in mass capacity demand in the fiscal fourth quarter, especially nearline cloud products and nearline enterprise and an uptick in demand in VIA markets.

For VIA, management projects demand to trend higher throughout 2024 with smart cities being the biggest end-market opportunity. For legacy and non-HDD markets, STX’s performance is expected to be at a similar level in the June quarter.

As a result, it anticipates fourth-quarter fiscal 2024 revenues to be $1.85 billion (+/- $150 million), implying 11.8% sequential growth at the midpoint. In the prior-year quarter, the company reported total revenues of $1.6 billion.

Non-GAAP earnings for the fiscal fourth quarter are expected to be 70 cents per share (+/- 20 cents), suggesting a 112% rise sequentially at the midpoint. In the prior-year quarter, STX reported a loss per share of 18 cents.

Headwinds Persist

Weakness in global macroeconomic conditions, especially a relatively sluggish recovery in China, remains a major concern. This could negatively impact the IT budget, especially for small and mid-scale businesses.

The leveraged balance sheet is an added concern. As of Mar 29, cash and cash equivalents were $795 million compared with $787 million as of Dec 29, 2023. Long-term debt (including the current portion) was $5.671 billion compared with $5.669 billion as of Dec 29, 2023.

Other Stocks to Consider

Some other top-ranked stocks worth consideration in the broader technology space are Alphabet GOOGL, Arista Networks ANET and Woodward Inc WWD, currently sporting a Zacks Rank #1 each. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Alphabet’s 2024 EPS is pegged at $7.60, up 12.1% in the past 60 days. GOOGL’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 11.3%. The long-term earnings growth rate is 17.5%. Shares of GOOGL have risen 43.1% in the past year.

The Zacks Consensus Estimate for Arista Network’s 2024 EPS is pegged at $7.92, up 5.7% in the past 60 days. The long-term earnings growth rate is 15.7%. ANET’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 15.4%. Shares of ANET have gained 108.2% in the past year.

The Zacks Consensus Estimate for Woodward’s fiscal 2024 EPS has increased 11.4% in the past 60 days to $5.88. WWD earnings beat the Zacks Consensus Estimate in the last four quarters, the average surprise being 26.1%. Shares of WWD have risen 57.6% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Seagate Technology Holdings PLC (STX) : Free Stock Analysis Report

Woodward, Inc. (WWD) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance