Seeking Growth? 3 Large Cap Stocks Worth a Buy

Large-cap stocks are frequently targeted among investors. They typically have greater stability and a proven track record, two reasons why they're beloved.

And in 2024, large-cap technology has launched higher, with small-caps unable to enjoy a sustained positive move.

Currently, many large-caps carry favorable growth expectations, including beloved Arista Networks ANET, Meta Platforms META, and Amazon AMZN. Let’s take a closer look at each.

AWS Reacceleration Sparks Rally

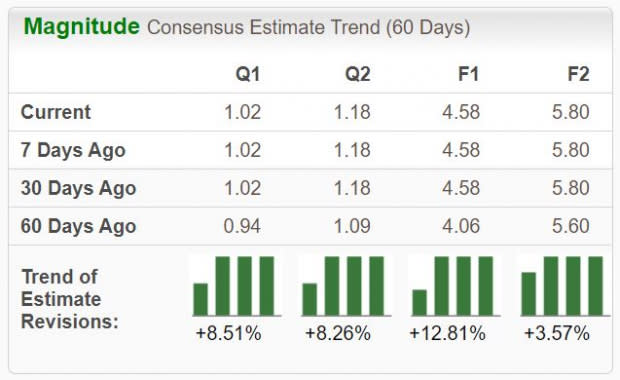

Amazon’s strong performance in 2024 has seemingly been overshadowed, gaining nearly 30% compared to the S&P 500’s 16% gain. Favorable quarterly results that have recently revealed a reacceleration in AWS has sparked positivity, with analysts also positively revising their earnings expectations across the board.

Image Source: Zacks Investment Research

Regarding its latest quarterly print, Amazon exceeded both Zacks Consensus EPS and Sales estimates, reporting earnings and sales growth of 260% and 12%, respectively. The company was firing on all cylinders throughout the period, with operating income of $15.3 billion 220% higher than the $4.8 billion mark in the same period last year.

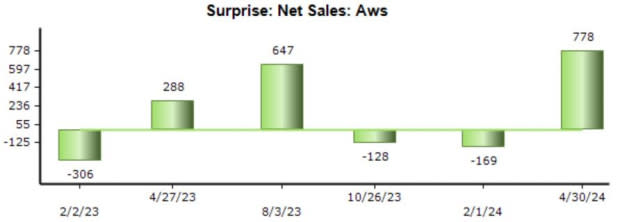

AWS delivered great results, with net sales of $25 billion showing 17% year-over-year growth and snapping a recent streak of negative surprises on the metric.

Image Source: Zacks Investment Research

Thanks to the positive results, the company’s growth profile remains bright, with Zacks Consensus estimates suggesting 60% EPS growth on 11% higher sales in its current fiscal year. Peeking ahead to FY25, expectations allude to an additional 27% EPS growth on an 11% sales increase.

Meta Platforms Benefits from Improved Efficiencies

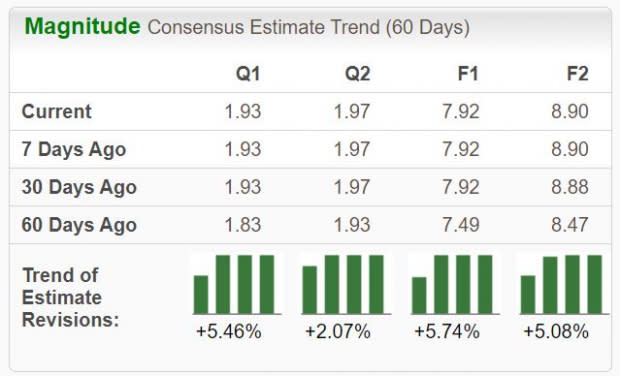

META shares have been big-time gainers in 2024, with improved operational efficiencies aiding its profitability significantly. Concerning its latest quarterly release, EPS of $4.71 showed 80% growth relative to the year-ago period, with sales also jumping nearly 30% year-over-year.

The outlook for its current fiscal year continues to remain bullish, with the $20.16 Zacks Consensus EPS estimate up 35% over the last year and suggesting a 35% year-over-year jump.

Image Source: Zacks Investment Research

It’s worth mentioning that the company’s advertising revenue has positively surprised in six consecutive quarters, with the most recent beat totaling 0.2% (or $46.4 million). Advertising represents the bulk of META’s revenue.

Image Source: Zacks Investment Research

Shares aren’t expensive despite the strong run, with the current 23.4X forward 12-month earnings multiple comparing favorably to the 28.1X average of the Zacks Computer & Technology sector. Shares have traded as high as 31.5X over the last five years.

Arista Networks Benefits from AI Trade

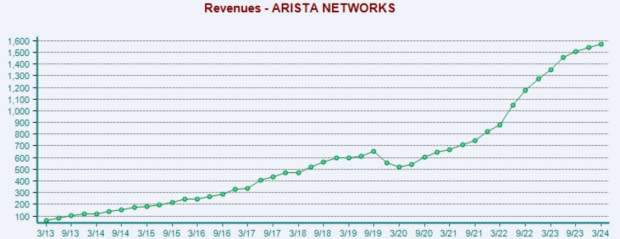

Arista Networks upped its current year (FY24) revenue growth guidance following its latest quarterly print, causing shares to soar post-earnings. The company provides cloud networking solutions for data centers and cloud computing environments, reflecting an angle to obtain exposure to the AI frenzy.

Arista Networks is a Zacks Rank #1 (Strong Buy), reflective of positive expectations stemming from healthy business demand. ANET’s sales growth has been fantastic, with Q1 sales of $1.5 billion 16% higher than the year-ago period.

Image Source: Zacks Investment Research

Consensus expectations allude to continued growth, with earnings and revenue for its current fiscal year forecasted to climb 15% and 14%, respectively. Below is a chart illustrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment Research

Bottom Line

Large-cap stocks have dominated the market in 2024, undoubtedly boosting many portfolios. Small caps have seen their performance hindered amid the higher interest rate environment, with many pointing to a rate cut as the spark needed to really get going.

And for those interested in joining the large-cap trade, all three companies above – Arista Networks ANET, Meta Platforms META, and Amazon AMZN – deserve consideration.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance