SEHK Growth Companies With Up To 30% Insider Ownership

The Hong Kong market, like many global markets, has experienced fluctuations influenced by various economic indicators and geopolitical events. Recent data indicates a cautious sentiment among investors, reflecting broader concerns about inflation and economic growth. In such an environment, growth companies with high insider ownership in Hong Kong can offer potential resilience, as significant insider stakes often align management’s interests with those of shareholders, fostering long-term strategic planning and robust oversight.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

iDreamSky Technology Holdings (SEHK:1119) | 20.1% | 104.1% |

Fenbi (SEHK:2469) | 32.4% | 43% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.5% | 79.3% |

Adicon Holdings (SEHK:9860) | 22.3% | 29.6% |

Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

DPC Dash (SEHK:1405) | 38.2% | 89.7% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 76.5% |

Beijing Airdoc Technology (SEHK:2251) | 28.2% | 83.9% |

RemeGen (SEHK:9995) | 16.2% | 54.9% |

We're going to check out a few of the best picks from our screener tool.

BYD

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Company Limited operates in the automobile and battery sectors across China, Hong Kong, Macau, Taiwan, and internationally, with a market capitalization of approximately HK$754.99 billion.

Operations: The company generates revenue primarily from the automobile and battery sectors.

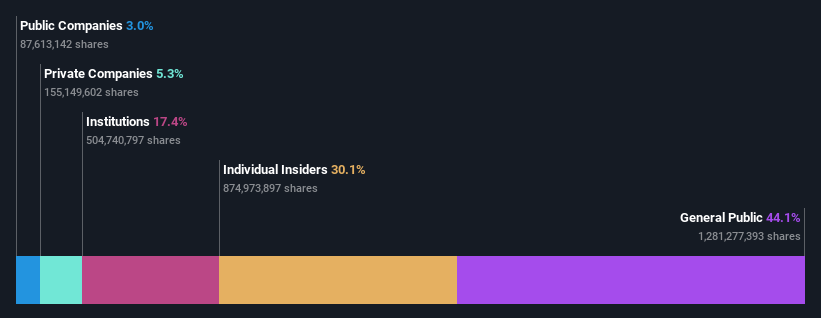

Insider Ownership: 30.1%

BYD, a prominent growth company in Hong Kong with substantial insider ownership, is poised for robust expansion. Analysts forecast a high return on equity of 22.2% in three years and anticipate earnings to grow by 14.84% annually, outpacing the local market's average. Recent corporate activities include amendments to company bylaws and a dividend increase following strong sales and production figures reported in May 2024, indicating solid operational momentum. However, revenue growth projections of 14% per year slightly lag behind the significant benchmark of over 20%.

Delve into the full analysis future growth report here for a deeper understanding of BYD.

The valuation report we've compiled suggests that BYD's current price could be inflated.

J&T Global Express

Simply Wall St Growth Rating: ★★★★☆☆

Overview: J&T Global Express Limited, primarily engaged in express delivery services as an investment holding company, has a market capitalization of approximately HK$77.11 billion.

Operations: The company generates HK$8.85 billion in revenue from its air freight transportation segment.

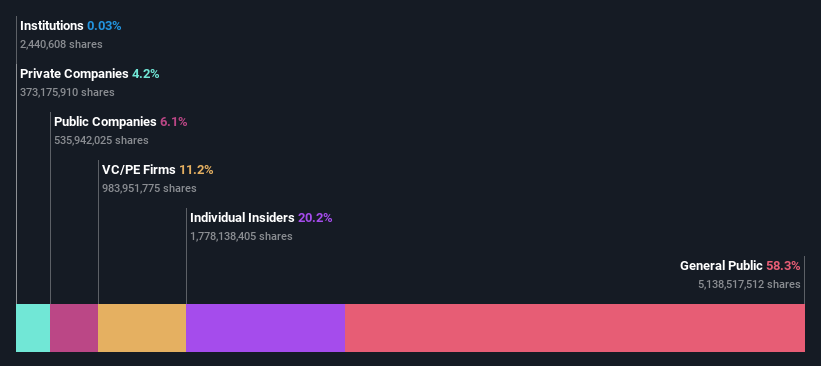

Insider Ownership: 20.2%

J&T Global Express, a growth-focused firm in Hong Kong with high insider ownership, is navigating a transformative phase. Despite recent board changes and the resignation of a key director, the company reported a substantial increase in parcel volume to 5.03 billion for Q1 2024, up from 3.39 billion year-over-year. Revenue growth is expected at 15.9% annually, surpassing Hong Kong's average of 7.8%, with profitability anticipated within three years and earnings projected to surge by over 100% annually. However, its return on equity remains modest at an expected 17.9%.

Meituan

Simply Wall St Growth Rating: ★★★★★☆

Overview: Meituan is a technology retail company based in the People's Republic of China, with a market capitalization of approximately HK$751.32 billion.

Operations: The company generates revenue through technology retail operations in China.

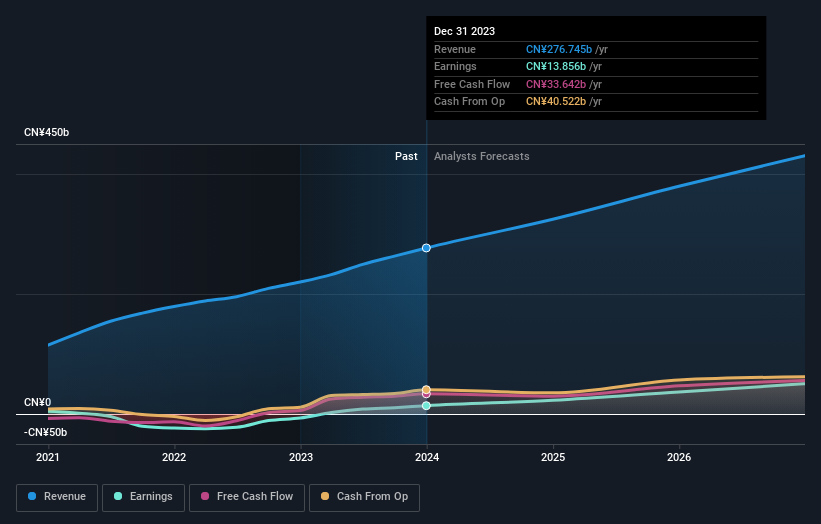

Insider Ownership: 11.4%

Meituan, a company with significant insider ownership in Hong Kong, has shown robust growth with earnings up significantly over the past year. Despite recent substantial insider selling, its revenue and earnings are forecasted to grow at 12.7% and 31.5% per year respectively, outpacing the local market averages. However, its revenue growth rate is below the high-growth benchmark of 20% per year and quality concerns arise from large one-off items affecting financial results. Recent financials confirm strong sales and net income increases in Q1 2024 compared to last year's figures.

Dive into the specifics of Meituan here with our thorough growth forecast report.

Our valuation report unveils the possibility Meituan's shares may be trading at a premium.

Turning Ideas Into Actions

Investigate our full lineup of 51 Fast Growing SEHK Companies With High Insider Ownership right here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1211 SEHK:1519 and SEHK:3690.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance