SEHK Growth Companies With Up To 38% Insider Ownership

In recent trading sessions, the Hong Kong market has shown positive momentum, with the Hang Seng Index climbing 2.64%, reflecting a buoyant mood spurred by strong holiday spending and recovery hopes. This backdrop provides an interesting context for examining growth companies in Hong Kong, particularly those with high insider ownership, which can be a marker of confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

iDreamSky Technology Holdings (SEHK:1119) | 20.1% | 104.1% |

New Horizon Health (SEHK:6606) | 16.6% | 61% |

Meitu (SEHK:1357) | 38% | 34.3% |

Adicon Holdings (SEHK:9860) | 22.3% | 29.6% |

DPC Dash (SEHK:1405) | 38.2% | 91.5% |

Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

Zhejiang Leapmotor Technology (SEHK:9863) | 14.2% | 74% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 15.7% | 100.1% |

Ocumension Therapeutics (SEHK:1477) | 17.7% | 93.7% |

Beijing Airdoc Technology (SEHK:2251) | 26.4% | 83.9% |

Let's explore several standout options from the results in the screener.

Zylox-Tonbridge Medical Technology

Simply Wall St Growth Rating: ★★★★★☆

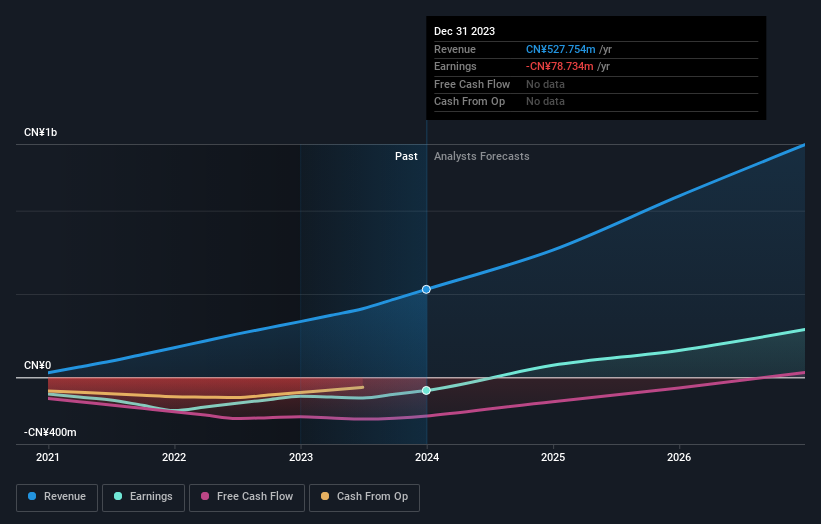

Overview: Zylox-Tonbridge Medical Technology Co., Ltd. is a medical device company specializing in neuro- and peripheral-vascular interventional devices, operating both in the People’s Republic of China and internationally, with a market capitalization of approximately HK$3.51 billion.

Operations: The company generates revenue primarily through the sale of neurovascular and peripheral-vascular interventional surgical devices, totaling CN¥527.75 million.

Insider Ownership: 18.3%

Zylox-Tonbridge Medical Technology Co., Ltd., a Hong Kong-based growth company with high insider ownership, is trading at 44.6% below its estimated fair value. The firm is expected to become profitable within three years, with earnings forecasted to grow by 79.31% annually. Additionally, revenue growth is anticipated at 23.5% per year, outpacing the Hong Kong market average of 8.1%. Recent strategic partnerships and new product approvals in international markets underline its expansion efforts and innovative edge in medical technology.

IGG

Simply Wall St Growth Rating: ★★★★☆☆

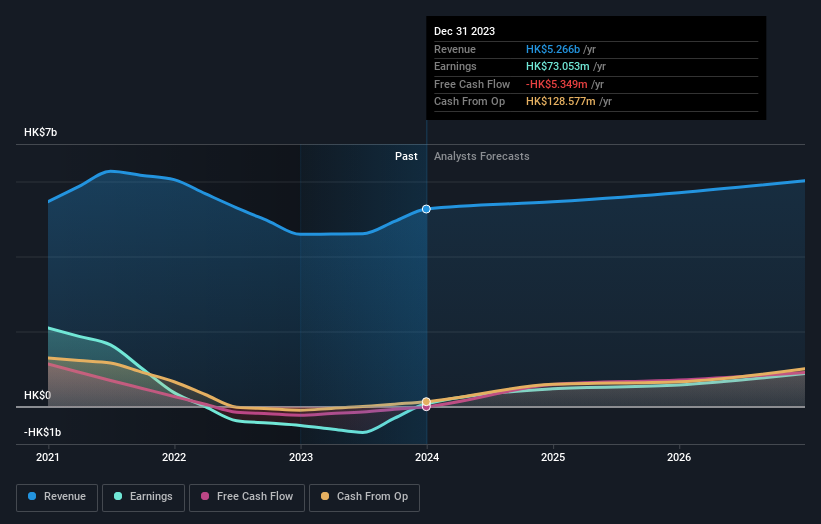

Overview: IGG Inc is an investment holding company that develops and operates mobile and online games across Asia, North America, Europe, and other international markets, with a market capitalization of approximately HK$3.82 billion.

Operations: The company generates revenue primarily from the development and operation of online games, totaling HK$5.27 billion.

Insider Ownership: 38.4%

IGG Inc., a Hong Kong-based growth company with high insider ownership, recently amended its bylaws to align with new regulatory requirements, reflecting proactive governance. After a significant turnaround from a net loss in the previous year to reporting HK$73.05 million in net income for 2023, IGG is poised for robust growth. Analysts predict that IGG's earnings will grow substantially at 51.17% annually over the next three years, outperforming the broader Hong Kong market forecast of 12.3% per year growth, despite revenue growth projections being modest at 4.2% per year compared to the market's 8.1%.

Take a closer look at IGG's potential here in our earnings growth report.

The valuation report we've compiled suggests that IGG's current price could be inflated.

Linklogis

Simply Wall St Growth Rating: ★★★★☆☆

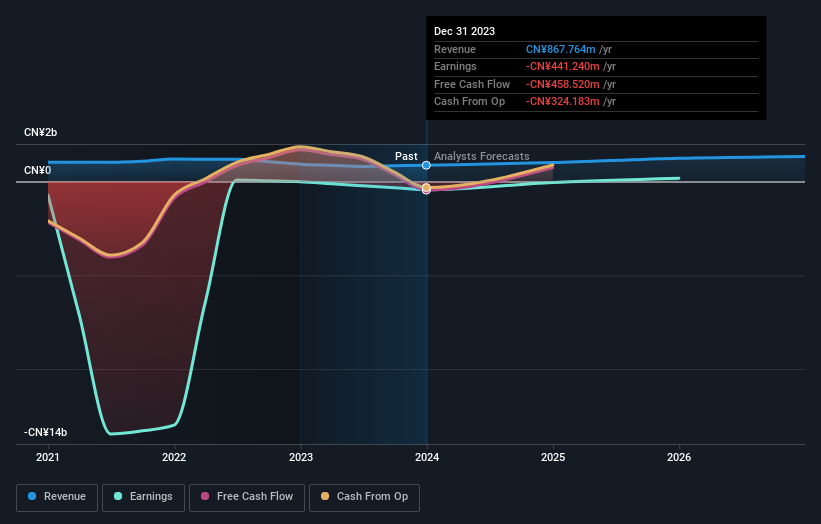

Overview: Linklogis Inc., operating primarily in Mainland China, is an investment holding company specializing in supply chain finance technology and data-driven solutions, with a market capitalization of approximately HK$3.77 billion.

Operations: The company's revenue is generated through various segments, including Cross-Border Cloud and SME Credit Tech Solutions within the Emerging Solutions category, contributing CN¥35.12 million and CN¥9.10 million respectively, as well as FI Cloud and Anchor Cloud under Supply Chain Finance Technology Solutions, which bring in CN¥299.65 million and CN¥523.90 million respectively.

Insider Ownership: 26.3%

Linklogis, a Hong Kong-based company with significant insider ownership, faces challenges with a recent substantial net loss of CNY 441.24 million and a basic loss per share increase. However, it shows potential for recovery with expected profitability within three years and revenue growth projected at 15.2% annually, outpacing the local market's 8.1%. Recent strategic moves include initiating a HK$100 million share repurchase and declaring a special dividend, signaling confidence from management despite past performance issues.

Click to explore a detailed breakdown of our findings in Linklogis' earnings growth report.

Upon reviewing our latest valuation report, Linklogis' share price might be too optimistic.

Make It Happen

Investigate our full lineup of 52 Fast Growing SEHK Companies With High Insider Ownership right here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:2190 SEHK:799 and SEHK:9959.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance