SEHK Growth Companies With High Insider Ownership To Watch In June 2024

As global markets navigate through a mix of challenges and opportunities, the Hong Kong stock market exhibits resilience with notable gains in the Hang Seng Index. Amidst this backdrop, growth companies with high insider ownership in Hong Kong could present interesting considerations for investors looking for potential stability and commitment from company leadership during fluctuating economic conditions.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

iDreamSky Technology Holdings (SEHK:1119) | 20.1% | 104.1% |

Fenbi (SEHK:2469) | 32.5% | 43% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.7% | 79.3% |

Adicon Holdings (SEHK:9860) | 22.3% | 28.3% |

Tian Tu Capital (SEHK:1973) | 33.9% | 70.5% |

DPC Dash (SEHK:1405) | 38.2% | 89.7% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 76.5% |

Beijing Airdoc Technology (SEHK:2251) | 28.2% | 83.9% |

Ocumension Therapeutics (SEHK:1477) | 23.1% | 93.7% |

Let's review some notable picks from our screened stocks.

DPC Dash

Simply Wall St Growth Rating: ★★★★★☆

Overview: DPC Dash Ltd operates a chain of fast-food restaurants across the People's Republic of China, with a market capitalization of approximately HK$8.36 billion.

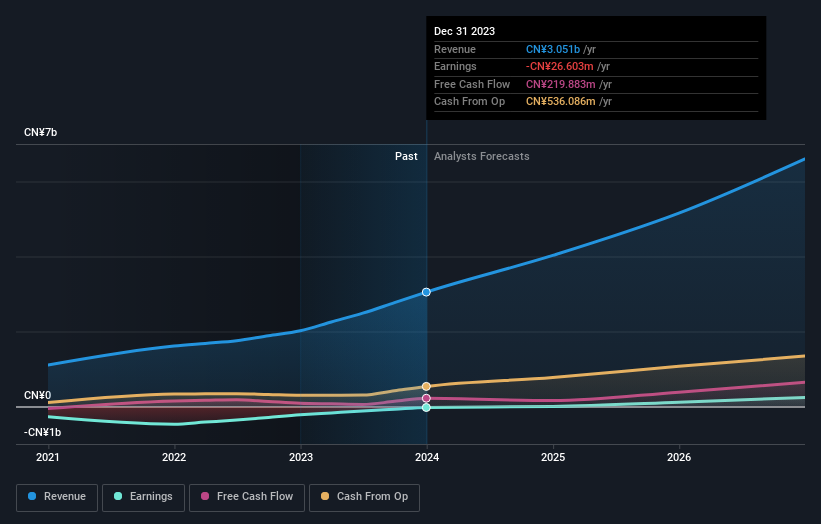

Operations: The company generates CN¥3.05 billion in revenue from its fast-food restaurant operations across China.

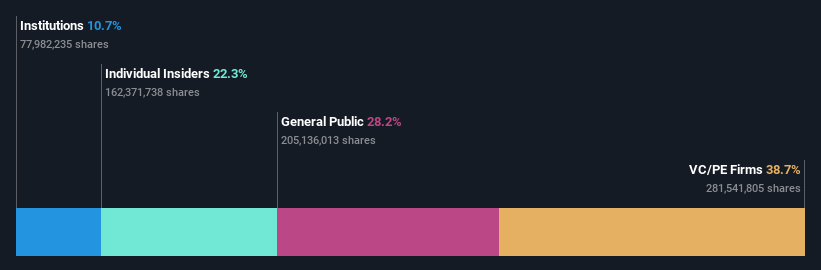

Insider Ownership: 38.2%

Revenue Growth Forecast: 24.4% p.a.

DPC Dash Ltd, a growth company in Hong Kong with high insider ownership, has shown promising signs despite its challenges. The company's revenue is expected to grow at 24.4% annually, outpacing the local market average of 7.8%. Over the past five years, earnings have increased by 22.2% per year and are projected to surge by 89.74% annually moving forward. Recent financial results indicate significant improvement with sales reaching CNY 3.05 billion and a reduced net loss from CNY 222.63 million to CNY 26.6 million year-over-year.

Dive into the specifics of DPC Dash here with our thorough growth forecast report.

Our valuation report here indicates DPC Dash may be overvalued.

Adicon Holdings

Simply Wall St Growth Rating: ★★★★★☆

Overview: Adicon Holdings Limited, with a market capitalization of HK$7.11 billion, operates medical laboratories across the People’s Republic of China.

Operations: The company generates revenue primarily from its healthcare facilities and services segment, totaling CN¥3.30 billion.

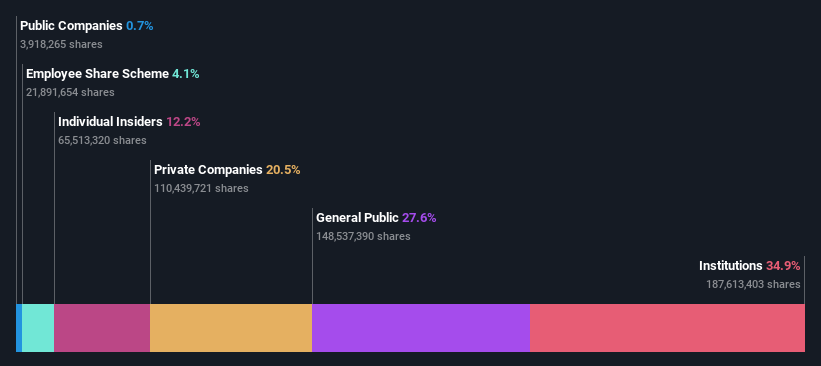

Insider Ownership: 22.3%

Revenue Growth Forecast: 15.1% p.a.

Adicon Holdings, a Hong Kong-based growth company with high insider ownership, is navigating a challenging economic landscape. Despite a decline in annual sales from CNY 4.86 billion to CNY 3.30 billion and reduced net income from CNY 680.79 million to CYN 234.89 million, the company's revenue is expected to grow by 15.1% annually, outperforming the local market forecast of 7.8%. Analysts anticipate significant earnings growth over the next three years at an annual rate of 28.3%, buoyed by strategic share repurchases aimed at enhancing shareholder value and earnings per share metrics following recent board changes and strategy adjustments under new leadership.

RemeGen

Simply Wall St Growth Rating: ★★★★★☆

Overview: RemeGen Co., Ltd. is a biopharmaceutical company focused on developing biologics for autoimmune, oncology, and ophthalmic diseases in Mainland China and the United States, with a market capitalization of approximately HK$22.14 billion.

Operations: The company generates revenue primarily through its biopharmaceutical research, service, production, and sales segment, totaling CN¥1.25 billion.

Insider Ownership: 16.2%

Revenue Growth Forecast: 27.1% p.a.

RemeGen, a Hong Kong-based biotech firm with high insider ownership, is poised for substantial growth, driven by its innovative pipeline. The company's recent positive Phase III trial results for Disitamab Vedotin in treating advanced breast cancer underscore its potential. Despite a short cash runway and current unprofitability, RemeGen's revenue is expected to grow 27.1% annually, outpacing the local market significantly. Strategic moves including FDA fast track designations and planned marketing applications highlight its proactive approach in addressing high-impact medical needs.

Click to explore a detailed breakdown of our findings in RemeGen's earnings growth report.

Our valuation report unveils the possibility RemeGen's shares may be trading at a premium.

Where To Now?

Navigate through the entire inventory of 53 Fast Growing SEHK Companies With High Insider Ownership here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1405 SEHK:9860 and SEHK:9995.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance