SEHK Growth Companies With High Insider Ownership And Up To 22% Revenue Growth

As global markets experience varied performances with notable advancements in technology stocks and a cautious eye on inflation, the Hong Kong market presents unique opportunities for investors. In this context, growth companies with high insider ownership in Hong Kong are particularly appealing, as they often signal strong confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

iDreamSky Technology Holdings (SEHK:1119) | 20.1% | 104.1% |

Fenbi (SEHK:2469) | 32.4% | 43% |

DPC Dash (SEHK:1405) | 38.2% | 89.7% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.5% | 79.3% |

Adicon Holdings (SEHK:9860) | 22.3% | 29.6% |

Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

MicroTech Medical (Hangzhou) (SEHK:2235) | 25.8% | 94.7% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 76.5% |

Beijing Airdoc Technology (SEHK:2251) | 28.2% | 83.9% |

Let's dive into some prime choices out of from the screener.

BYD

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Company Limited operates in the automobile and battery sectors across China, Hong Kong, Macau, Taiwan, and internationally, with a market capitalization of approximately HK$753.40 billion.

Operations: The company's revenue is primarily derived from its automobile and battery sectors.

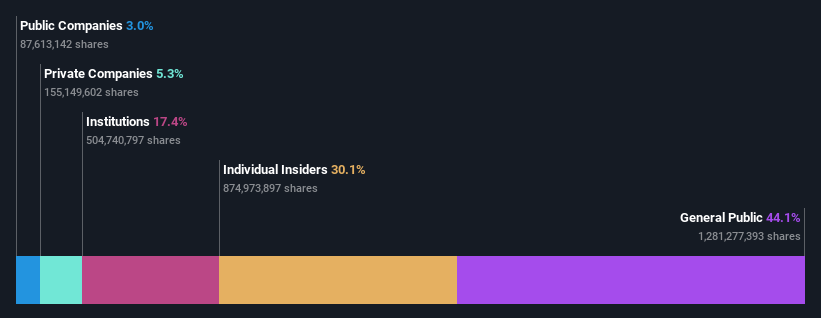

Insider Ownership: 30.1%

Revenue Growth Forecast: 14.1% p.a.

BYD, a prominent player in Hong Kong's growth sectors with significant insider ownership, has demonstrated robust operational performance and strategic expansion. Recently, it reported a substantial year-over-year increase in production and sales volumes as of May 2024, reflecting strong market demand. The company also enhanced shareholder returns with a dividend increase approved on June 6, 2024. Furthermore, BYD is innovating with new product launches like the BYD SHARK pickup in Mexico, indicating its commitment to diversifying and capturing global markets. These strategic moves align with its financial growth forecasts which outpace the Hong Kong market average.

Lianlian DigiTech

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lianlian DigiTech Co., Ltd. is a company based in China that offers digital payment services and additional value-added services to small and mid-sized merchants and enterprises, with a market capitalization of approximately HK$10.34 billion.

Operations: The company generates revenue through three primary segments: global payments (CN¥0.66 billion), domestic payments (CN¥0.22 billion), and value-added services (CN¥0.13 billion).

Insider Ownership: 19.4%

Revenue Growth Forecast: 22.7% p.a.

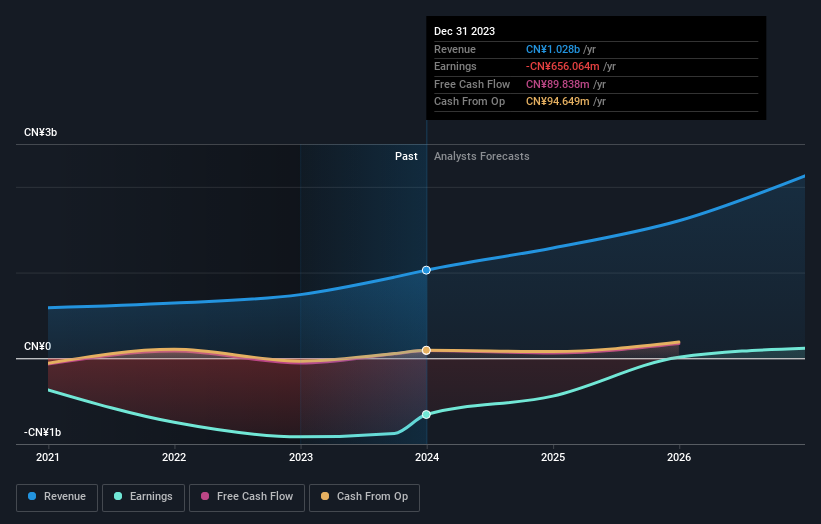

Lianlian DigiTech, a growth-focused company in Hong Kong with high insider ownership, recently secured a strategic Electronic Money Institution License in Luxembourg, enhancing its European market presence and service capabilities. Despite significant financial challenges including a net loss reported for 2023, the firm's aggressive expansion and leadership changes signal its commitment to improving performance and broadening its operational scope.

Angelalign Technology

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Angelalign Technology Inc. is an investment holding company that specializes in researching, developing, designing, manufacturing, and marketing clear aligner treatment solutions in the People’s Republic of China, with a market capitalization of approximately HK$9.92 billion.

Operations: The company generates revenue primarily from its dental equipment and supplies segment, totaling CN¥1.48 billion.

Insider Ownership: 18.5%

Revenue Growth Forecast: 16% p.a.

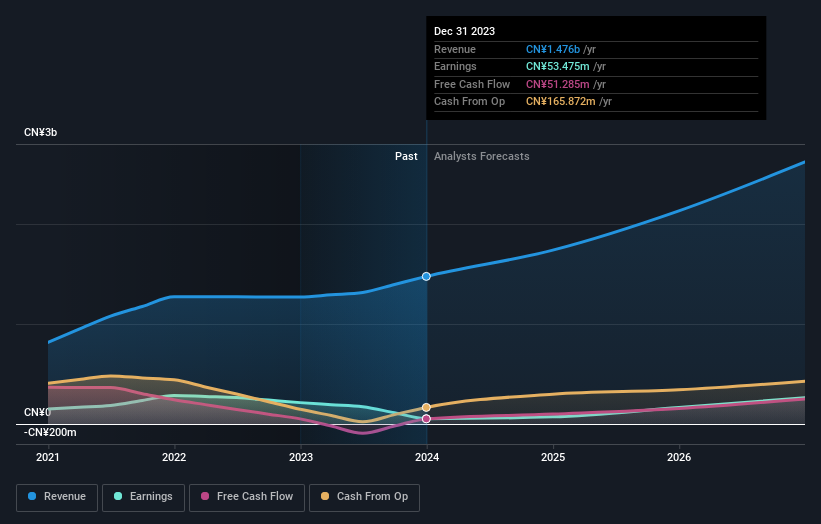

Angelalign Technology, a Hong Kong-based growth company with high insider ownership, has been actively expanding its product offerings and market reach. Recent developments include launching new orthodontic features and entering the Canadian market, signaling innovation and strategic growth. Despite these advancements, the company's financial performance shows mixed results with a significant decline in net income from the previous year and lower profit margins. However, revenue and earnings are expected to grow above the market rate over the next three years.

Summing It All Up

Discover the full array of 51 Fast Growing SEHK Companies With High Insider Ownership right here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1211 SEHK:2598 and .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance