SEHK Growth Leaders With High Insider Ownership

Amidst a backdrop of fluctuating global markets, the Hong Kong stock market has shown resilience with modest gains, reflecting a cautious optimism among investors. In such an environment, growth companies with high insider ownership in Hong Kong stand out as potentially strong performers due to their leaders' vested interest in driving long-term value.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

iDreamSky Technology Holdings (SEHK:1119) | 20.2% | 104.1% |

Fenbi (SEHK:2469) | 32.5% | 43% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.7% | 79.3% |

Adicon Holdings (SEHK:9860) | 22.3% | 28.3% |

Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

DPC Dash (SEHK:1405) | 38.2% | 89.7% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 76.5% |

Beijing Airdoc Technology (SEHK:2251) | 28.2% | 83.9% |

Ocumension Therapeutics (SEHK:1477) | 23.1% | 93.7% |

Let's uncover some gems from our specialized screener.

DPC Dash

Simply Wall St Growth Rating: ★★★★★☆

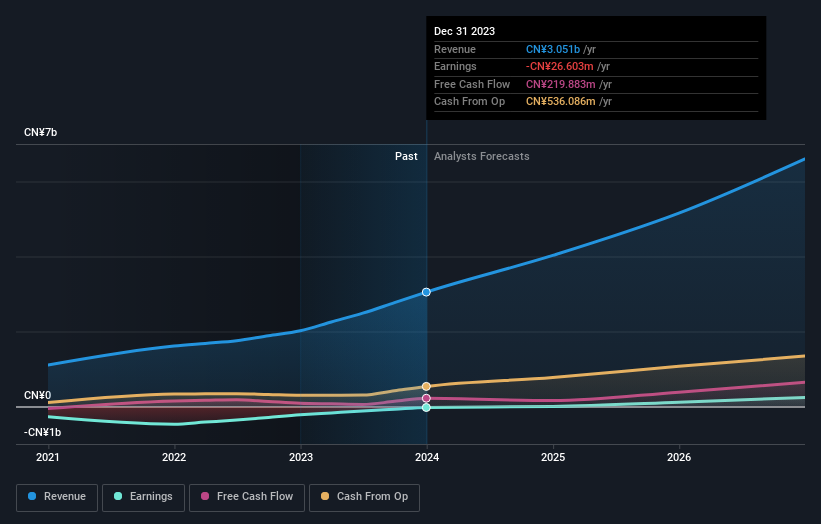

Overview: DPC Dash Ltd operates a chain of fast-food restaurants in the People’s Republic of China, with a market capitalization of approximately HK$8.48 billion.

Operations: The company generates CN¥3.05 billion in revenue from its fast-food restaurant operations in China.

Insider Ownership: 38.2%

Earnings Growth Forecast: 89.7% p.a.

DPC Dash, trading at HK$60.6% below our estimated fair value, has shown a robust growth trajectory with earnings increasing by 22.2% annually over the past five years. Looking ahead, it's forecasted to see revenue growth of 24.4% per year and earnings growth of 89.74% annually, both figures outpacing the broader Hong Kong market significantly. Additionally, there has been substantial insider buying in recent months without corresponding sales, signaling strong confidence from those closest to the company despite its forecasted low Return on Equity of 14%.

Unlock comprehensive insights into our analysis of DPC Dash stock in this growth report.

Our valuation report unveils the possibility DPC Dash's shares may be trading at a premium.

Beijing Fourth Paradigm Technology

Simply Wall St Growth Rating: ★★★★☆☆

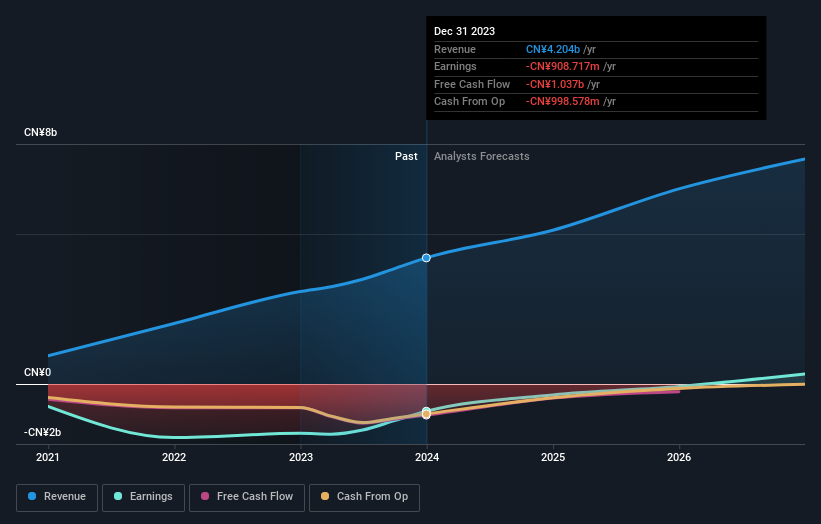

Overview: Beijing Fourth Paradigm Technology Co., Ltd. is an investment holding company that offers platform-centric artificial intelligence solutions in the People's Republic of China, with a market capitalization of HK$24.56 billion.

Operations: The company generates revenue through three primary segments: the Sage AI Platform (CN¥2.51 billion), SageGPT AIGS Services (CN¥0.42 billion), and Shift Intelligent Solutions (CN¥1.28 billion).

Insider Ownership: 22.8%

Earnings Growth Forecast: 96% p.a.

Beijing Fourth Paradigm Technology is poised for significant growth with revenue expected to increase by 19.3% annually, outstripping the Hong Kong market's 7.8%. The company is on track to become profitable within three years, reflecting robust business prospects. Recent executive shifts, including a new acting CFO and a vice chairman promotion, align with strategic enhancements aimed at sustainable development. These changes coupled with a share repurchase plan underscore strong insider confidence and commitment to enhancing shareholder value.

Adicon Holdings

Simply Wall St Growth Rating: ★★★★★☆

Overview: Adicon Holdings Limited is a company that operates medical laboratories in the People's Republic of China, with a market capitalization of approximately HK$7.24 billion.

Operations: The company generates revenue primarily from healthcare facilities and services, totaling CN¥3.30 billion.

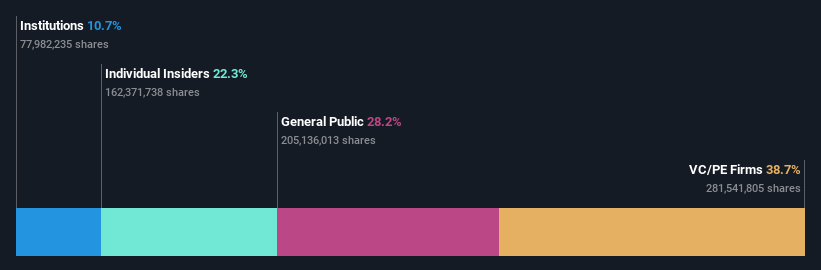

Insider Ownership: 22.3%

Earnings Growth Forecast: 28.3% p.a.

Adicon Holdings, a Hong Kong-based company, has recently initiated a share repurchase program, signaling strong insider confidence and potential for enhanced shareholder value. Despite a significant drop in annual sales and net income for the year ended December 31, 2023, Adicon is projected to outpace the Hong Kong market with an expected annual profit growth of 28.3% and revenue growth of 15.1%. However, it's noteworthy that its profit margins have declined compared to the previous year.

Summing It All Up

Unlock our comprehensive list of 53 Fast Growing SEHK Companies With High Insider Ownership by clicking here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1405 SEHK:6682 and SEHK:9860.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance