SEHK Growth Leaders With High Insider Stakes

As global markets navigate through a period of cautious optimism, Hong Kong's Hang Seng Index has experienced a downtrend, reflecting concerns about the region's economic momentum. In such an environment, identifying growth companies with high insider ownership in Hong Kong can offer investors potential resilience and alignment of interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

iDreamSky Technology Holdings (SEHK:1119) | 20.2% | 104.1% |

Fenbi (SEHK:2469) | 32.5% | 43% |

Adicon Holdings (SEHK:9860) | 22.4% | 28.3% |

Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

DPC Dash (SEHK:1405) | 38.2% | 90.2% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.7% | 79.3% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 76.5% |

Beijing Airdoc Technology (SEHK:2251) | 28.7% | 83.9% |

Ocumension Therapeutics (SEHK:1477) | 23.1% | 93.7% |

We'll examine a selection from our screener results.

China Ruyi Holdings

Simply Wall St Growth Rating: ★★★★☆☆

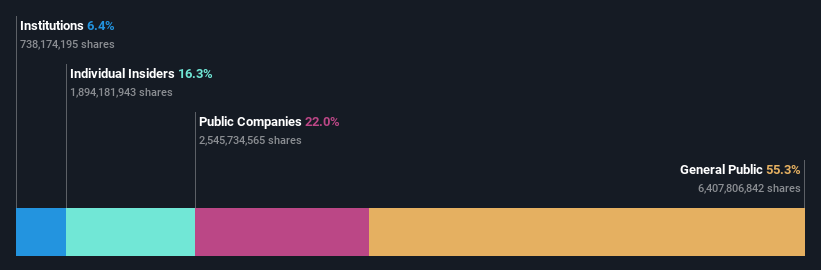

Overview: China Ruyi Holdings Limited operates as an investment holding company focused on content production and online streaming, serving markets in the People's Republic of China, Hong Kong, Europe, and internationally with a market capitalization of approximately HK$26.26 billion.

Operations: The company's revenue is primarily derived from its content production business, which generated CN¥2.23 billion, and its online streaming and gaming segments, which together brought in CN¥1.38 billion.

Insider Ownership: 15.1%

China Ruyi Holdings, amid a backdrop of significant corporate activity including a HK$4 billion equity offering and bylaw amendments, shows robust growth prospects with revenue expected to grow at 27.7% per year. However, the company's profit margins have declined from last year's 59.8% to 19%. Despite this, earnings are still set to outpace the Hong Kong market with an annual growth rate forecasted at 14.7%. Notably, the firm is trading at a substantial discount to its estimated fair value.

Beijing Fourth Paradigm Technology

Simply Wall St Growth Rating: ★★★★☆☆

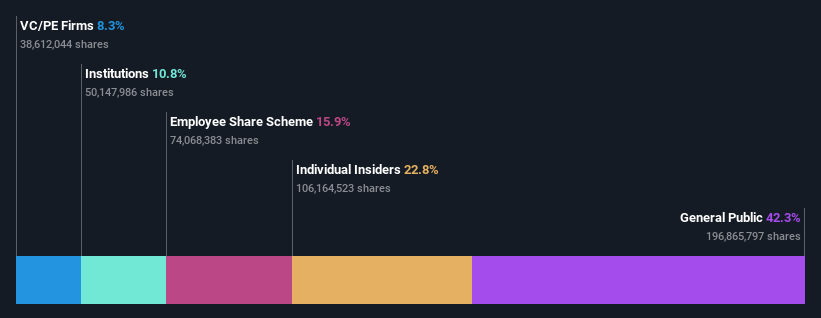

Overview: Beijing Fourth Paradigm Technology Co., Ltd. is an investment holding company that offers platform-centric artificial intelligence solutions in the People's Republic of China, with a market capitalization of HK$24.91 billion.

Operations: The company generates revenue through three main segments: the Sage AI Platform at CN¥2.51 billion, Shift Intelligent Solutions at CN¥1.28 billion, and SageGPT AiGS Services at CN¥415.50 million.

Insider Ownership: 22.8%

Beijing Fourth Paradigm Technology is poised for significant growth with a revenue increase of 36.4% last year and expected earnings growth of 95.97% annually. The company's revenue is projected to grow at 19.3% per year, outpacing the Hong Kong market average of 7.8%. Recent leadership changes, including the promotion of Mr. Yu Zhonghao to vice chairman and Ms. Guo Qingyuan stepping in as acting CFO, underscore a strategic push towards sustainable development, although its forecasted Return on Equity remains low at 6%.

Adicon Holdings

Simply Wall St Growth Rating: ★★★★★☆

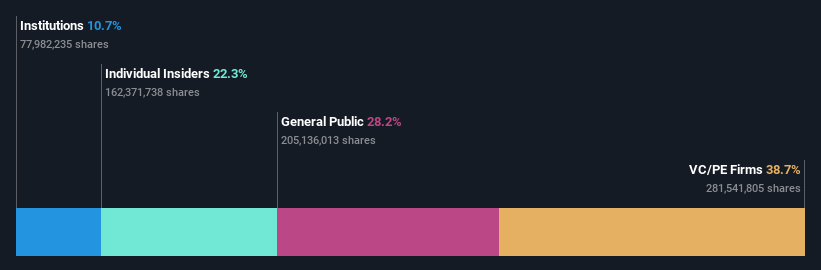

Overview: Adicon Holdings Limited, with a market cap of HK$7.40 billion, operates medical laboratories across the People’s Republic of China.

Operations: The company generates CN¥3.30 billion from its healthcare facilities and services segment.

Insider Ownership: 22.4%

Adicon Holdings is experiencing robust earnings growth, projected at 28.33% annually over the next three years, significantly outpacing the Hong Kong market average. Although its revenue growth forecast of 15.1% yearly lags behind some peers, it still exceeds the market's 7.8%. Recent strategic moves include a substantial share repurchase program initiated on June 7, 2024, enhancing shareholder value by potentially increasing net asset value and earnings per share. However, profit margins have dipped to 7.1%, down from last year's 14%.

Make It Happen

Navigate through the entire inventory of 54 Fast Growing SEHK Companies With High Insider Ownership here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:136SEHK:6682 SEHK:9860

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance