September 2023 Quarterly Report

KEY POINTS

Quarter highlights

Catalyst completed consolidation of the Plutonic gold belt in late June 2023, making the September quarter the operation's first under CYL ownership

New management team installed at the Plutonic gold mine

Plutonic operational performance increased month-on-month, beginning to demonstrate what performance could be possible from the Plutonic gold mine

Trident Scoping Study released, demonstrating pathway to increased production through low cost, high grade supplementary ore sources

Production

Gold sold totalled 19,214oz

Plutonic: 15,515oz gold sold at an AISC of A$2,507/oz

Henty: 3,699oz gold sold at an AISC of A$3,215/oz

Plutonic performance metrics improved materially during the quarter compared to the first six months of 2023

Discovery and Growth

Trident Small Mining Operations Proposal received from DMIRS, allowing for surface and decline development

Trident infill drill program completed; results will support updated Mineral Resource and definitive feasibility study

Considerable planning underway for broader Plutonic Gold Belt exploration

Financial

30 September cash was A$22.8 million

The Company held loan facilities of $31.4 million for the same date; this includes a reclassification of a working capital loan inherited by Superior Gold, to debt

Corporate

During the quarter, David Jones AM was appointed as Chairman, replacing long serving Chairman, Stephen Boston

PERTH, Australia, Nov. 1, 2023 /PRNewswire/ -

OVERVIEW

The September quarter represents an inflection point for the Company, following the completion of the acquisition of Superior Gold Inc at the end of June 2023. The September quarter is the first full quarter of production from both Plutonic and Henty, under Catalyst's ownership.

At Plutonic a new management team identified and implemented a number of initiatives that have had an immediate positive impact.

Operational metrics at Plutonic during the quarter improved month on month, with September results some of the best seen at Plutonic in many years. Through this, the Company is focused on stabilising production and costs over the coming months.

Now that the team has demonstrated what is possible at Plutonic, the conversation is changing to consistently performing at these levels.

Performance at the Henty Gold Mine in Tasmania was impacted by low mill availability, lower than expected grade performance and mine equipment downtime. As previously noted, an equipment replacement and overhaul program has been commissioned to alleviate some of these issues. In the September quarter, the Company invested $1.1m in new equipment which is expected to improve availability and reliability.

In Victoria, the Company continues to progress plans for the submission of an Environmental Impact Statement for the proposed Four Eagles Exploration Tunnel.

MANAGEMENT COMMENTARY

"We have been very pleased with the improving operational performance at Plutonic following the completion of the acquisition. The new management team has been warmly welcomed by the existing workforce, many of whom have been there for many years. The problem-solving attitude and willingness to embrace new processes has seen nearly all operational metrics improve over the quarter.

"Whilst all current production is sourced from the Plutonic Underground operations, we are well prepared for the introduction of high-grade ore from the Trident deposit in 2024. The approvals received during the quarter will allow development to commence prior to the completion of the Definitive Feasibility Study.

"Henty continued to have operational challenges during the quarter that impacted production, however the equipment replacement program is expected to see meaningful improvements over the next 3-6 months.

"The exploration team continues to consolidate, validate and interpret the datasets acquired from the Vango and Superior transactions. This is a mammoth task that cannot be underestimated. It requires the painstaking process of reorganising databases after years of neglect. Upon completion during this next quarter, we'll be well placed in our exploration efforts.

"Finally, we'd like to thank all of the Catalyst team for their hard work and commitment during these past few months of consolidation. Bringing different assets and people together to create a cohesive and productive mining house takes a significant amount of patience and extra efforts. As we build a mid-tier gold company, the contribution by the team is highly appreciated."

Table 1: September quarter 2023 performance summary – by production centre

3 MONTHS ENDING 30 SEP 2023 | Units | Plutonic | Henty |

Ore Mined | Tonnes | 292,447 | 57,680 |

Mined Grade | g/t Au | 2.20 | 2.90 |

Ounces Mined | oz | 20,681 | 5,386 |

Milled Tonnes | Tonnes | 291,194 | 53,456 |

Head Grade | g/t Au | 2.11 | 2.90 |

Recovery | % | 86.2 % | 91.2 % |

Gold Recovered | oz | 17,091 | 4,563 |

Gold Sold | oz | 15,515 | 3,699 |

Average Price | A$/oz | 2,875 | 2,979 |

Total Stockpiles Contained Gold | oz | 1,061 | - |

Gold in Circuit (GIC) | oz | 2,162 | 722 |

Gold in Transit | oz | - | 637 |

Total Gold Inventories | oz | 3,223 | 1,359 |

Underground Mining | A$/oz | 1,684 | 1,946 |

Processing | A$/oz | 500 | 489 |

Site Services | A$/oz | 367 | 354 |

Ore Stock & GIC Movements | A$/oz | (265) | (835) |

Cash Operating Cost | A$/oz | 2,286 | 1,954 |

Royalties | A$/oz | 78 | 172 |

Rehabilitation | A$/oz | 19 | 10 |

Corporate Overheads | A$/oz | 30 | 87 |

Sustaining Capital | A$/oz | 94 | 992 |

All-in Sustaining Cost | A$/oz | 2,507 | 3,215 |

ENVIRONMENT, SOCIAL AND SAFETY (ESS)

Catalyst Metals values the health and safety of its employees, contractors and stakeholders within our host community. Plutonic has a strong safety culture and Catalyst intends to build upon this strong foundation in the coming months.

Henty had nil recordable injuries for the quarter. Plutonic had five reportable incidents during the quarter and one LTI.

Table 2: September 2023 Group safety performance (12-month moving average)

Plutonic | Henty | |

TRIFR | 25.9 | 12.4 |

LTIFR (per million hours worked) | 6.1 | 15.5 |

OPERATIONS

Plutonic Gold Operations

The September quarter represents Catalyst's first quarter of ownership of the Plutonic Operations. The immediate priority for Catalyst has been to stabilise the mine and its workforce. Managing Director & CEO, James Champion de Crespigny, based himself at site and a transition team was installed to help in the early stages of this transition.

The results for the quarter demonstrate a broad buy-in of the operating strategy by the workforce beyond just the senior management. It also shows that early changes implemented by the new management team are yielding positive results.

Catalyst recorded improvements in all key performance indicators across the operations, shown in Table 3.

Table 3: September quarter monthly metrics compared to 18-month average to June 2023

Metric | 18-month average | September quarter average | Variance |

Development metres (m) | 585 | 719 | +23 % |

Drilling metres (m) | 12,517 | 18,405 | +47 % |

Ore processed (t) | 71,145 | 97,305 | +37 % |

Material movement (t) | 95,530 | 118,368 | +24 % |

Gold produced (oz) | 4,857 | 5,678 | +17 % |

Plutonic recorded gold sales of 15,515oz for the quarter. Gold produced for the quarter was 17,091oz.

The mine delivered 292,447 tonnes of ore during the quarter. A total of 291,194 tonnes of ore were processed at a head grade of 2.11 g/t Au.

Henty Gold Mine

Site operations delivered gold sales of 3,699oz for the quarter. Gold produced for the quarter was 4,563oz of gold at a grade of 2.90g/t Au (Previous quarter: 4,903oz at 2.70g/t Au).

The mine delivered 57,680 tonnes of ore during the quarter (previous quarter: 50,709 tonnes). A total of 53,456 tonnes of ore were processed at a head grade of 2.90 g/t Au (previous quarter: 61,915t at 2.70g/t Au).

Recovery for the quarter was 91.2% which was in line with expectations given ore sources available.

Henty's cost management continued during the quarter with operating costs below expectations. Production was below budget during the quarter, owing to mine equipment downtime and lower than expected grade performance.

The equipment replacement plan has been implemented with combined rebuild and replacement of the ageing mining equipment having commenced into the new financial year. Mill availability previously impacted by unplanned failures will continue to be mitigated with conditioning monitoring. A review has commenced on the Mineral Resource model to mitigate below expected grades realised and improve forecast confidence.

EXPLORATION AND DEVELOPMENT

Plutonic Gold Belt Exploration

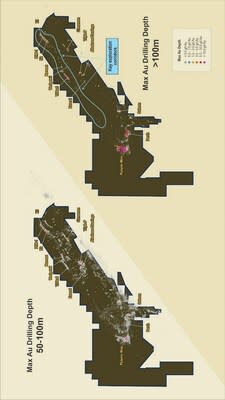

During the quarter, Catalyst released a scoping study on the Trident deposit. The study contemplated an underground mine development with ore transported and processed at the Plutonic processing facility. Trident will be an incremental ore source to a base load being processed at Plutonic. The study was based off the historical Mineral Resource Estimate of ASX listed Vango Mining Ltd.

Catalyst has commenced a Definitive Feasibility Study (DFS) at Trident. To support this, Catalyst completed the first round of Mineral Resource verification drilling at the prospective and high-grade Trident Deposit. The DFS is expected to be completed in Q4 2023.

Forty drill holes were completed in the period, comprising reverse circulation (RC) pre-collars with diamond core tails to test the ore zone, for a total of 7,154 metres. Importantly, this drilling has confirmed the high-grade intercepts and grade continuity as reported by previous operators.

The Trident DFS is well underway and includes independent work by consultants on geotechnology, metallurgy, mineralogy, hydrology, environmental, mining engineering and Mineral Resource estimation.

During the quarter, Catalyst announced that approval for Small Mining Operations had been received from the Department of Mines, Industry Regulations and Safety (DMIRS)1, allowing Catalyst to commence portal construction and decline development at the Trident project. This will de-risk the project schedule by allowing early works to commence ahead of final mining approvals.

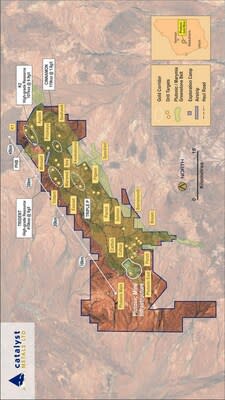

Exploration reviews are underway to prioritise the plethora of advanced and grassroots targets along the newly consolidated Plutonic Gold Belt.

Plutonic is characterised by mineralisation at depth with transported cover. This has parallels to Catalyst's Bendigo tenements where the Company has had success utilising ionic soil sampling to identify prospective areas. Catalyst plans to leverage this internal knowledge and is planning an ionic sampling program across the Plutonic Gold Belt.

Future exploration programmes will range from surface geochemistry and geophysics to discover hidden mineralisation at depth, through to drill outs of known deposits around existing mothballed pits, which number almost 30. New ore sources can be delivered to the Plutonic mill thanks to the network of existing haul roads extending the full 48km length of the Catalyst mining leases.

Victorian Gold Exploration

No significant field activity was undertaken in the September quarter. This period is often hampered by wet weather restricting equipment access and seasonal cropping by landholders.

Four Eagles Gold Project

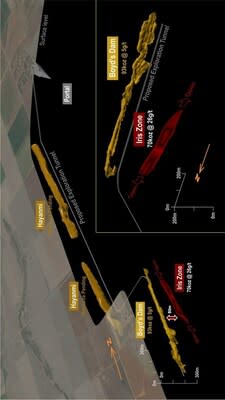

The Four Eagles Gold Project comprises numerous prospects, four of which are Boyd's Dam, Hayanmi, Pickles and the Iris Zone. Management's main focus at the Four Eagles Joint Venture is to gain approval to construct an access tunnel to explore underground.

The release of the maiden Mineral Resource2 at the Four Eagles Gold Project (665,000t at 7.7g/t for 163,000oz Au), which included the high-grade Iris Zone (70,000oz at 26.2g/t Au) has demonstrated proof of concept of the repetitive nature of mineralisation similar to that discovered at the historical 22-million-ounce Bendigo Goldfield.

Gaining approval to explore underground will allow Catalyst to better understand and further explore these exciting deposits.

Across its tenement package, Catalyst has numerous prospects that hold several targets. These have the potential to host high-grade mineralisation similar to that already discovered in the Iris Zone.

To gain approval for an exploration tunnel at the Four Eagles Project, collaboration with Victorian Government's regulation body, Earth Resources Regulation (ERR) has continued during the quarter.

Catalyst had been advised in the June quarter that the application would require an Environmental Impact Statement (EIS). Works to address the Impact Statement have commenced, with the preparation of the Scope of Works underway.

Whilst the timeline regarding approval of the tunnel remains uncertain, Catalyst do not believe an EIS will negatively impact the currently anticipated timeline.

_________________________________ |

1 ASX Announcement 14 September 2023 - Approval received for Trident early works |

2 ASX Announcement 15 June 2023 – Maiden Mineral Resource of 163,000oz at Four Eagles Gold Project |

Henty Exploration

During the quarter, Henty replaced and mobilised a new diamond drilling services provider. Underground grade control drilling resumed in September and exploration drilling is yet to resume.

FINANCE

Cash and Equivalents

At the end of the September 2023 quarter, the Company held cash reserves of $22.8 million.

During the quarter, the Company made payments of:

$3.1 million for ongoing exploration and evaluation of the Company's existing exploration and mining projects (including capitalised and expensed expenditure);

$44.9 million for mining and production activities;

$3.5 million for the repayment of loans;

$2.7 million for the repayment of equipment financing and insurance premium facilities; and

$0.3 million to related parties, comprising payments to directors for executive salaries and consulting fees paid to Mr Kay for the provision of additional technical services to the Company.

During the quarter, 775,000 Ordinary shares were issued pursuant to the employee incentive scheme.

Loan Facilities

The movements on the loan facilities during the September 2023 quarter were as follows:

Table 4: Movements in loan facilities

$m | Balance at 30 June | Repayments | Balance at 30 |

Convertible Notes | 12.1 | - | 12.1 |

Auramet advances, gold loans and working | 21.2 | (2.7) | 18.5 |

Other loans | 1.6 | (0.8) | 0.8 |

Total** | 34.9 | (3.5) | 31.4 |

* The Company has various financing facilities in place with Auramet, which are presented in the annual financial statements under loans, deferred revenue (gold loans) and advances. |

** Loan facilities presented in the above table represent the nominal value of the facilities and exclude equipment financing facilities (hire-purchase and leases) and insurance premium financing. The repayments made during the quarter on these facilities amounted to $2.7 million. |

Hedging

At the end of the September quarter, the Company held the following calls and forward sale contracts.

Table 5: Calls and forward sales

Quarter | Average Call Price | Ounces | Average Forward | Ounces |

December 2023 | 2,878 | 5,800 | 2,997 | 14,000 |

March 2024 | 2,970 | 7,500 | 3,052 | 6,000 |

June 2024 | 3,000 | 3,500 | ||

Total | 2,944 | 16,800 | 3,013 | 20,000 |

CORPORATE

Freshwater Royalty transfer

During the quarter, Catalyst was notified that Grange Resources Ltd (ASX: GRR) (Grange) had received an offer from Vox Royalty Corp. (TSX: VOXR) (Vox) to acquire the Freshwater Royalty. Post quarter end, Catalyst was advised that the sale had completed and the royalty had been transferred to Vox. Catalyst does not intend to undertake exploration activities on these areas.

Superior Gold – Issue of Shares

On 29 June 2023, Catalyst and Superior Gold Inc. ("Superior") announced the completion of the previously announced plan of arrangement (the "Arrangement"), whereby Catalyst has acquired all of the issued and outstanding common shares in the capital of the Company (the "Common Shares") by way of a court-approved plan of arrangement under the Business Corporations Act (Ontario).

Under the terms of the Arrangement, each former shareholder of Superior is entitled to receive 0.3571 of an ordinary share in the capital of Catalyst for each Common Share held immediately prior to the completion of the Arrangement.

The Arrangement, which was announced on February 23, 2023, was approved by the Shareholders at Superior's special meeting of shareholders held on June 26, 2023 and by the Ontario Superior Court of Justice (Commercial List) on June 28, 2023.

Catalyst has issued all CYL shares due to Superior Gold Inc shareholders to TMX Trust. This step was completed on 29 June 2023 and all shares were issued to TMX Trust on this date. Canadian brokers (and US brokers who held Superior Gold Inc shares via DTC) will need to apply to TMX Trust to have their Catalyst shares released from escrow and delivered into their name on the Australian Catalyst share register.

To do this, all registered Shareholders are encouraged to complete, sign and return the letter of transmittal, which has been previously mailed and is available under Superior's SEDAR profile at www.sedar.com, with accompanying Common Share certificate(s) and DRS advice-statement(s) (if applicable) to TSX Trust Company as soon as possible, if they have not already done so. Non-registered Shareholders are encouraged to contact their broker or other intermediary for instructions and assistance in receiving the Catalyst Shares in respect of their Common Shares.

This report has been approved for release by the Board of Directors of Catalyst Metals Limited.

Corporate summary (at 30 September 2023) | |

ASX trading code | CYL |

Quoted shares (CYL) | 220,087,544 |

Unquoted options | 1,357,010 |

Unquoted performance rights | 1,800,000 |

Postal address | PO Box 1784 |

West Perth, WA 6872 | |

Telephone | (+61) 8 6324 0090 |

admin@catalystmetals.com.au | |

Website | www.catalystmetals.com.au |

Tenement directory as at 30 September 2023 | ||

Project | Tenement | Beneficial interest |

Victoria | ||

Four Eagles | RL006422 | 50 % |

EL5295 | 50 % | |

EL5508 | 50 % | |

EL006859 | 50 % | |

Macorna | EL5521 | 100% (farm-out of 50% to GEV) |

EL006894 | 100% (farm-out of 50% to | |

EL006549 | 100% of mineral rights | |

Boort | EL006670 | 50 % |

Tandarra | RL006660 | 51 % |

Raydarra East | EL5509 | 100 % |

Sebastian | EL5533 | 100 % |

Raydarra | EL007214 | 100 % |

Drummartin | EL006507 | 100 % |

Golden Camel | EL5490 & EL5449 | 50.1 % |

Tasmania | ||

Henty | ML 7M/1991 | 100 % |

ML 5M/2002 | 100 % | |

ML 7M/2006 | 100 % | |

EL28/2001 | 100 % | |

EL8/2009 | 100 %

| |

Western Australia (Marymia) | ||

L 52/154 | 100 % | |

E 52/2072 | 100 % | |

P 52/1609 | 100 % | |

M 52/218 | 100 % | |

M 52/226 | 100 % | |

M 52/229 | 100 % | |

M 52/232 | 100 % | |

M 52/235 | 100 % | |

M 52/257 | 100 % | |

M 52/269 | 100 % | |

M 52/279 | 100 % | |

M 52/293 | 100 % | |

M 52/304 | 100 % | |

M 52/320 | 100 % | |

M 52/366 | 100 % | |

M 52/370 | 100 % | |

M 52/572 | 100 % | |

M 52/748 | 100 % | |

M 52/781 | 100 % | |

L 52/188 | 100 % | |

P 52/1587 | 100 % | |

M 52/183 | 100 % | |

M 52/219 | 100 % | |

M 52/227 | 100 % | |

M 52/230 | 100 % | |

M 52/233 | 100 % | |

M 52/246 | 100 % | |

M 52/258 | 100 % | |

M 52/270 | 100 % | |

M 52/291 | 100 % | |

M 52/299 | 100 % | |

M 52/305 | 100 % | |

M 52/321 | 100 % | |

M 52/367 | 100 % | |

M 52/396 | 100 % | |

M 52/593 | 100 % | |

M 52/779 | 100 % | |

M 52/782 | 100 % | |

E 52/2071 | 100 % | |

P 52/1588 | 100 % | |

M 52/217 | 100 % | |

M 52/220 | 100 % | |

M 52/228 | 100 % | |

M 52/231 | 100 % | |

M 52/234 | 100 % | |

M 52/247 | 100 % | |

M 52/259 | 100 % | |

M 52/278 | 100 % | |

M 52/292 | 100 % | |

M 52/303 | 100 % | |

M 52/306 | 100 % | |

M 52/323 | 100 % | |

M 52/369 | 100 % | |

M 52/478 | 100 % | |

M 52/654 | 100 % | |

M 52/780 | 100 % | |

E 52/2456 | Earning in | |

E 52/2493 | Earning in | |

E 52/2734 | Earning in | |

E 52/3473 | Earning in | |

E 52/3476 | Earning in | |

Western Australia (Plutonic) | E52/3189 E52/3578 E52/4167 E52/4168 E52/4169 E52/4170 L52/203 L52/40 L52/41 L52/48 L52/52 L52/54 L52/55 L52/56 L52/70 L52/71 L52/74 M52/148 M52/149 M52/150 M52/170 M52/171 M52/222 M52/223 M52/253 M52/263 M52/264 M52/289 M52/295 M52/296 M52/300 M52/301 M52/308 M52/309 M52/395 M52/590 M52/591 M52/592 M52/670 M52/671 M52/672 P52/1560 P52/1561 P52/1562 P52/1606 | 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100%

|

Western Australia (Hermes) | E52/2361 E52/3322 G52/291 L52/116 L52/117 L52/118 L52/164 L52/165 L52/166 L52/201 L52/204 M52/685 M52/753 M52/796 M52/797 P52/1569 P52/1570 | 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% |

Western Australia (Bryah Basin JV) | E52/1668 E52/1678 E52/1723 E52/1730 E52/1731 E52/1852 E52/2362 E52/3406 E52/3408 E52/3499 L52/208 L52/231 L52/235 M52/1049 M52/737 M52/795 P52/1538 P52/1539 P52/1577 | 70% 70% 80% 70% 80% 80% 80% 80% 80% 100% 100% 100% 100% 80% 80% 80% 100% 100% 100%

|

No interests in mining tenements or farm-in or farm-out agreements were acquired or disposed of during the quarter | ||

Competent person's statement

The information in this report that relates to exploration results is based on information compiled by Mr Bruce Kay, a Competent Person, who is a Fellow of the Australasian Institute of Mining and Metallurgy. Mr Kay is a non-executive director of the Company and has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the JORC Code). Mr Kay consents to the inclusion in the report of the matters based on his information in the form and context in which it appears.

JORC 2012 Mineral Resources and Reserves

Catalyst confirms that it is not aware of any new information or data that materially affects the information included in the original market announcements and that all material assumptions and technical parameters underpinning the estimates in the relevant market announcements continue to apply and have not materially changed. The Company confirms that the form and context in which the Competent Persons findings are presented have not been materially modified from the original market announcements.

Catalyst Metals

Catalyst Metals controls three highly prospective gold belts. It has a multi asset strategy.

It owns the 40km long Plutonic Gold Belt in Western Australia hosting the Plutonic gold mine and neighbouring underexplored, high-grade resources.

It also owns and operates the high-grade Henty Gold Mine in Tasmania which lies within the 25km Henty gold belt. Production to date is 1.4Moz @ 8.9 g/t.

Catalyst also controls +75km of strike length immediately north of the +22Moz Bendigo goldfield and home to high-grade, greenfield resources at Four Eagles.

Capital Structure

Shares o/s: 220m

Options: 1.4m

Rights: 1.8m

Cash: $22.8m

Debt: $31.4m

Board Members

David Jones AM

Non-Executive Chairman

James Champion de Crespigny

Managing Director & CEO

Robin Scrimgeour

Non-Executive Director

Bruce Kay

Non-Executive Director

Corporate Details

ASX: CYL

E:investors@catalystmetals.com.au

W:catalystmetals.com.au

View original content to download multimedia:https://www.prnewswire.com/news-releases/september-2023-quarterly-report-301973803.html

SOURCE Catalyst Metals LTD.

Yahoo Finance

Yahoo Finance