ServisFirst Bancshares Inc. Reports Mixed Q1 2024 Results; EPS Beats Estimates, Revenue Dips

Net Income: Reported at $50.03 million for Q1 2024, surpassing the estimate of $47.74 million.

Earnings Per Share (EPS): Achieved $0.92, exceeding the estimated $0.88.

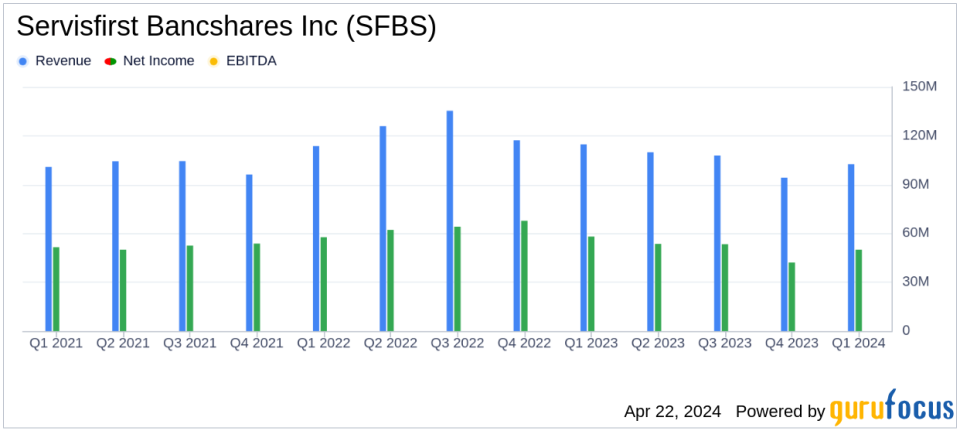

Revenue: Net interest income for the quarter was $102.5 million, falling short of the estimated $109.10 million.

Return on Average Assets: Recorded at 1.26%, showing a decrease from 1.63% in Q1 2023.

Loan Growth: Total loans reached $11.88 billion, marking a 1.9% increase from the previous quarter.

Deposit Levels: Total deposits were $12.75 billion, reflecting a 3.9% decrease from the previous quarter.

Efficiency Ratio: Improved to 43.30% in Q1 2024 from 55.23% in the previous quarter.

ServisFirst Bancshares Inc. (NYSE:SFBS) disclosed its financial outcomes for the first quarter ended March 31, 2024, via its recent 8-K filing. The company, a prominent bank holding entity known for its comprehensive range of banking services across several states, reported a mixed financial performance with an earnings per share (EPS) that surpassed analyst expectations but a slight decline in revenue.

Financial Highlights and Performance Metrics

For Q1 2024, ServisFirst Bancshares reported a net income of $50.03 million, a notable increase from $42.07 million in the previous quarter, yet a decrease from $57.97 million year-over-year. The diluted EPS was $0.92, exceeding the estimated $0.88 and showing improvement from $0.77 in Q4 2023 but down from $1.06 in Q1 2023. Despite these gains, the company experienced a slight revenue shortfall, posting $102.5 million in net interest income against the anticipated $109.10 million.

While the bank managed to stabilize its funding costs, as highlighted by CFO Kirk Pressley, challenges remain evident in the reduced net interest margin of 2.66%, down from 3.15% in the same quarter the previous year. This reduction reflects broader industry trends affecting financial institutions.

Operational and Strategic Developments

Amidst the financial discourse, ServisFirst continues to expand its team, with nine new bankers hired in the first quarter, emphasizing its commitment to attracting top industry talent. Additionally, the bank's strategic maneuvers, such as the adjustment of its deposit strategy, reflect a proactive approach to managing high-cost and non-core deposits, which saw a 3.9% reduction from the previous quarter.

However, the bank faces increased non-performing assets, which now stand at 0.22% of total assets, up from 0.12% in the previous year. This rise is attributed to a specific loan moving to non-accrual status, though it remains well-collateralized.

Balance Sheet and Capital Adequacy

Total assets were reported at $15.72 billion, a slight decrease from $16.13 billion at the end of the previous quarter but up 7.9% from the previous year. The bank's loan portfolio modestly grew to $11.88 billion, and despite the challenges, the bank maintains a robust capital position, with a common equity tier 1 capital ratio of 11.07%.

Looking Forward

As ServisFirst Bancshares navigates through fluctuating market conditions, its focus on maintaining a strong capital base and improving operational efficiencies continues to be central to its strategy. The bank's ability to manage costs and attract quality talent positions it well to handle the ongoing challenges in the banking sector.

For more detailed information and continuous updates, investors and stakeholders are encouraged to refer to the filings available on the SEC's website or visit ServisFirst Bancshares' official website.

Explore the complete 8-K earnings release (here) from Servisfirst Bancshares Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance