SGX Dividend Stocks To Watch In May 2024

As global markets navigate through various economic challenges, the Singapore market remains a focal point for investors looking for stable returns, particularly through dividend stocks. In light of current market conditions, selecting stocks with robust dividend yields and strong fundamentals is crucial for those looking to enhance their investment portfolios in May 2024.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

Civmec (SGX:P9D) | 6.05% | ★★★★★☆ |

Singapore Exchange (SGX:S68) | 3.54% | ★★★★★☆ |

Multi-Chem (SGX:AWZ) | 9.68% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.97% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.67% | ★★★★★☆ |

BRC Asia (SGX:BEC) | 7.62% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 6.88% | ★★★★★☆ |

Singapore Airlines (SGX:C6L) | 7.13% | ★★★★★☆ |

YHI International (SGX:BPF) | 6.56% | ★★★★★☆ |

Sing Investments & Finance (SGX:S35) | 6.03% | ★★★★☆☆ |

Click here to see the full list of 19 stocks from our Top SGX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

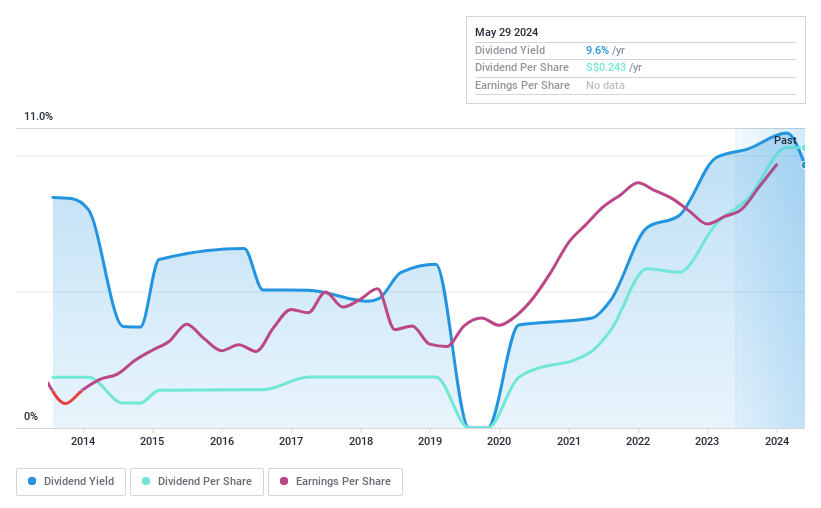

Multi-Chem

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Multi-Chem Limited, primarily an investment holding company, operates in the distribution of information technology products across regions including Singapore, Greater China, Australia, and India, with a market capitalization of approximately SGD 226.14 million.

Operations: Multi-Chem Limited generates revenue through its IT business in Singapore (SGD 372.78 million), Australia (SGD 54.60 million), India (SGD 40.56 million), Greater China (SGD 34.96 million), and other regions (SGD 153.93 million), alongside a smaller PCB business in Singapore contributing SGD 1.79 million.

Dividend Yield: 9.7%

Multi-Chem Limited, a player in the Singapore market, offers a dividend yield higher than the average, reflecting its potential attractiveness to income-focused investors. However, its dividend history shows variability which might concern those seeking stability. Recent board changes with the addition of Chong Teck Sin as Chairman and other experienced directors could signal a strategic shift or stabilization effort. Financially, while dividends are covered by both earnings and cash flow (payout ratios of 80.7% and 88.1%, respectively), the firm's value trades significantly below estimated fair value, suggesting undervaluation or investor caution regarding future prospects.

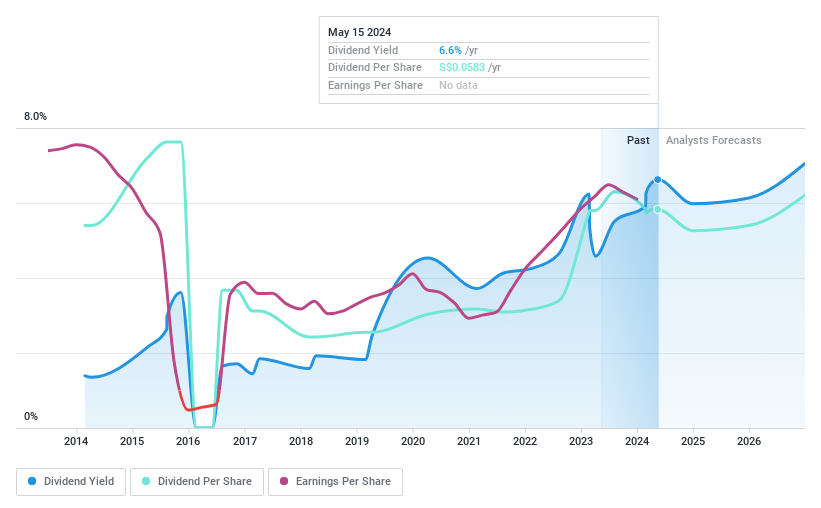

Delfi

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Delfi Limited is an investment holding company that specializes in manufacturing, marketing, distributing, and selling chocolate and chocolate confectionery products across Indonesia, the Philippines, Malaysia, Singapore, and other international markets with a market capitalization of SGD 531.71 million.

Operations: Delfi Limited generates revenue primarily through its operations in Indonesia, where it earned SGD 370.41 million, and its regional markets, contributing SGD 185.07 million.

Dividend Yield: 6.7%

Delfi Limited, while offering a competitive dividend yield of 6.7% in the top quartile for Singapore, faces challenges with dividend sustainability. The company's dividends are not well-supported by cash flows, with a high cash payout ratio of 17.77 times earnings, indicating potential risk for future payouts. Additionally, recent executive changes including the appointment of Doreswamy Nandkishore as Chairman may influence strategic direction but do not directly address underlying financial concerns regarding its dividend reliability and coverage issues highlighted by volatile payment history and inadequate free cash flow coverage.

Delve into the full analysis dividend report here for a deeper understanding of Delfi.

Our valuation report here indicates Delfi may be undervalued.

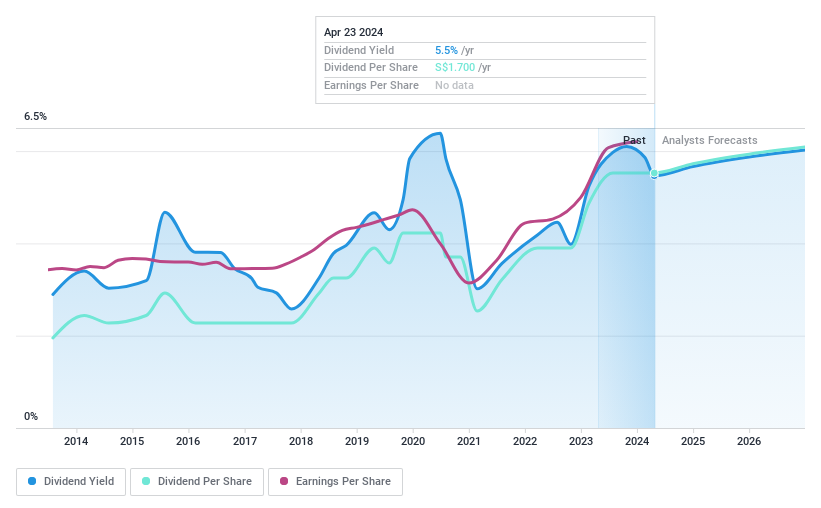

United Overseas Bank

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Overseas Bank Limited operates globally, offering a comprehensive range of banking products and services, with a market capitalization of approximately SGD 51.17 billion.

Operations: United Overseas Bank Limited generates its revenue from a diverse array of banking products and services offered globally.

Dividend Yield: 5.6%

United Overseas Bank's dividend yield of 5.56% trails behind the top quartile in Singapore, where yields average 6.17%. Despite this, its dividends are sustainably covered by earnings with a payout ratio of 50.8%, and forecasts suggest continued coverage at 49.3% in three years. However, UOB has demonstrated unstable dividend reliability over the past decade, marked by volatility and inconsistent growth patterns in payouts. Recent strategic moves include a share repurchase program initiated on May 8, signaling potential confidence from management in the bank’s valuation and future prospects.

Make It Happen

Take a closer look at our Top SGX Dividend Stocks list of 19 companies by clicking here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:AWZSGX:P34SGX:U11

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance