Some Shareholders Feeling Restless Over Allreal Holding AG's (VTX:ALLN) P/E Ratio

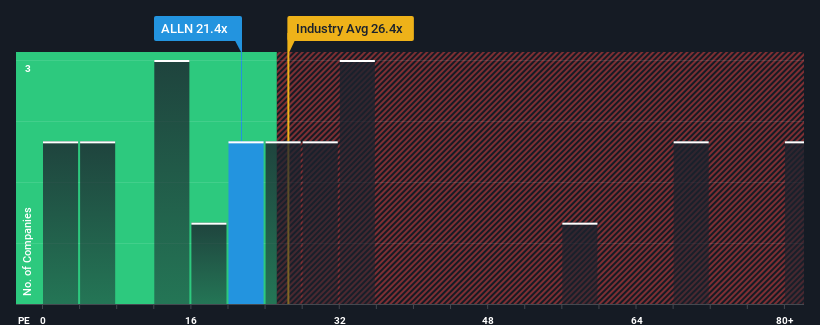

With a price-to-earnings (or "P/E") ratio of 21.4x Allreal Holding AG (VTX:ALLN) may be sending bearish signals at the moment, given that almost half of all companies in Switzerland have P/E ratios under 18x and even P/E's lower than 12x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

While the market has experienced earnings growth lately, Allreal Holding's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for Allreal Holding

Keen to find out how analysts think Allreal Holding's future stacks up against the industry? In that case, our free report is a great place to start.

Is There Enough Growth For Allreal Holding?

In order to justify its P/E ratio, Allreal Holding would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered a frustrating 25% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 53% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 0.9% each year as estimated by the dual analysts watching the company. With the market predicted to deliver 8.7% growth each year, the company is positioned for a weaker earnings result.

With this information, we find it concerning that Allreal Holding is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Allreal Holding's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Allreal Holding's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Plus, you should also learn about these 2 warning signs we've spotted with Allreal Holding.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance