Shareholders in Lion Group Holding (NASDAQ:LGHL) have lost 59%, as stock drops 23% this past week

The nature of investing is that you win some, and you lose some. And unfortunately for Lion Group Holding Ltd. (NASDAQ:LGHL) shareholders, the stock is a lot lower today than it was a year ago. In that relatively short period, the share price has plunged 59%. Because Lion Group Holding hasn't been listed for many years, the market is still learning about how the business performs. Furthermore, it's down 27% in about a quarter. That's not much fun for holders.

With the stock having lost 23% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Lion Group Holding

Because Lion Group Holding made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In just one year Lion Group Holding saw its revenue fall by 44%. That looks pretty grim, at a glance. In the absence of profits, it's not unreasonable that the share price fell 59%. Fingers crossed this is the low ebb for the stock. We don't generally like to own companies with falling revenues and no profits, so we're pretty cautious of this one, at the moment.

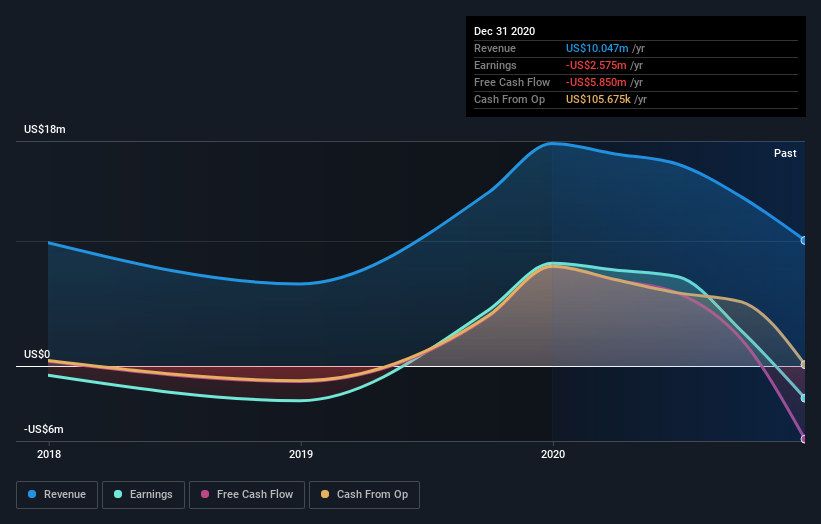

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While Lion Group Holding shareholders are down 59% for the year, the market itself is up 33%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. With the stock down 27% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 4 warning signs for Lion Group Holding you should be aware of, and 2 of them are a bit concerning.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance