Would Shareholders Who Purchased Hostelworld Group's (LON:HSW) Stock Three Years Be Happy With The Share price Today?

Hostelworld Group plc (LON:HSW) shareholders will doubtless be very grateful to see the share price up 47% in the last quarter. But only the myopic could ignore the astounding decline over three years. To wit, the share price sky-dived 79% in that time. Arguably, the recent bounce is to be expected after such a bad drop. But the more important question is whether the underlying business can justify a higher price still.

Check out our latest analysis for Hostelworld Group

Hostelworld Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years, Hostelworld Group's revenue dropped 9.6% per year. That's not what investors generally want to see. The share price fall of 21% (per year, over three years) is a stern reminder that money-losing companies are expected to grow revenue. We're generally averse to companies with declining revenues, but we're not alone in that. Don't let a share price decline ruin your calm. You make better decisions when you're calm.

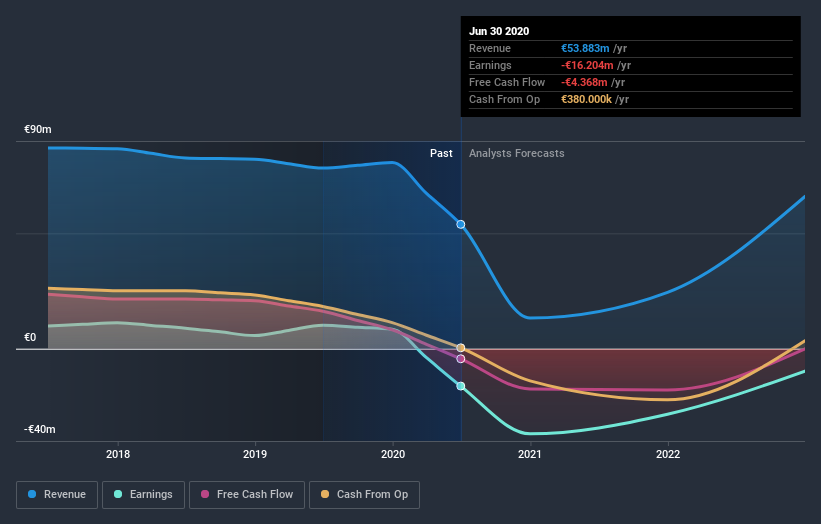

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. If you are thinking of buying or selling Hostelworld Group stock, you should check out this free report showing analyst profit forecasts.

What about the Total Shareholder Return (TSR)?

We've already covered Hostelworld Group's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Hostelworld Group's TSR of was a loss of 77% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

We regret to report that Hostelworld Group shareholders are down 49% for the year. Unfortunately, that's worse than the broader market decline of 4.7%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Hostelworld Group is showing 2 warning signs in our investment analysis , you should know about...

Hostelworld Group is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance