Shareholders in Sol-Gel Technologies (NASDAQ:SLGL) have lost 23%, as stock drops 12% this past week

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Unfortunately the Sol-Gel Technologies Ltd. (NASDAQ:SLGL) share price slid 23% over twelve months. That contrasts poorly with the market return of 25%. On the other hand, the stock is actually up 1.9% over three years. In the last ninety days we've seen the share price slide 30%. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

With the stock having lost 12% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for Sol-Gel Technologies

Sol-Gel Technologies wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last twelve months, Sol-Gel Technologies increased its revenue by 17%. We think that is pretty nice growth. Unfortunately that wasn't good enough to stop the share price dropping 23%. You might even wonder if the share price was previously over-hyped. But if revenue keeps growing, then at a certain point the share price would likely follow.

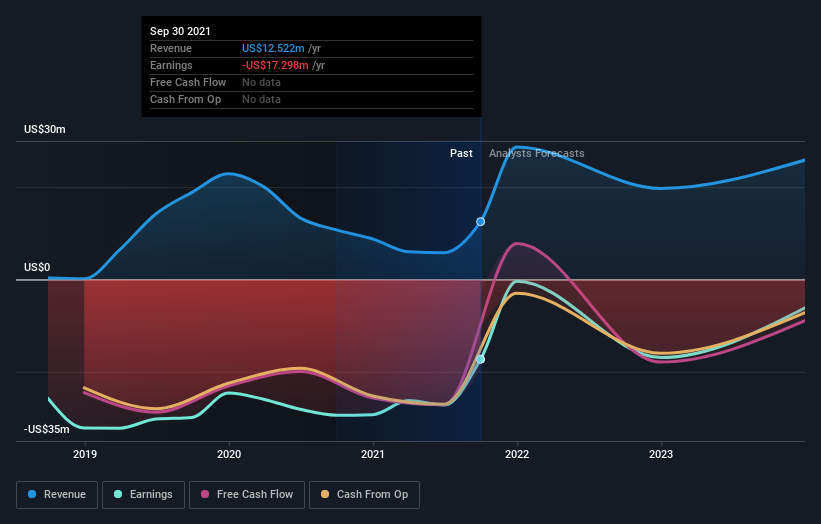

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free report showing analyst forecasts should help you form a view on Sol-Gel Technologies

A Different Perspective

Sol-Gel Technologies shareholders are down 23% for the year, but the broader market is up 25%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Investors are up over three years, booking 0.6% per year, much better than the more recent returns. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. It's always interesting to track share price performance over the longer term. But to understand Sol-Gel Technologies better, we need to consider many other factors. To that end, you should be aware of the 2 warning signs we've spotted with Sol-Gel Technologies .

Of course Sol-Gel Technologies may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance