Shoe Carnival (SCVL) Q1 Earnings Beat Estimates, Sales Up Y/Y

Shoe Carnival, Inc. SCVL reported first-quarter fiscal 2024 results, wherein both the top and bottom lines surpassed the Zacks Consensus Estimate. Also, both metrics improved year over year.

The company witnessed robust performance, registering double-digit revenue growth in the sandal category. Additionally, it achieved gross margin expansion, improved cost management and demonstrated strong pricing power. The company's performance positions it well to continue enhancing shareholder value and achieving its vision of becoming the nation's leading family footwear retailer.

Q1 Details

The Zacks Rank #3 (Hold) company reported adjusted earnings per share of 64 cents, which beat the Zacks Consensus Estimate of 60 cents. Also, the bottom line improved from adjusted earnings of 60 cents per share reported in the year-ago quarter.

Net sales amounted to $300.4 million, up 6.8% year over year. Also, the top line surpassed the consensus estimate of $292 million. The increase in revenues was primarily driven by sales from the February 2024 acquisition of Rogan Shoes, Incorporated (“Rogan’s”), ongoing growth in Shoe Station and e-commerce, and improving trends in Shoe Carnival.

Comparable store sales declined 3.4% year over year. However, comparable store sales trends showed significant improvement as the quarter progressed.

Adjusted gross profit increased 8.6% year over year to $106.9 million. The gross margin of 35.6% expanded 60 basis points (bps) year over year. This increase was driven by higher merchandise margins and leverage in buying, distribution, and occupancy due to increased sales.

Adjusted selling, general and administrative expenses increased 8% year over year to $83.9 million. As a percentage of net sales, selling, general and administrative expenses expanded 40 bps year over year to 28%, primarily driven by expenses related to Rogan’s and increased marketing investments.

Shoe Carnival, Inc. Price, Consensus and EPS Surprise

Shoe Carnival, Inc. price-consensus-eps-surprise-chart | Shoe Carnival, Inc. Quote

Store Update

As of May 4, 2024, the company reached a milestone of 430 stores, consisting of 371 Shoe Carnival, 31 Shoe Station stores and 28 Rogan’s locations acquired in February 2024.

Continuing its commitment to modernization, SCVL is engaged in a multi-year remodel program. As of May 4, more than 60 percent of the Shoe Carnival store modernization was completed, with plans to continue modernizing additional stores throughout fiscal 2024. The company anticipates total capital expenditures to remain in the band of $25-$35 million in fiscal 2024 as the store modernization program nears completion.

Looking ahead, Shoe Carnival has set ambitious goals, aiming to surpass 500 stores and become a multi-billion-dollar retailer by fiscal 2028. This vision includes plans for organic growth and strategic M&A activities.

Other Financial Aspects

The company ended the quarter with cash and cash equivalents of $57 million, a long-term portion of operating lease liabilities of $313.3 million and total shareholder’s equity of $597.8 million.

As of May 23, 2024, the company had $50 million available for future share repurchases. SCVL did not engage in any share repurchase activity during the quarter.

Outlook

Following the first-quarter results, the company has reaffirmed its fiscal 2024 outlook. Management expects net sales growth in the range of 4-6% compared with fiscal 2023. The company anticipates GAAP earnings per share (EPS) to fall within the range of $2.50- $2.70 and adjusted EPS to be between $2.55 and $2.75.

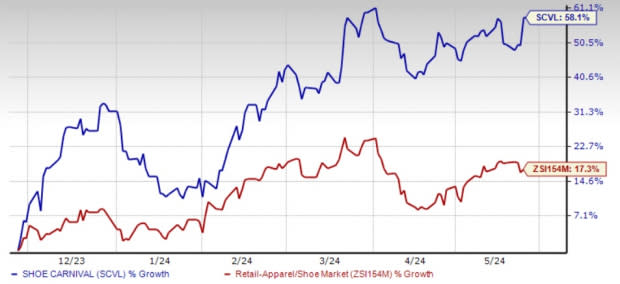

The stock has outperformed the industry in the past six months. Shares of the company have gained 58.1% as compared to the industry’s growth of 17.3%.

Image Source: Zacks Investment Research

Key Picks

We have highlighted three better-ranked stocks, namely, The Gap, Inc. GPS, Abercrombie & Fitch Co. ANF and DICK'S Sporting Goods, Inc. DKS.

Gap, a leading apparel retailer, currently sports a Zacks Rank #1 (Strong Buy). GPS has a trailing four-quarter earnings surprise of 180.9%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for GPS’ current financial-year sales and earnings suggests declines of 0.3% and 3.5%, respectively, from the year-ago reported figures.

Abercrombie & Fitch, a specialty retailer of premium, high-quality casual apparel, currently carries a Zacks Rank #2 (Buy). ANF has a trailing four-quarter average earnings surprise of 715.6%.

The consensus estimate for Abercrombie & Fitch’s current fiscal-year sales and earnings indicates growth of 6.3% and 22.5%, respectively, from the prior-year levels.

DICK'S Sporting Goods operates as an omnichannel sporting goods retailer. It currently carries a Zacks Rank of 2. DKS has a trailing four-quarter earnings surprise of 3.1%, on average.

The Zacks Consensus Estimate for DICK'S Sporting’s current fiscal-year sales and earnings suggests growth of 1.3% and 2.8%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report

DICK'S Sporting Goods, Inc. (DKS) : Free Stock Analysis Report

Shoe Carnival, Inc. (SCVL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance