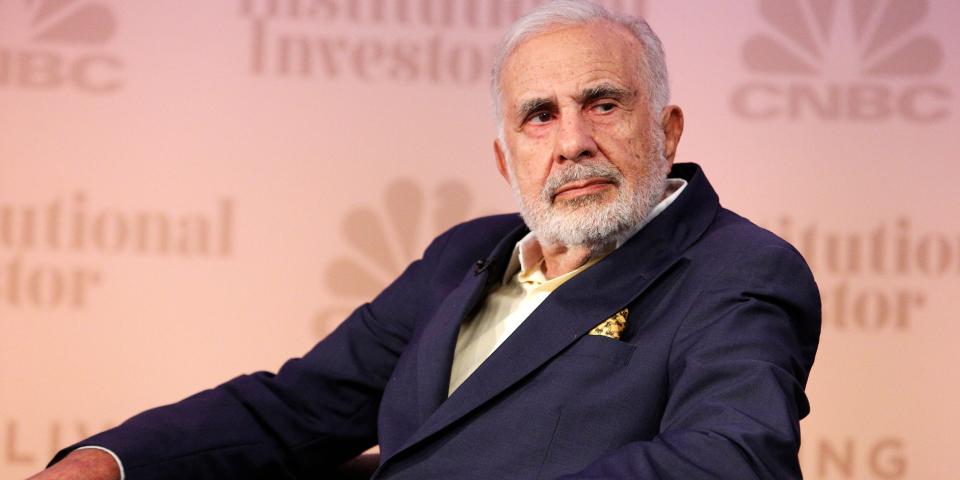

Short sellers haven't profited a lot from Hindenburg Research's salvo against Carl Icahn's investment firm

Short sellers haven't profited significantly from Hindenburg Research's recent report against Icahn Enterprises.

That's because Wall Street investors remain hesitant to place bets against the billionaire owner Carl Icahn, Bloomberg reported.

Short sellers have made just $9 million in mark-to-market profit, per S3 Partners data.

Short sellers haven't profited a lot from Hindenburg Research's scathing report on Carl Icahn's investment firm, because big Wall Street investors are hesitant to wager against the billionaire activist investor, according to a report by Bloomberg.

Icahn Enterprises' shares have slid 35% since Hindenburg released its report, erasing over $6 billion in market value in just a few days. Still, those who shorted the stock are only seeing marginal benefits – $9 million in mark-to-market profit, according to financial data firm S3 Partners.

That's because the American conglomerate is one of the least shorted stocks among companies with market capitalization greater than $1 billion, Bloomberg reported, citing data from S3.

Carl Icahn's personal wealth – which is derived from an 89% stake in Icahn Enterprises – has plunged as much as $10 billion following the report, which claimed that the Wall Street legend's holding company used inflated asset valuations, further alleging "Ponzi-like" economic structures at the firm.

Hindenburg also alleged that the company is "using money taken in from new investors to pay out dividends to old investors." But Icahn Enterprises responded to the allegations on the same day by calling the report "self-serving" and "intended solely to generate profits on Hindenburg's short position at the expense of IEP's long-term unitholders."

Icahn is the third public figure to be targeted by Hindenburg in 2023. The short seller's report on Gautam Adani's company shaved tens of billions off of its market cap and dealt a huge blow to the billionaire's net worth.

Months later, Hindenburg followed up with a report on payments company Block — co-founded by Twitter founder Jack Dorsey — stating that the company misled investors "with inflated metrics" and facilitated fraud. Dorsey's net worth tumbled by $526 million in a single day following the report.

Read the original article on Business Insider

Yahoo Finance

Yahoo Finance