Silver Set to Gain as Market Heads for a Deficit: 4 Stocks to Buy

Silver has seen a solid performance year to date, gaining 23.1% and outpacing gold’s 12% climb, making it one of the year’s best-performing major commodities. The metal even broke above the $30 level and notched an 11-year high of $32.57 on May 20. The rally has been fueled by geopolitical uncertainties and increasing bets of U.S. interest rate cuts. Global industrial demand for silver is expected to reach a record high in 2024, mainly driven by photovoltaics, while supply is expected to dip 1%. This suggests that the silver market is headed for a fourth consecutive year of deficit, which is likely to lead to further price appreciation.

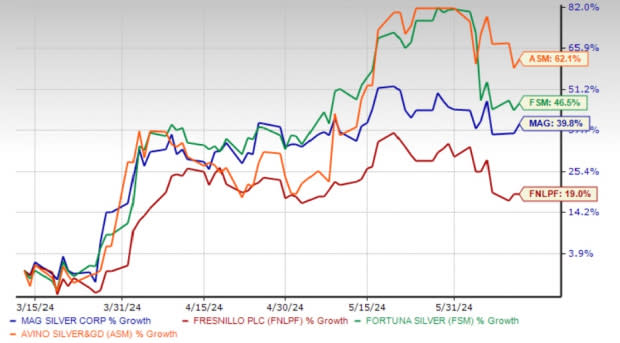

The Zacks Mining - Silver industry has gained 19.6% year to date against the S&P 500’s growth of 7%. Meanwhile, the broader Basic Materials sector has declined 3.7%. We recommend keeping tabs on top-ranked silver mining companies like Fresnillo FNLPF, Fortuna Silver Mines FSM, MAG Silver MAG and Avino Silver & Gold Mines ASM that are expected to benefit from these favorable trends.

Image Source: Zacks Investment Research

Industrial Demand Poised to Witness Record High in 2024

Per the Silver Institute, total industrial demand for silver in 2024 is expected to surpass last year’s record of 654.4 million ounces and rise 9% year over year to 710.9 million ounces. Notably, industrial applications account for more than 50% of the total silver demand.

Last year, higher-than-expected photovoltaic demand (up 64% year over year) and the faster adoption of new-generation solar cells boosted global electrical and electronics demand by 20%. Other green applications, including power grid construction and automotive electrification, contributed to the improvement. Riding on the same trends, the demand for electrical and electronics is expected to rise 9% in 2024, fueled by 20% growth in photovoltaics.

Demand in jewelry is expected to rise 4% year over year to 211.3 million ounces in 2024 and silverware demand is likely to be up 7% to 58.8 million ounces. Both are expected to gain from higher discretionary spending and recover from the declines seen last year. These upbeat projections will help offset an anticipated 13% decline in investment demand in 2024. The Institute, thus, projects total demand for the metal to grow 2% year over year to 1,219 million ounces, indicating a recovery from the 7% decline in 2023.

Also, per reports, India’s silver imports in January-April 2024 of 4,172 tons exceeded the total imports of 3,625 tons in 2023. This is attributed to rising demand from the solar panel industry and investment demand. Increased demand from the world’s biggest silver consumer could boost silver prices.

On the supply side, mine production is expected to dip 0.8% year over year in 2024, as increased output from Mexico and the United States is expected to be negated by declines in Peru and China.

This sets the stage for a market deficit of 215.3 million ounces in 2024 — the second-largest in more than 20 years. This will likely mark the fourth consecutive year of a deficit, which bodes well for silver prices.

4 Silver Stocks to Bet on

Avino Silver: In the first quarter of 2024, ASM’s consolidation production was 6.3 million silver-equivalent ounces, a 13% sequential increase. With this performance, the company is on track to achieve its targeted full-year production of 2.5-2.8 million silver-equivalent ounces. In January 2024, ASM signed a long-term land-use agreement with a local community for the development of La Preciosa in Durango, Mexico, which is one of the largest undeveloped primary silver resources in the country. The addition of La Preciosa's mineral resource inventory significantly enhanced Avino Silver’s consolidated NI 43-101 mineral resources, which currently comprise 371 million silver-equivalent ounces. Also, it completed a Pre-Feasibility Study for its Oxide Tailings Project at the Avino Mine Operations. The study highlighted proven and probable mineral reserves of 6.7 million tons at a silver and gold grade of 55 g/t and 0.47 g/t, respectively, a first in the company’s 57-year history. This project is expected to play a significant role in ASM’s target to become an intermediate silver producer in Mexico.

The Zacks Consensus Estimate for this Vancouver, Canada-based company’s 2024 earnings has moved up 33% over the past 60 days. ASM currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

Fresnillo: FNLPF reported attributable silver production of 13.5 million ounces in the first quarter of 2024, up 2.7% year over year, aided by increased contribution from Juanicipio, the higher ore grade at San Julián Veins and increased volume of ore processed at Saucito. The company expects attributable silver production of 55-62 million ounces in 2024. Silver-equivalent ounces are expected to be 101-112 million. The new Juanicipio project has now been fully ramped up, and is expected to boost the company’s silver production and lower consolidated group costs. Fresnillo is investing in a number of projects to increase production and ensure steady growth in the future years. The company’s focus on improving operational performance and efficiency is expected to reduce costs. Its high-quality assets, ample mineral resources, competitive margins and disciplined approach to development will continue to drive growth.

The Zacks Consensus Estimate for this Mexico-based company’s current-year earnings has shot up 700% in 60 days. The estimate suggests year-over-year growth of 54.8%. FNLPF carries a Zacks Rank #2 (Buy) at present.

Fortuna Silver: In the first quarter of 2024, the company achieved gold-equivalent production of 112,543 ounces, marking a 20% increase from the year-ago quarter. The improvement was mainly attributed to the contribution of Séguéla. FSM expects to produce gold of 343-385 thousand ounces in 2024, and a silver production of 4-4.7 million ounces. Gold-equivalent ounces are expected to be 457,000-497,000. Capital allocation priorities for 2024 aim to enhance balance sheet flexibility through debt reduction and funding aggressive organic growth programs, with a focus on the Diamba Sud project and the Séguéla Mine. The company's strategy focuses on maximizing production, while maintaining operational efficiencies to lower cash costs. Its disciplined approach to seeking new deposits or pursuing mergers and acquisitions will drive growth.

The Zacks Consensus Estimate for Fortuna Silver's 2024 is pegged at earnings of 8 cents against the loss of 12 cents mentioned 60 days ago. The estimate indicates year-over-year growth of 68.2%. The company has a trailing four-quarter earnings surprise of 85%, on average. FSM currently carries a Zacks Rank of 2.

MAG Silver: MAG’s principal asset is the high-margin underground silver project Juanicipio in Zacatecas, Mexico. In the project, it has a 44% interest, with the remaining 56% held by Fresnillo Plc. The Juanicipio project achieved commercial production on Jun 1, 2023, which was a milestone for MAG as it marked its transition from a developer to a producer. In the first quarter of 2024, Juanicipio achieved silver production and silver-equivalent production of 4.5 million ounces and 6.4 million ounces, respectively. MAG Silver expects Juanicipio to produce 14.3-15.8 million silver ounces in 2024, thus yielding between 13.2 million and 14.6 million payable silver ounces. An expanded exploration program is in place for Juanicipio to look for multiple highly prospective targets. MAG is also executing multi-phase exploration programs at the 100% earn-in Deer Trail Project in Utah and the 100% owned Larder Project, located in the historically prolific Abitibi region of Canada.

The Zacks Consensus Estimate for this Vancouver, Canada-based company’s 2024 earnings indicates 21.3% growth from the year-ago reported figure. The estimate has moved north by 21% over the past 60 days. MAG has a trailing four-quarter earnings surprise of 6.1%, on average. The company presently carries a Zacks Rank of 2.

Image Source: Zacks Investment Research

The chart above shows the price performances of our four picks in the past three months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fortuna Silver Mines Inc. (FSM) : Free Stock Analysis Report

Fresnillo PLC (FNLPF) : Free Stock Analysis Report

Avino Silver (ASM) : Free Stock Analysis Report

MAG Silver Corporation (MAG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance