Singapore E-Commerce Giant Sea Is Up After Topping Estimates

(Bloomberg) -- Shares of Sea Ltd. jumped after the Southeast Asia e-commerce giant reported first-quarter earnings that exceeded analysts’ estimates, a sign that it has been successfully navigating fierce competition from the likes of ByteDance Ltd.’s TikTok.

Most Read from Bloomberg

China Attempts to End Property Crisis With Broad Rescue Package

With a BlackRock CEO, $9 Trillion Vanguard Braces for Turbulence

US Inflation Data Was Accidentally Released 30 Minutes Early

Voters Prefer Trump Over Biden on Economy. This Data Shows Why

The stock rose 3.7% after the market opened in New York on Tuesday. The Singapore-based internet firm posted adjusted earnings before interest, taxes, depreciation and amortization of $401 million. While that’s a 21% decline from a year earlier, it topped the $222 million analysts expected on average. Sales also beat estimates, and the net loss of $23.7 million was narrower than analysts predicted.

Sea is fighting to maintain its dominance in Southeast Asia’s e-commerce arena as competition from deep-pocketed rivals such as TikTok and Alibaba Group Holding Ltd.’s Lazada heats up. Newer entrants like Shein and PDD Holdings Inc.’s Temu are also gaining users in the region of about 675 million people, where more shoppers are moving online.

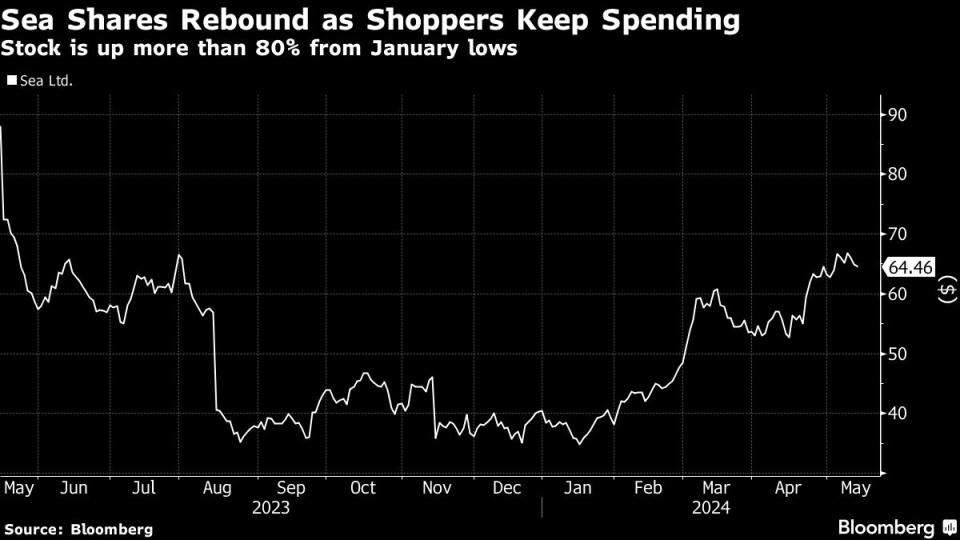

The results are set to give confidence to investors focused on assessing if Sea can sustain double-digit growth rates while improving its bottom line. Its shares have advanced more than 80% from a mid-January low and are hovering close to their highest in 12 months. Yet they remain far below historic highs.

Read more: Sea’s 90% Stock Rally Sets Bar High for Earnings to Impress

The earnings beat comes even as Sea spends on marketing to ward off rivals, and on research and development to add live-streaming and artificial intelligence features. E-commerce gross merchandise volume, or the value of goods sold, rose 36% to $23.6 billion, topping estimates. Revenue for the group climbed 23% to $3.7 billion.

The company’s gaming arm Garena, known for its hit Free Fire, increased adjusted Ebitda by 27% to $292 million as it gained paying users and lowered costs. The division, which has struggled to come up with new titles to boost sales, reported a 15% decline in revenue to $458 million.

What Bloomberg Intelligence Says

Marketing costs will likely stay elevated, but adjusted Ebitda should still grow as Shopee’s dominance in Southeast Asian e-commerce and a dense user ecosystem lure more merchants into high-margin services such as advertising. This scale advantage might be its strongest defense against the encroachment of TikTok, IPO-bound Shein and PDD Holdings’ Temu in e-commerce in the region.

— Nathan Naidu, analyst

Click here for research

Sea said it’s on track to reach its target of a second straight annual profit this year. The profitability improvements have been driven by a ruthless cost-cutting drive, including thousands of job cuts, which helped it post its first annual net income since a 2017 listing. Still, founder Forrest Li has said Sea would ramp up efforts to build out its live-streaming arm, which would potentially help it cope with rising competition but pit it against TikTok and weigh on margins.

“We have a clear roadmap to profitable growth for the year,” Li said in a memo to employees on Tuesday. “This strong first quarter gives us a good head start to it.”

(Adds share price in the second paragraph.)

Most Read from Bloomberg Businessweek

Walgreens and CVS Are Trying to Fix America’s Flailing Pharmacies

How the ‘Harvard of Trading’ Ruined Thousands of Young People’s Lives

Milei Targets Labor Law That’s Set to Hand Banker $10 Million Severance

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance