Single-use Bioprocessing Market Report 2022: Several Advantages Associated With the Implementation Of Single Use Technology In the Bio-Manufacturing Process Drives Growth

Global Single-use Bioprocessing Market

Dublin, Feb. 27, 2023 (GLOBE NEWSWIRE) -- The "Single-use Bioprocessing Market Size, Share & Trends Analysis Report by Product (Work Equipment, Apparatus & Plants), by Workflow (Upstream, Downstream), by End-use, by Region, and Segment Forecasts, 2022-2030" report has been added to ResearchAndMarkets.com's offering.

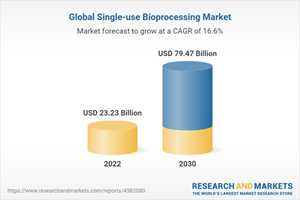

The global single-use bioprocessing market size is projected to reach USD 79.47 billion by 2030, registering a compound annual growth rate (CAGR) of 16.6% over the forecast period. The demand for single-use bioprocessing offerings is driven by the commercial advantages offered, including a reduction in costs and time required for bioprocessing operations.

Originally used for monoclonal antibody production, single-use technologies are also gaining traction for cell and gene therapy manufacturing. As a result, broadening the scope of applications in biomanufacturing operations is likely to drive industry growth.

Furthermore, strategic initiatives from key players are expanding the industry's growth prospects. For instance, in July 2021, Cytiva and Pall Corp. announced investment plans for capacity expansion over two years. Among other key products, more than USD 300 million were invested in single-use technologies, such as bioreactor bags for cell expansion, used to make personalized therapies and syringe filters for scientific research.

Similarly, the growing adoption of single-use equipment for in-house and contract manufacturing has opened new avenues for the flow of investments in this space. The industry is witnessing significant advancements in several product portfolios, including disposable probes and sensors, stirring systems, bioreactor designs, and filtration technologies, which are expected to contribute to strong revenue growth.

The benefits offered by single-use bioprocessing systems have enabled biopharmaceutical manufacturers to offer their products faster to the market by introducing multi-product facilities, entering into partnerships, or outsourcing pipeline products for contract development and manufacturing. For instance, in January 2021, Sartorius AG partnered with RoosterBio, a leading supplier of human Mesenchymal Stem/Stromal Cells (hMSC). This collaboration aimed at advancing cell & gene therapy manufacturing by leveraging the single-use manufacturing technologies from Sartorius AG. The COVID-19 pandemic has generated new growth opportunities for key stakeholders in the industry.

Key biopharmaceutical players can leverage the opportunity by expanding their COVID-19-related product offerings by scaling up their production facilities with the implementation of single-use bioprocessing equipment. A significant number of biopharmaceutical companies are actively involved in the development and production of COVID-19 vaccines. These programs are majorly based on single-use technologies as these systems are flexible, cost-effective, and reduce the risk of cross-contamination. Such an ongoing and continuous increase in the adoption of bioprocessing systems due to the COVID-19 pandemic is anticipated to drive industry growth.

Market Dynamics

Market Drivers

Several Advantages Associated With the Implementation Of Single Use Technology In the Bio-Manufacturing Process

Increasing Investments In Expansion Of cGMP Manufacturing

Widespread Adoption Of Single Use Technology By Cmos

Market Restraints

Concerns Due To Leachable And Extractable

Limited Adoption Of Single Use Technology In Downstream Process

Market Challenges

Delay In The Delivery Speed And Supply Chain Of Customized Products

Restraints With Scalability Of Single-Use Operations

Vast Availability Of Multi-Use Systems

Market Opportunities

Developing Technologies For Downstream Adoption

CMO-Outsourcing To Focus On The New Product Development

Single-use Bioprocessing Market Report Highlights

The simple & peripheral elements segment held the largest share in 2021 due to the significant adoption of these products as a result of a variety of customizable options available for bioprocessing applications

The upstream bioprocessing workflow segment accounted for the largest share in 2021. Continuous developments and betterment in technologies for upstream bioprocessing are driving the segment growth

North America was the leading region in 2021 due to the high R&D spending and growth of the biopharmaceutical manufacturing sector in the region

Furthermore, the presence of key players, such as Thermo Fisher Scientific, Inc. and Danaher Corp., is driving the regional market

The biopharmaceutical manufacturers end-use segment dominated the industry in 2021 and accounted for the maximum revenue share. This was due to the high demand for biologics and heavy investments in cell & gene therapy manufacturing

Report Attribute | Details |

No. of Pages | 225 |

Forecast Period | 2022 - 2030 |

Estimated Market Value (USD) in 2022 | $23.23 Billion |

Forecasted Market Value (USD) by 2030 | $79.47 Billion |

Compound Annual Growth Rate | 16.6% |

Regions Covered | Global |

Key Topics Covered:

Chapter 1 Methodology and Scope

Chapter 2 Executive Summary

Chapter 3 Market Variables, Trends, & Scope

Chapter 4 Product Business Analysis

4.1 Single Use Bioprocessing Market-Product Movement Analysis

4.2 Simple And Peripheral Elements

4.3 Apparatus And Plants

4.4 Work Equipment

Chapter 5 Workflow Business Analysis

5.1 Single Use Bioprocessing Market-Workflow Movement Analysis

5.2 Upstream Bioprocessing

5.3 Fermentation

5.4 Downstream Bioprocessing

Chapter 6 End-Use Business Analysis

6.1 Single Use Bioprocessing Market-End-Use Movement Analysis

6.2 Biopharmaceutical Manufacturers

6.3 Academic And Clinical Research Institutes

Chapter 7 Regional Business Analysis

Chapter 8 Competitive Landscape

Companies Mentioned

Sartorius AG

Danaher Corporation

Thermo Fisher Scientific, Inc.

Merck Kgaa

Avantor, Inc.

Eppendorf Se

Corning Incorporated

Boehringer Ingelheim International GmbH

Lonza

Infors AG

Pbs Biotech, Inc.

Entegris, Inc.

Kuhner AG

Meissner Filtration Products, Inc.

Rentschler Biopharma Se

For more information about this report visit https://www.researchandmarkets.com/r/99aolb-use?w=12

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance