SmileDirectClub (SDC) Gains From Innovation Amid Macro Issues

SmileDirectClub’s SDC robust product line, growth across the teledentistry space, and strategic retail and insurance partnerships bolster our confidence in the stock. Yet, ongoing operating loss, leveraged balance sheet and tough competitive landscape remain overhangs. The stock currently carries a Zacks Rank #3 (Hold).

SmileDirectClub exited the third quarter of 2022 with better-than-expected earnings and revenues. While the third-quarter revenues were impacted by continued macro headwinds affecting SmileDirectClub’s customers, the company’s restructuring plan (implemented in January) drove meaningful improvements in its cost structure and free cash flow.

Despite a $31 million year-over-year decline in revenues from the third quarter of 2021, EBITDA improved by $24 million and free cash flow rose by $29 million in the reported quarter.

A series of cutting-edge innovations, strategic distribution and insurance partnerships are added positives. The company’s continued investments to influence consumer decision-making and penetrate new demographics also seem strategic.

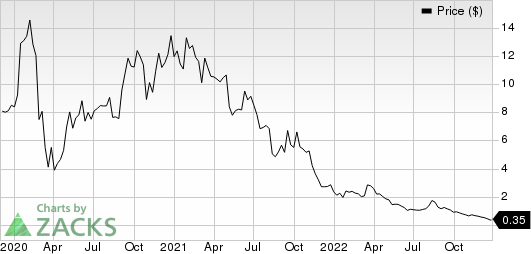

SmileDirectClub, Inc. Price

SmileDirectClub, Inc. price | SmileDirectClub, Inc. Quote

SmileDirectClub is focused on developing products to further differentiate its offerings in the oral care industry. In November 2022, the company announced the launch of its SmileMaker Platform. This technology is an industry first, upgrading current 2D remote scanning options and introducing real-time AI to capture a 3D view of the teeth.

In October 2022, the company announced the expansion of its premium oral care product line, with the launch of its innovative new Space Saver Countertop Water Flosser. In September 2022, the company announced the complete transition of its second-generation retainer manufacturing technology in its FDA-registered Smile Labs, based in Antioch, TN. In May 2022, the company announced the expansion of its best-in-class oral care product offerings with its new Wireless Premium Teeth Whitening Kit. In February 2022, it expanded its award-winning oral care product offerings with the new Stain Barrier.

In terms of the retail partnership, SmileDirectClub’s oral care products are now available at more than 12,500 retail stores nationwide, including Walmart, CVS, Walgreens, and Sam's Club. These partnerships are aimed at serving a highly efficient lead source and offering a brand-building opportunity.

In September 2022, the company announced its association with the Dental Trade Alliance, thus joining dozens of the most elite suppliers and service providers in the oral health industry. SmileDirectClub will be the organization’s only member that offers clear aligners exclusively.

On the flip side, SDC registered a year-over-year revenue decline in the third quarter due to lower unique aligner shipments. The company also witnessed a drop in its net and financing revenues on a year-over-year basis. Per the company, the worsening of the macroeconomic conditions and increasing inflation have been particularly difficult for its core customers.

SmileDirectClub shipped approximately 52,000 initial aligners in the third quarter, down 16% sequentially. The contraction of gross margin does not bode well. Escalating operating costs are exerting pressure on the bottom line.

According to the company, challenges to consumer spending and sustained high inflation continue to impact its overall expected demand for the rest of the year.

SmileDirectClub’s third-quarter marketing and selling expenses contracted 39.5%. General and administrative expenses were down 11.9% year over year. The company incurred an adjusted operating loss of $58.9 million in the quarter, narrower than the year-ago adjusted operating loss of $83.6 million.

Over the past year, shares of SmileDirectClub have underperformed the broader industry. The stock has declined 86.3% compared with the industry’s 11.1% fall.

Key Picks

A few better-ranked stocks in the broader medical space that investors can consider are ShockWave Medical, Inc. SWAV, Orthofix Medical Inc. OFIX and Merit Medical System MMSI.

ShockWave Medical, sporting a Zacks Rank #2 (Buy) at present, has an estimated growth rate of 33.1% for 2023. The company’s earnings surpassed estimates in all the trailing four quarters, the average beat being 180.1%.

SWAV has outperformed its industry in the past year. It has gained 35% against the industry’s 32.6% decline in the past year.

Orthofix Medical, currently carrying a Zacks Rank #1 (Strong Buy), reported third-quarter 2022 adjusted EPS of 13 cents, which beat the Zacks Consensus Estimate by a stupendous 550%. Revenues of $114 million outpaced the consensus mark by 2.7%. OFIX has an estimated next-year growth rate of 58.9%.

Merit Medical’s earnings surpassed estimates in the trailing three quarters and missed in one, the average being 129.1%. The company, currently carrying a Zacks Rank of 2, reported third-quarter 2022 adjusted EPS of 64 cents, which beat the Zacks Consensus Estimate by 20.8%. Revenues of $287.2 million outpaced the consensus mark by 5.2%.

MMSI has an estimated long-term growth rate of 11%. The company’s earnings surpassed estimates in all the trailing four quarters, the average being 25.4%

You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ORTHOFIX MEDICAL INC. (OFIX) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report

SmileDirectClub, Inc. (SDC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance