Swiss Pick Insider Schlegel to Lead SNB as Jordan Exits

(Bloomberg) -- Swiss National Bank Vice President Martin Schlegel won promotion to the institution’s top job after the government opted against rocking the boat by appointing an outsider.

Most Read from Bloomberg

YouTuber Dr Disrespect Was Allegedly Kicked Off Twitch for Messaging Minor

Volkswagen Invests $5 Billion in EV Startup Rivian to Form Joint Venture

Bolivia’s President Arce Swears in New Army Chief After Coup Bid

The 47-year-old economist from Zurich will succeed current President Thomas Jordan on Oct. 1, officials in Bern said in a statement on Wednesday.

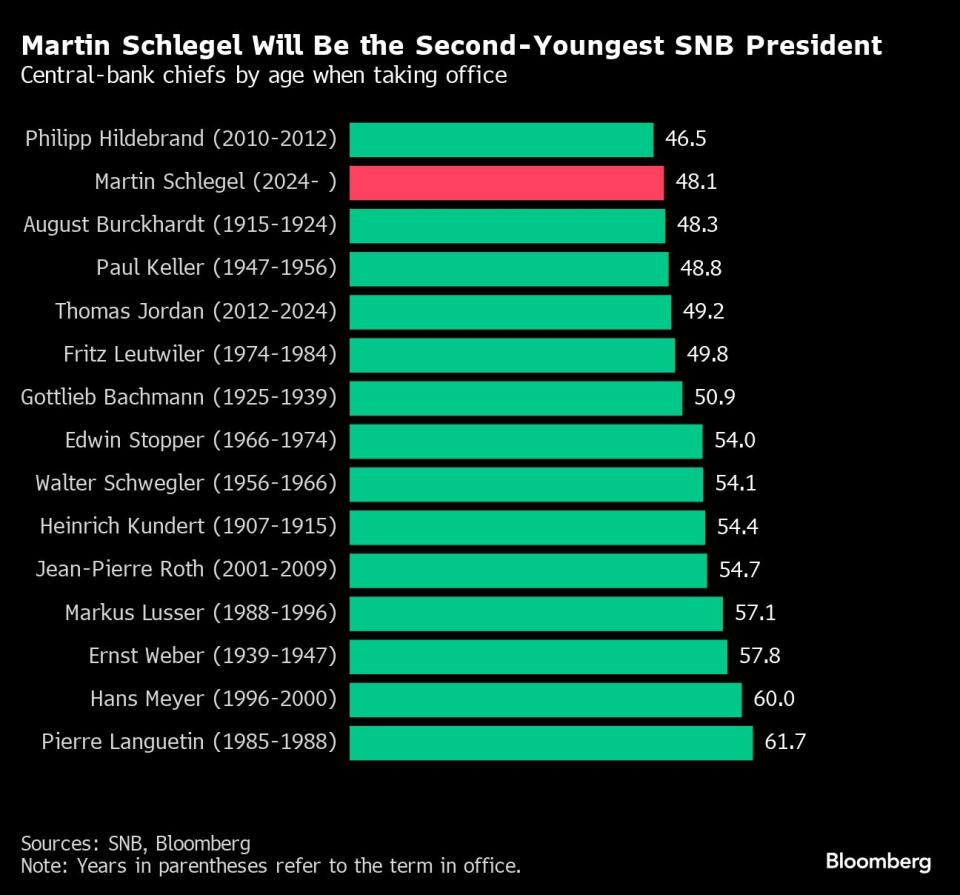

Schlegel, a 20-year veteran of the central bank, will be the second-youngest chief in the SNB’s history. The selection is no surprise, since it’s usual for the institution’s No. 2 official to get the top position. He is also widely seen as the preferred choice of Jordan himself.

The government also announced that current alternate policymaker Petra Tschudin will join the Governing Board as its third member, making her only the second female interest-rate setter in SNB history. Antoine Martin, currently the third board member, will succeed Schlegel as vice president.

The revamped board will set monetary policy in a country where officials are constantly watchful for franc strengthening — as seen recently when investors piled into the currency amid political uncertainty in France. The large size of UBS AG in relation to the economy is another vulnerability that policymakers will be conscious of.

The SNB’s approach so far has been to pare the returns of investors in the franc by cutting interest rates twice at a time when global peers are showing caution about easing.

The selections are likely to augur continuity in Swiss monetary policy. Schlegel is known to have been a long-time protege of Jordan’s, and has recently echoed statements by his boss — for example in saying the SNB must prioritize rebuilding equity over making payouts to the state.

“Little will change in terms of the SNB’s monetary policy and communication,” said Raiffeisen Switzerland economist Alexander Koch. “Schlegel is risk-averse, deliberate and rather even more cautious than Jordan.”

What Bloomberg Economics Says...

“Today’s announcement on the new SNB chief signals continuity and doesn’t change our views on the policy trajectory of a final rate cut in December. Still, an earlier cut (in September) remains possible, particularly if political uncertainty in Europe remains elevated.”

—Maeva Cousin, senior economist. For more, click here

The top post became available after Jordan announced in March that he will step down after more than 12 years of being the franc’s chief guardian.

“He led the Swiss National Bank in various difficult situations, including most recently the Covid-19 pandemic and the Credit Suisse crisis,” the government said in its statement. “Under his leadership, the SNB made a significant contribution to preventing damage to the country, the economy and the population, and to ensuring monetary stability.”

Despite widespread discontent in Switzerland about the collapse of Credit Suisse, the SNB under Jordan largely managed to dodge blame for a debacle that amounts to the only instance of a globally systemic bank failing since the 2008-2009 crisis.

That episode remains a stain on Switzerland’s whole financial bureaucracy — not least since the economy is now dominated by a single bank — but Finma, the regulator, has taken more heat.

Speaking in Bern after the appointment, Finance Minister Karin Keller-Sutter praised Schlegel’s “high professional competence, which is also renowned internationally.”

Questioned about promoting insiders, she highlighted that the government’s shortlist did in fact include external candidates, but the field “narrowed to this solution.”

Sitting next to her, Schlegel said he felt honored by the appointment — “I will accept this role with great happiness, but also with great respect.”

Raised in Zurich, Schlegel graduated from university there in 2003 and subsequently joined the SNB as an intern in the research department, which was then led by Jordan.

After earning an economics doctorate, Schlegel headed the SNB’s foreign-exchange and gold operations from 2009 to 2016. That made him responsible for executing the central bank’s surprise scrapping of the franc cap in 2015.

He later led the SNB’s branch in Singapore, became a deputy member of the Governing Board in 2018, and was appointed as vice president in charge of financial stability less than four years later — a job that Martin will now do.

Schlegel’s leapfrogging to that role meant that the No. 3 official at the time, Andrea Maechler, was effectively sidelined. She later left for the Bank for International Settlements.

“He may have described himself as an ‘intern’, but his qualifications are beyond question,” Raiffeisen’s Koch said. “He is an SNB native and knows the organization. That means he’ll have it easier than someone from the outside.”

Tschudin is currently a member of the extended SNB board and was appointed deputy head of economic affairs in 2021. She joined the SNB in 2004 in the research department, but later took leave to spend five years at the BIS and in an academic role in Dublin. In her current role, she’s involved in preparing economic calculations for rate decisions.

The SNB also announced that Rosmarie Schlup, who was already set to become a board deputy, will succeed Tschudin in Department I, which runs economics. She was previously Switzerland’s director at the European Bank for Reconstruction and Development in London.

Schlegel’s appointment follows a tradition in the central bank, which unlike many European peers is known for giving its top job to long-term officials insiders.

Out of 14 presidents the SNB has had since 1907, only three weren’t rate setters before, while all others already sat on the board. Since the 1980s, it has also always been the case that a leaving chairman was succeeded by his vice president.

--With assistance from Paula Doenecke.

(Updates with Bloomberg Economics after eighth paragraph, finance minister starting in 13th)

Most Read from Bloomberg Businessweek

How Jeff Yass Became One of the Most Influential Billionaires in the 2024 Election

Why BYD’s Wang Chuanfu Could Be China’s Version of Henry Ford

How Glossier Turned a Viral Moment for ‘You’ Perfume Into a Lasting Business

The FBI’s Star Cooperator May Have Been Running New Scams All Along

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance