SocGen’s Stock and Credit Investors Have Very Different Views

(Bloomberg) -- Societe Generale SA shares and credit default swaps are painting a very different picture of investors’ views of the bank’s future.

Most Read from Bloomberg

Wells Fargo Fires Over a Dozen for ‘Simulation of Keyboard Activity’

Apple to ‘Pay’ OpenAI for ChatGPT Through Distribution, Not Cash

Hunter Biden Was Convicted. His Dad’s Reaction Was Remarkable.

US Producer Prices Surprise With Biggest Decline Since October

Gavin Newsom Wants to Curb a Labor Law That Cost Businesses $10 Billion

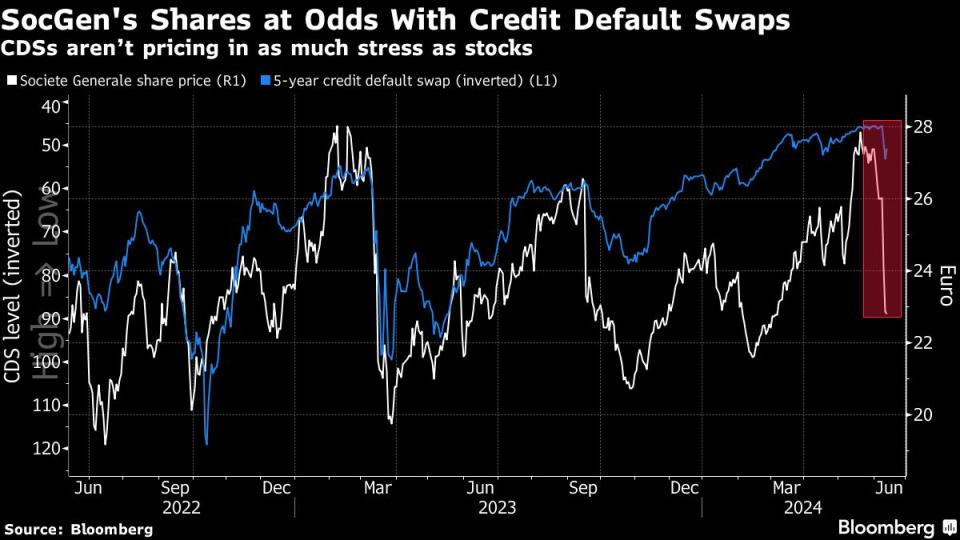

The contrast between its beaten-down shares and the relative stability of its CDSs, which are pricing in only modest risk, shows a notable inconsistency in the market, according to Paris-based Ginjer Asset Management.

CDSs, financial derivatives allowing investors to protect against corporate defaults, generally widen when corporate credit risk rises, with the size of the moves typically reflected in share prices. However, a major gap has opened up this month between SocGen’s share price and its CDSs.

“Someone’s wrong,” said Leonard Cohen, Ginjer AM’s chief executive officer and manager of the Ginjer Actifs 360 fund, which holds about €200 million ($216 million) in assets and has outperformed 93% of its peers over the past five years.

SocGen shares have plunged about 16% this month, rattled first by S&P Global’s downgrade of France’s sovereign rating and then by heightened risk following President Emmanuel Macron’s surprise decision to call a snap election. Yet CDSs widened only moderately after both events, showing nowhere near the level of stress that could be seen in the stock.

“It was a knee-jerk reaction,” Cohen said, pointing out that if France’s downgrade had indeed made a substantial dent in SocGen’s balance sheet, then this would have been priced in a similar way through swaps.

Divergence between the price of shares and CDSs can occur, but is usually short lived. For Cohen, the stock market’s reaction didn’t fit with what bond investors were pricing through derivatives at the same time, one of the reasons he remains invested in SocGen.

SocGen declined to comment on the divergence.

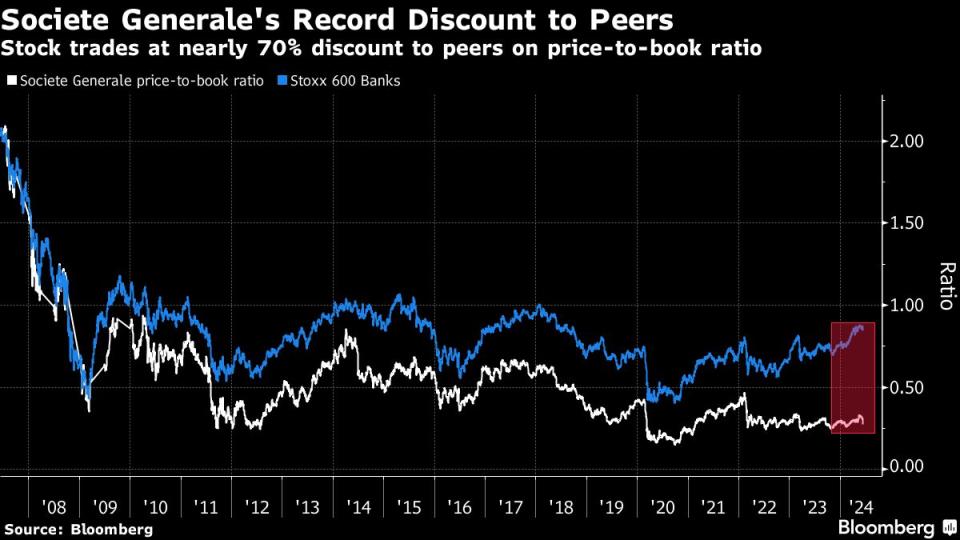

After the stock’s recent declines, SocGen is now the cheapest bank in Europe, with a price-to-book ratio of 0.28 and trading at a record discount of nearly 70% to that of the pan-European banking index. The bank has a history of trading at a steep discount to its peers, which can be traced back to a 2008 scandal around a €4.9 billion trading loss, which led to years of lawsuits and an overhaul of its internal systems.

Bloomberg Intelligence research:

Societe Generale’s loss of €14 billion (50%) in market value over 2.5 years — calculated as the shortfall vs. if its shares had matched the index — suggests deeper reforms are needed than those outlined at last year’s investor day. The bank may continue to bleed share as it prioritizes capital-light activity.

— Philip Richards, BI senior banks analyst, and Uzair Kundi, BI associate banks analyst

CEO Slawomir Krupa took over the bank in 2023 but has failed so far to narrow the discount and prop up the shares, which have slipped about 1% in the past 12 months while the sector has surged by about a third.

For Cohen, part of the discount is due to the fact that investors tend to sell SocGen indiscriminatingly at the first whiff of stress across the financial sector. His fund is therefore keeping its exposure to French banks, including SocGen, as it’s too soon to draw conclusions about how the current political uncertainty will impact SocGen’s fundamentals, Cohen added.

Cohen’s fund recently reduced its exposure to Spanish and Italian banks because of their strong performance in the past year, but has kept an equity exposure of about 30% to European banking and financial stocks.

“We’re keeping a cool head,” he said, adding that opportunities arise when market prices are driven by emotions rather than risk analysis.

Most Read from Bloomberg Businessweek

Israeli Scientists Are Shunned by Universities Over the Gaza War

Grieving Families Blame Panera’s Charged Lemonade for Leaving a Deadly Legacy

The World’s Most Online Male Gymnast Prepares for the Paris Olympics

China’s Economic Powerhouse Is Feeling the Brunt of Its Slowdown

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance