SoftBank’s Son Edges Back Into Dealmaking With a Bet on Autonomy

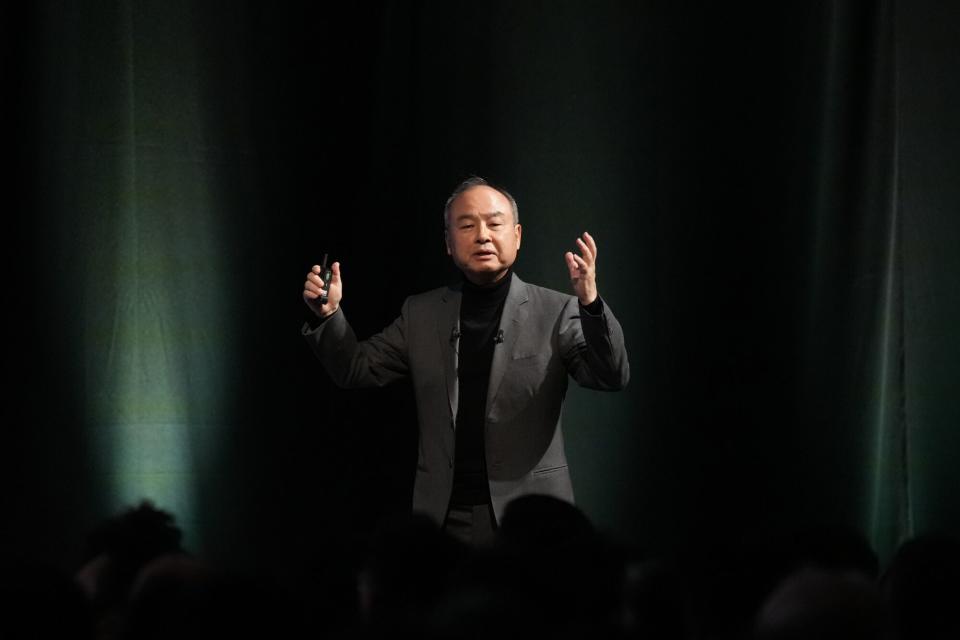

(Bloomberg) -- Masayoshi Son retreated almost completely from venture investing as his Vision Fund unit lost ¥6.9 trillion ($53 billion) in the last two years on startups like WeWork Inc., which just filed for bankruptcy. Now SoftBank Group Corp. founder is tip-toeing back into dealmaking after overhauling his strategy to make more modest, focused investments.

Most Read from Bloomberg

An Opioid-Like Drink Is Masquerading As a Wholesome Alcohol Alternative

Xi Jinping’s ‘Old Friends’ from Iowa Get a Dinner Invitation

In one prominent example, Son has made a series of bets this year on autonomous technologies that could disrupt transportation and logistics. SoftBank agreed to put more than $1 billion into Stack AV, an autonomous trucking startup, and joined a $100 million joint venture with Symbotic Inc. to develop AI-infused warehousing.

Then SoftBank injected $280 million into Mapbox Inc., a creator of AI-powered maps and navigation software. The startup, whose clients include Toyota Motor Corp. and General Motors Co., also got a starring role at SoftBank World in October — an event where Son exhorted business leaders to embrace AI or perish.

“AI-based map generation is a required ingredient for autonomy,” Peter Sirota, chief executive officer of Mapbox, said in an interview. “SoftBank has a thesis about AI, autonomy, autonomous vehicles — we are an interesting component of that overall architecture.”

The 66-year-old Son is making the latest investments directly from SoftBank, rather than from the once highly touted Vision Fund unit. SoftBank has been accumulating cash as it sells off stakes in portfolio companies, including chip designer Arm Holdings Plc.

Son has a lot riding on his latest effort. He missed out on leaders of the AI revolution such as OpenAI and Anthropic, despite investing more than $140 billion in hundreds of startups, and lost billions on the likes of WeWork and Zume Pizza Inc.

WeWork Saga Cost Masayoshi Son $11.5 Billion and His Credibility

Investors will get an idea of how his latest deals are working out when SoftBank reports financial results on Thursday. The Japanese conglomerate is projected to report net income of about ¥229 billion ($1.5 billion), according to the average estimates of four analysts surveyed by Bloomberg.

Mapbox’s latest product, MapGPT, functions like a combination of ChatGPT and navigation maps. It has an AI assistant that allows drivers to conduct web searches, purchase items and reserve places as they drive. Its voice is trained by AI to sound more natural. For large language models, Mapbox borrows technology from OpenAI, Microsoft Corp., Cohere Inc. and Anthropic depending on what clients prefer. Mapbox’s proprietary AI action model is what enables the machine to execute orders.

Mapbox’s growing client pool offers a glimpse of how Son imagines SoftBank-backed startups creating a tightly-knit web of businesses — a concept he’s touted for years without much benefit. Sirota said there’s a “big overlap” between his target customers and startups supported by SoftBank.

PayPay, Japan’s largest QR-code payment app, and search engine Yahoo Japan are both under the SoftBank umbrella and now use Mapbox. At least three other SoftBank portfolio companies are Mapbox clients, including Pittsburgh-based Stack AV, according to people familiar with the matter, who asked not to be identified because the details are private.

In another break from SoftBank’s traditional investment strategy, Mapbox is not a nascent business: it counts major automakers like BMW AG and e-commerce players among its customers and has 700 million monthly active users. It uses AI and data from those users’ cars and mobile phones to perfect and constantly update its maps.

The founders of Stack AV — Bryan Salesky, Pete Rander and Brett Browning — previously ran the self-driving operation Argo AI, which Ford Motor Co. and Volkswagen AG shut down last year. Their efforts were resurrected as SoftBank agreed to provide “patient capital” to see the startup through to commercializing its autonomous trucking technology.

Stack AV has hired 150 people and runs a test fleet of trucks on US roads. The Japanese conglomerate is betting Stack AV will generate high growth by eliminating supply chain hiccups that surfaced during the pandemic as more consumers turned to online commerce.

“We have access to the entire SoftBank Group, the entire team,” Stack AV’s Salesky said in an interview with Bloomberg TV. “They see a lot in terms of business models and what works and what doesn’t.”

This string of direct investments and long-term commitments underscores Son’s growing disinterest in operations at the Vision Fund arm. The second Vision Fund still has at least $5 billion to spend on startups, but the overall pace of investments has slowed dramatically over the past year.

Kentaro Matsui, head of new business at SoftBank, is one of Stack AV’s advocates. He expects the company’s AI technology to “fundamentally change the transportation of goods and supply chains” and its backers at SoftBank “understand the significant resources needed to succeed.”

Matsui, who oversees investment in Japanese startups at the Vision Fund, was last year also assigned the job of seeking out new AI business and investment opportunities at the group.

At home, SoftBank Group’s wireless spinoff, SoftBank Corp., has been quietly looking for ways to boost the adoption of autonomous technology. Its affiliate Boldly Inc. teamed up with an Estonian startup with a goal to mobilize self-driving buses in 50 locations by 2025. SoftBank also plans to set up a joint venture with architectural design firm Nikken Sekkei Ltd. for the development of autonomous buildings in the country.

Robotics are a key connective piece in SoftBank’s autonomous-technology equation. The firm said it will invest a combined $100 million with Symbotic to establish GreenBox Systems LLC, a joint venture for warehouse automation.

Mapbox is working closely with Arm, SoftBank’s chip unit, on the development of semiconductor designs tailored for the broader adoption of MapGPT in cars, the people said. New chips have to be powerful enough to support real-time rendering of interactive maps and chat functions.

Son may have been wildly off when he predicted during the Davos forum in 2021 that autonomous vehicles will be in mass production by this year. But his passionate belief in the segment has only intensified since, and SoftBank’s recent investments have assembled complementary pieces with the goal of making that a reality sooner rather than later.

“When it comes to mobility - moving things, riding a car or delivering goods - a lot of it will be done autonomously,” Son said during a speech last month. “In logistics, the concept of being ‘just on time’ will be about getting it right down to the second.”

Most Read from Bloomberg Businessweek

US Veterans Got a Mortgage Break. Now They’re Losing Their Homes

A German Startup Races Google to Develop a Universal Translator

©2023 Bloomberg L.P.

Yahoo Finance

Yahoo Finance