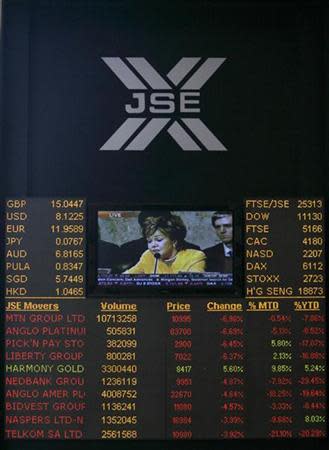

South Africa stocks down as banks fall on ex-dividend

JOHANNESBURG (Reuters) - South African stocks fell slightly on Monday after leading financial shares such as Barclays Africa Group and Standard Bank took a knock from trading ex-dividend, or without the right to the latest dividend payout. But mining shares such as AngloGold Ashanti and Harmony Gold rose as employees ended a strike in the sector over wages. "The banks and a few shares are ex-dividend today which is why they are down quite to a large extent," said Ferdi Heyneke, a portfolio manager at Afrifocus Securities. Johannesburg's blue-chip Top-40 index fell 0.3 percent to 38,306.88. The broader All-share index eased 0.16 percent to 42,769.62. Three of South Africa's biggest banks fell on ex-dividend, dragging the index of banks down nearly 2 percent. Barclays Africa Group was the leading decliner on the Top-40 index, falling 2.8 percent to 138.75 rand. Standard Bank was down 2.48 percent to 113.01 rand, while Nedbank lost 2.53 percent to close at 194.45 rand. Mining shares rose after a strike by tens of thousands of South African gold miners wound down over the weekend after workers accepted a revised pay rise offer from employers. "There is some buying come back into the (mining) sector because they feel that the strikes and the problems we have seen in the mining companies are starting to get priced in and sorted out hopefully," Heyneke said. Among the gainers were AngloGold Ashanti, which rose 2.57 percent to 141.80 rand, while Harmony Gold added 4.23 percent to 40.65 rand and Sibanye Gold ended 4.13 percent higher at 11.09 rand. Around 157 million shares changed hands, according to preliminary bourse data. Advancers outnumbered decliners 148 to 133 with 66 shares unchanged.

Yahoo Finance

Yahoo Finance