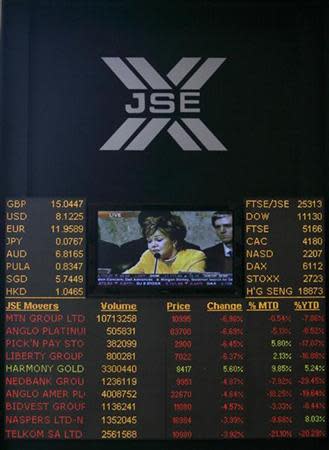

South African stocks hit new record on Fed euphoria

JOHANNESBURG (Reuters) - South African stocks surged to new record highs on Thursday in line with global peers after the U.S. Federal Reserve stunned markets by delaying a pull-back in its stimulus programme. Gold producers such as AngloGold Ashanti led the local charge as bullion's price leapt over 4 percent on the Fed move, seen as a positive for the precious metal as its status as an inflation hedge is enhanced by the flow of easy money. Johannesburg's gold mining index rallied 7 percent to its highest close in 10 days, but it remains about 45 percent down on the year, not least because bullion's price had been steadily falling as concerns mounted that the Fed would scale back its asset purchases. "If the Fed had of wound down, that would have also been good for markets because it would have signaled confidence in the U.S. economy," said Sasha Naryshkine, an analyst at Johannesburg-based private wealth manager Vestact. "Having said that, the anticipation that loose policy is going to remain even in the short term bodes well for equity markets," he said. AngloGold Ashanti, Africa's top bullion producer, shot up over 10 percent to 138.00 rand, making it the biggest gainer on the Top-40 index, which added 2.24 percent to a record close high of 39,701.11. The wider All-share index ended 2.15 percent higher at 44,302.94, also its highest close ever. South Africa's Reserve Bank left its repo rate steady at 5 percent as expected on Thursday and kept its forecasts for 2013 economic growth and inflation unchanged but warned about the impact of labour strikes, underscoring the fragility of domestic fundamentals in Africa's top economy. Leaving rates at 40-year lows, the bank said the growth outlook had not changed and kept its 2013 GDP forecast at 2 percent, and at 3.3 percent and 3.6 percent for 2014 and 2015 respectively. Turnover was brisk, with 299 million shares changing hands compared to 167 million on Wednesday, according to preliminary bourse data. Advancers outnumbered decliners 207 to 80 with 64 shares unchanged.

Yahoo Finance

Yahoo Finance