South Korea Kicks Off $19 Billion of Chip Loans, Funds From July

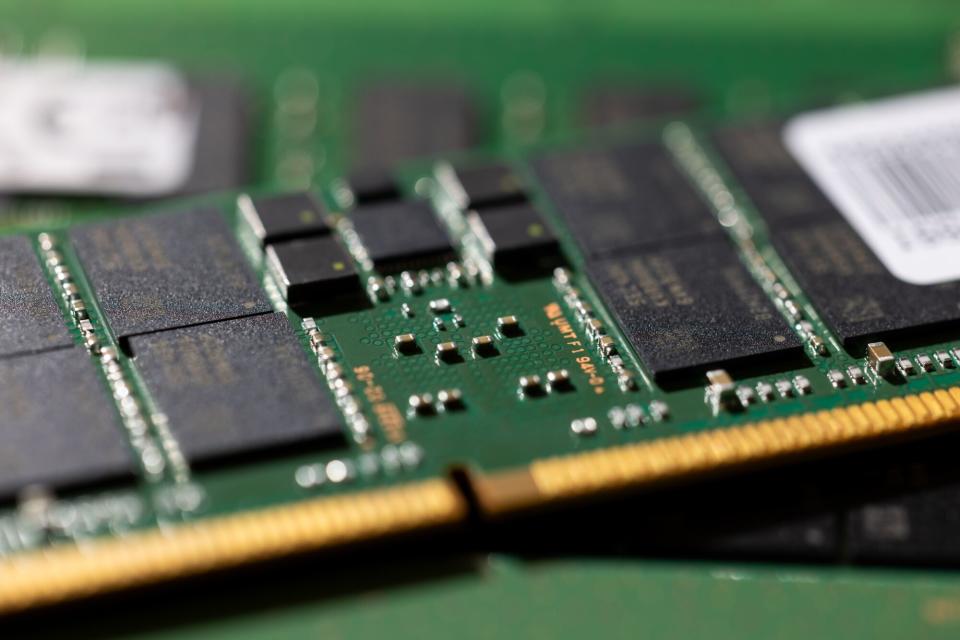

(Bloomberg) -- South Korea will begin awarding aid to chipmakers from July, kicking off a 26 trillion won ($19 billion) package of financial support pledged toward boosting a critical industry.

Most Read from Bloomberg

YouTuber Dr Disrespect Was Allegedly Kicked Off Twitch for Messaging Minor

VW Latches Onto Rivian in $5 Billion EV Pact to Regain Momentum

Nvidia Rout Takes Breather as Traders Scour Charts for Support

Julian Assange Leaves Court ‘Free Man,’ Ending 14-Year Drama

Seoul will begin with an 18 trillion won package of measures including preferential loans and investment capital. Starting next month, eligible firms can tap a 17 trillion-won loan program at the market’s lowest interest rates, the finance ministry said in a statement on Wednesday. The government will also help set up two funds totaling 1.1 trillion won, the smaller of which will pool 300 billion won by 2025 and begin investing in local makers of chipmaking gear and materials next month.

Korea joins countries from the US to China that’re funneling government aid into a strategic arena, particularly as geopolitical tensions fragment the global chip supply chain. Samsung Electronics Co. and SK Hynix Inc. technology helps make South Korea the world’s biggest maker of memory chips. The government is now investing $470 billion to build a semiconductor “mega cluster” outside of Seoul that will serve as the heart of its chip industry.

Seoul’s package of aid moves comes as the US presses allies to curb China’s access to semiconductor technology. American officials want South Korea to restrict the flow of equipment and technologies for making high-end logic and memory chips to China, Bloomberg News has reported.

To support the overall plan, the government will extend tax incentives to eligible firms by another three years. It’s also considering expanding the scope of beneficiaries to include makers of chip materials, parts and equipment.

Most Read from Bloomberg Businessweek

How Jeff Yass Became One of the Most Influential Billionaires in the 2024 Election

Why BYD’s Wang Chuanfu Could Be China’s Version of Henry Ford

Independence Without Accountability: The Fed’s Great Inflation Fail

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance