Spring Budget 2024: Jeremy Hunt to cut national insurance rather than income tax as rate windfall fails to materialise

Jeremy Hunt will cut national insurance rather than income tax in next week’s Spring Budget, according to reports.

With the Conservatives trailing Labour by around 20 percentage points, Hunt is under a lot of pressure to announce crowd-pleasing tax cuts tomorrow to revive his party’s electoral prospects.

The Chancellor has repeatedly stressed his determination to bring down the tax burden, which is on course to rise to record levels no matter what Hunt announces in the Budget.

The Times reported that the centrepiece of Hunt’s statement will be a two percentage-point reduction in national insurance, costing about £10bn a year.

Hunt is expected to say that workers will see a £900 benefit from the changes, including the 2p cut to National Insurance announced in November. He will also announce an extension of the fuel duty freeze, costing £1bn a year.

EXCLUSIVE:

Jeremy Hunt will cut national insurance by 2 per cent in the Spring Budget tomorrow

It will cost £10bn and be worth £450 for the average worker. He will sell it as £900 worth of tax cuts when combined with 2 per cent NI cut in Autumn Statement

As per @SamCoatesSky…— Steven Swinford (@Steven_Swinford) March 5, 2024

Although Hunt had been weighing up a 2p cut to income tax, which would cost over £13bn, this now looks too expensive given changing market expectations on interest rates. Cutting income tax is more expensive as it benefits both workers and pensioners.

The measures will be paid for through a new levy on vaping, an extension of the levy on North Sea oil and gas companies, and reduction in scope of the non-dom tax status. Hunt is also considering a tighter squeeze on public spending after the election.

Hunt’s reduced scope to cut taxes reflects his limited headroom. According to reports, the OBR gave Hunt just than £12.8bn in headroom, down from as much as £30bn at the turn of the year.

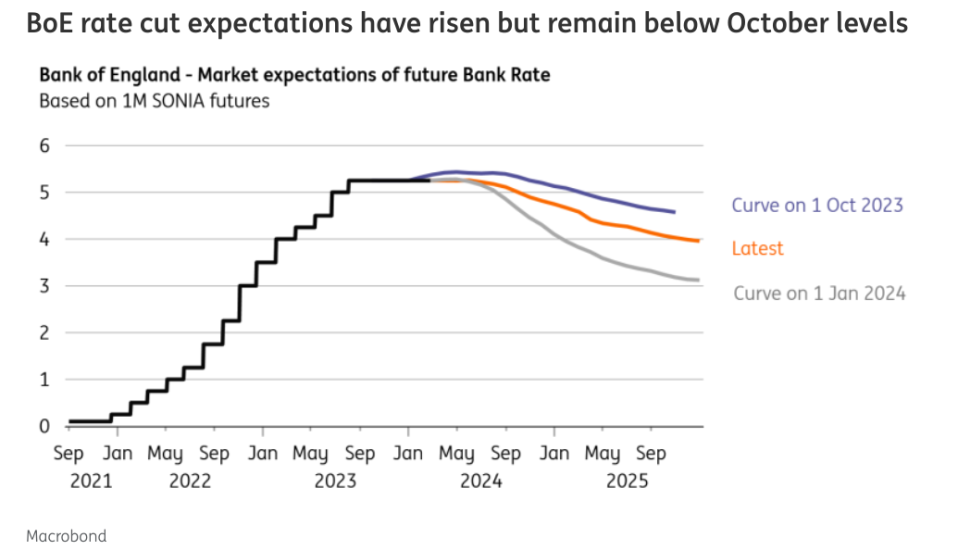

This reflects changing rate expectations. Markets now think that the Bank of England will cut interest rates more slowly than was thought at the beginning of the year, which will keep the cost of government borrowing high.

“The reappraisal of Bank of England rate cuts in financial markets means the money available for giveaways has dwindled over the past few weeks,” analysts at ING wrote.

The analysts said that investors are “keeping an eye on UK fiscal risk”. Although the situation today looks “very different” to the Truss mini-budget in Autumn 2022, “fresh tax cuts could still apply some upward pressure on yields”.

In a report released last week the IFS warned said that if the Conservatives wanted to cut taxes, then they should provide more detail on how government spending would change after the election.

A number of economists have argued that Hunt’s post-election spending plans are unrealistic, as it will impose significant real terms spending cuts on already struggling government departments.

“Until the government is willing to provide more detail on its spending plans in a Spending Review, it should refrain from providing detail on tax cuts,” Martin Mikloš, a Research Economist at IFS and an author of the report, said.

Yahoo Finance

Yahoo Finance