SPS Commerce Inc (SPSC) Reports Steady Growth Amid Economic Headwinds

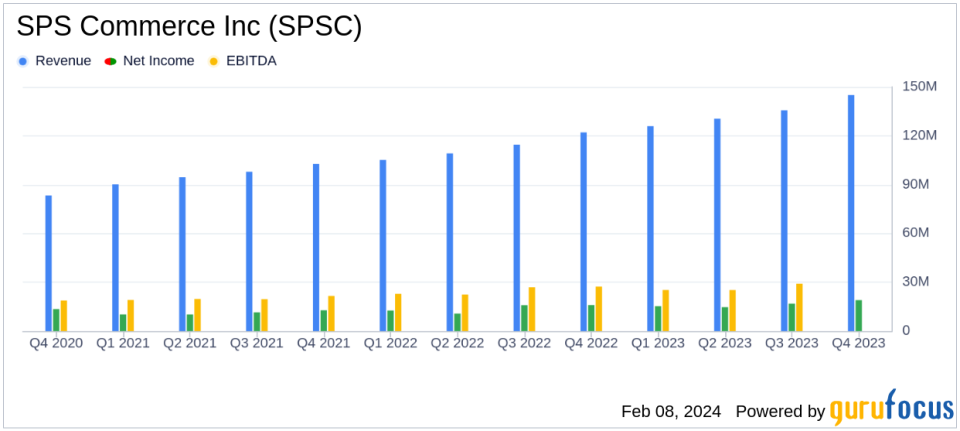

Revenue: $145.0 million in Q4 2023, a 19% increase year-over-year.

Net Income: $19.0 million in Q4 2023, up from $15.9 million in Q4 2022.

Recurring Revenue: Grew by 19% in Q4 2023, indicating strong customer retention.

Non-GAAP Income Per Diluted Share: Rose to $0.75 in Q4 2023 from $0.63 in Q4 2022.

Adjusted EBITDA: Increased by 20% to $42.0 million in Q4 2023.

Fiscal Year Revenue: Reached $536.9 million, a 19% growth over the previous year.

Guidance: Q1 2024 revenue expected to be between $145.9 million and $146.7 million.

On February 8, 2024, SPS Commerce Inc (NASDAQ:SPSC), a leading provider of cloud-based supply chain management services, released its 8-K filing, showcasing its financial results for the fourth quarter and fiscal year ended December 31, 2023. The company continued its impressive streak of growth, marking its 92nd consecutive quarter of revenue increase.

SPS Commerce Inc is renowned for its innovative solutions that enhance supply chain performance, optimize inventory levels, and meet the demands of omnichannel retail experiences. The company's platform offers Fulfillment, Analytics, and other products such as Assortment and Community, alongside one-time services like professional services and testing and certification. SPS Commerce's revenue primarily comes from recurring monthly fees and setup fees.

Financial Performance and Future Outlook

SPS Commerce Inc reported a 19% increase in both quarterly and annual revenue, reaching $145.0 million for Q4 and $536.9 million for the fiscal year. This growth is a testament to the company's robust business model and its ability to attract and retain customers. The recurring revenue growth of 19% and 20% for the quarter and year, respectively, underscores the company's strong customer loyalty and the sticky nature of its services.

Net income also saw a significant uptick, with a 19% rise to $19.0 million, or $0.51 per diluted share, in Q4 2023, up from $15.9 million, or $0.43 per diluted share, in the same period last year. For the full year, net income climbed to $65.8 million, or $1.76 per diluted share, from $55.1 million, or $1.49 per diluted share, in 2022. The company's ability to increase its profitability while expanding its revenue base is a positive sign for investors.

Adjusted EBITDA, a key metric for evaluating a company's operational efficiency, rose by 20% to $42.0 million in Q4 and by 19% to $157.6 million for the full year. This indicates that SPS Commerce is not only growing its top line but is also managing its expenses effectively to improve its bottom line.

Looking ahead, SPS Commerce provided guidance for the first quarter of 2024, with revenue expected to be between $145.9 million and $146.7 million. For the full fiscal year 2024, the company anticipates revenue to be in the range of $616.5 million to $619.0 million, representing a 15% growth over 2023. This forward-looking guidance suggests that SPS Commerce is confident in its ability to continue its growth trajectory despite the uncertain macroeconomic environment.

Challenges and Strategic Moves

Despite the positive results, SPS Commerce acknowledges the ongoing macroeconomic challenges. However, the company has strategically positioned itself for sustainable growth by closing two acquisitions and investing in future capabilities to strengthen its competitive edge in a large, addressable market.

CEO Chad Collins expressed enthusiasm for the company's long-term growth opportunities, highlighting SPS Commerce's role in enabling retailers' and suppliers' transition to omnichannel retail and international expansion. CFO Kim Nelson emphasized the company's delivery of profitable growth amidst these challenges.

Investors and potential GuruFocus.com members should note that while SPS Commerce's performance is robust, the company's forward-looking statements involve risks and uncertainties, and actual results may vary materially. Nonetheless, SPS Commerce's consistent performance and strategic investments position it as an attractive company for those interested in the software and retail network industry.

For a more detailed analysis of SPS Commerce Inc's financial results, including the full income statement and balance sheet, please refer to the company's 8-K filing.

Explore the complete 8-K earnings release (here) from SPS Commerce Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance