What is a SSAS pension and what are the benefits?

Fancy more control over how your pension is structured and invested? A small self-administered scheme (SSAS) could be right for you.

A SSAS is a type of defined contribution pension usually set up by sole traders, directors and family businesses.

Rather than a self-invested personal pension (Sipp), where you get to choose your own investments, a SSAS provides extra flexibility and you can even back your own business.

Here, Telegraph Money explains how it works and whether it could be right for your savings.

What is a SSAS pension?

If you run your own company or are a sole trader, then you don’t benefit from auto-enrolment rules that automatically put people into workplace pension schemes.

That leaves most workers who aren’t employees on their own when it comes to sorting a self-employed pension.

Options include a private pension or a Sipp, but if you want more control and flexibility, it may be worth considering a SSAS.

First introduced in the 1970s, a SSAS is a type of UK occupational pension scheme typically set up by small and medium-sized enterprises (SMEs), family businesses and entrepreneurs for the benefit of the business owners and sometimes, key employees.

Peter Collier, director of SSAS administration firm WBR Group, said: “SSAS have been a success story due to the flexibility they provide, giving control over investment decisions within the framework of pension regulations, rather than being restricted to those investments accepted by the provider.”

How does a SSAS pension work?

A SSAS can have up to 11 members.

A scheme can include company directors, staff and even relatives as long as it remains below 11.

Operating a SSAS comes with responsibilities and requirements. Trustees need to follow rules and regulations set out by HM Revenue and Customs (HMRC) and The Pensions Regulator, and you may need to appoint a professional administrator to ensure you remain compliant.

The tax benefits are similar to other pensions, so members get tax relief on contributions, tax-free growth within the scheme and tax-free lump sums when they come to access their pot.

They also have the same limits on annual contributions and with certain exceptions, investment classes.

Tim Walford-Fitzgerald, tax partner at HW Fisher, said: “Pooling the pensions of several individuals may make it easier to access particular investments with minimum entry criteria or with charges that reduce based on the amounts invested.”

The scheme can invest in a range of assets, such as shares and funds as well as commercial property, plus it can provide loans to the sponsoring company, provided certain criteria are met.

Kevin Gude, pensions and incentives partner at Keystone Law, said: “These concern sensible details like security, the interest rate and the repayment terms, as well as a practical restriction on the use of residential property as that security, or the employer’s use of the loaned sum to acquire residential property.

“It is a valuable option, often exercised by the employer in order to raise working capital and grow the business; an arrangement intended to benefit the SSAS and its members over the long term.”

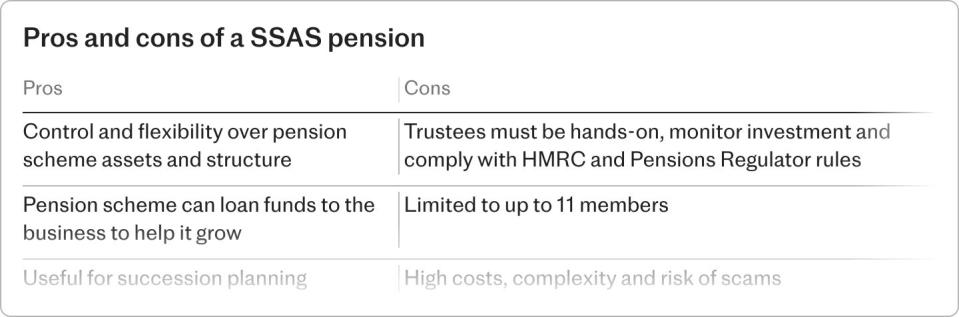

Pros and cons of a SSAS pension

A SSAS provides control and flexibility as all of the pension scheme members are also trustees of so they have control over the investment and other decisions.

It also has extra tax benefits beyond tax relief as company contributions are tax deductible.

A SSAS can be valuable to the owners of a growing business. In addition to serving the role of a typical pension, it can provide funds for projects that would otherwise require expensive loans or might not happen at all.

Funds can be borrowed from the scheme to purchase commercial property as well as to support the company.

Rick Gosling, associate director at Five Wealth Management, said: “This flexibility can be crucial for business growth and development.”

The pension can lend back up to half of the pension contributions to the sponsoring company.

Mr Walford-Fitzgerald added: “This can help the company deal with the cash flow of a large contribution, for instance, if it is catching up several years of contributions. That loan has to be secured against company assets and regularly paid back. It must also be at a reasonably commercial rate of interest and cannot last more than five years.”

There are risks associated with a SSAS, though.

It is more complex and expensive than an off the shelf pension product, Mr Collier added, as the administration can be very technical and time consuming.

He said: “The scheme trustees must adhere to strict rules, including reporting requirements, some investment restrictions and tax regulations.

“All members must be trustees and this provides the control that business owners seek; their role is governed by rules and often supplemented by a professional trustee. There is no third-party provider who can veto plans. Real control is a key distinguishing feature.”

As a SSAS is only available to up to 11 members, it will only be suitable for small businesses.

SSAS products can also be targets for pension scammers and need a hands-on approach.

Matthew Tailford, commercial director at Hoxton Capital Management, said: “A downside of SSASs is that they are typically a more ‘hands on’ arrangement and a might be viewed as an unnecessary cost unless their unique features are utilised.”

SSAS v Sipps

A SSAS and Sipp are pretty similar as both give users more control over how their contributions are invested.

The main difference is that with a Sipp you are using a third party to manage your individual pensions savings within a wrapper that includes many other individuals.

A SSAS is created by the employer, for the benefit of between one and 11 of its directors and other senior employees, which will often include different generations of a family-run business as members of the arrangement.

This can be helpful for succession planning between families and a business itself.

Mr Gude added: “Unlike when a Sipp member dies and death benefits are paid out to a separate pension arrangement in the name of the beneficiary, a SSAS member’s funds can be kept within the arrangement with the beneficiary invited to join as a member or with the benefit shared amongst existing members.

“The existing SSAS can then be used as the structure for the payment of death benefits in accordance with the deceased member’s wishes without, for example, requiring employer loans to be called in or property to be sold or refinanced in order to meet the large and immediate benefit liability where a death benefit has to be paid out.”

Both Sipps and an SSAS are vulnerable to investment performance. But if a Sipp provider merges with another brand a member can choose to accept these or incur the time and cost of transferring to another provider.

As SSASs are run by and for the employer and its employees, there is far less exposure to external forces.

Mr Gude added: “Conversely, SSAS rules require unanimity between trustees when decisions are made.

“Marital breakdown or other personal or commercial disagreements between members can sometimes place stresses on the running of the SSAS and how its funds are utilised in a way that doesn’t affect Sipps.”

A SSAS is typically more expensive to run than a basic pension plan, said Mr Collier, but that is due to the underlying regulations of the pension scheme. There are professional fees for the administration and professional trustee.

However, for SSASs with more than one member, the costs may not be dissimilar to a full service Sipp per member.

He said: “It’s been said that in a SSAS the member is the driver and with a Sipp they are a passenger.”

Transferring an existing pension to a SSAS pension

An old or existing pension can be transferred to a SSAS and usually requires a transfer form to be completed.

You may want to do this if you are moving to a new job or are becoming self-employed and want to take more control over your current pension savings.

It is worth getting a financial adviser to check if there are any valuable benefits you may be giving up by moving your money.

Costs associated with a SSAS pension

Costs differ depending on how the SSAS is to be used, and which provider or other third-party specialist is appointed.

The costs of setting up and running the SSAS are usually met by the sponsoring employer. Corporation tax relief can be claimed on the costs of setting up a SSAS.

Specialist firms that operate SSAS services charge either an annual administration fee plus additional charges for work over and above basic administration.

There may even be an all inclusive fee for all services which will not vary other than annual inflation increases so long as the SSAS remain materially the same year on year.

The total cost per year depends on the number of members, scheme activity and additional services required, the types of investments, if any retirement benefits are being paid and the requirement for trustee meetings and consultation.

A typical two-member SSAS with one commercial property would have set-up costs in the range £1,000 and £1,500 and an annual cost of between £1,500 and £2,500, according to WBR Group.

How to set up a SSAS pension

It can take several months to set up a SSAS and there is a lot of admin and paperwork involved. Here are the steps you’ll need to take:

You will need a specialist SSAS operator to provide the necessary documentation and to liaise with HMRC.

Documents need to be prepared that set out the scheme, including a trust deed that details how it works and who the members are.

The scheme has to be registered with HMRC and documents must be completed to transfer current member pensions to the SSAS if needed, or to sign up members.

The SSAS will need to maintain accurate records and comply with HMRC and The Pensions Regulator rules, submitting annual returns and reports.

Is a SSAS pension right for you?

A SSAS is a useful option for small or family-run businesses who want to take control of their pension savings and use it for the benefit of growing the company.

The costs and administration can be high though so you need to work out if it is worth the money and effort.

Mr Gude said: “Sipps will often be a more cost-efficient choice than single-member SSASs for individuals who want to make use of available investment options.

“But for employers who wish to provide a pension arrangement for two to 11 employees, a SSAS model may offer a better balance of cost and inward investment opportunity, particularly after any corporation tax deductions in respect of fees and contributions are taken into account.”

Yahoo Finance

Yahoo Finance